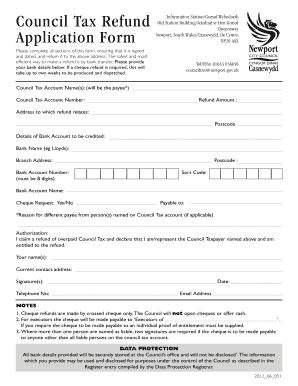

Council Tax Refund Application Form

What is the Council Tax Refund Application

The city council tax application is a formal request submitted by residents to reclaim overpaid council tax. This application is essential for individuals who believe they have paid more than their fair share due to various circumstances, such as changes in property status or eligibility for discounts. Understanding the purpose and function of this application is crucial for residents seeking financial relief.

Steps to Complete the Council Tax Refund Application

Completing the city council tax application involves several key steps to ensure accuracy and compliance. First, gather necessary personal information, including your address, council tax account number, and details regarding the overpayment. Next, fill out the application form accurately, providing all required information. After completing the form, review it for any errors or omissions. Finally, submit the application through the designated method, whether online or via mail.

Required Documents

To successfully submit the city council tax application, certain documents may be required. These typically include proof of identity, such as a driver's license or passport, and documentation supporting your claim of overpayment, such as previous council tax bills. Having these documents ready can expedite the application process and improve your chances of a successful refund.

Form Submission Methods

The city council tax application can be submitted through various methods, catering to different preferences. Residents may choose to submit their applications online, which is often the quickest option, or they can opt for traditional mail. In some cases, in-person submissions may be available at local council offices. Each method has its own advantages, so it's important to select the one that best suits your needs.

Eligibility Criteria

Eligibility for a council tax refund is determined by specific criteria that residents must meet. Typically, individuals who have overpaid their council tax due to changes in circumstances, such as moving out of a property or qualifying for exemptions, may be eligible. It is essential to review your situation against the council's guidelines to determine if you qualify for a refund.

Legal Use of the Council Tax Refund Application

The city council tax application is legally binding when completed and submitted according to the relevant regulations. To ensure its legal standing, it is important to comply with all requirements, including providing accurate information and submitting the application within the specified time frame. Understanding the legal implications of your application can help safeguard your rights as a taxpayer.

Who Issues the Form

The city council tax application is typically issued by the local government authority responsible for managing council tax in your area. This may vary depending on the state or municipality, so it is advisable to check with your local council for the specific form and any additional requirements they may have. Knowing the issuing authority can also help clarify the process and any potential follow-up needed after submission.

Quick guide on how to complete council tax refund application

Complete Council Tax Refund Application easily on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, since you can locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents promptly without hold-ups. Handle Council Tax Refund Application on any platform using airSlate SignNow Android or iOS applications and enhance any document-focused procedure today.

The easiest way to modify and electronically sign Council Tax Refund Application effortlessly

- Locate Council Tax Refund Application and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact confidential details with tools that airSlate SignNow has specifically designed for that purpose.

- Generate your eSignature with the Sign feature, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from the device of your choosing. Edit and electronically sign Council Tax Refund Application and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the council tax refund application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a city council tax application?

A city council tax application is a formal request submitted to the local government for exemptions, reductions, or information regarding council tax. This application often requires detailed documentation, and airSlate SignNow can simplify the process by enabling easy eSignatures and document management.

-

How does airSlate SignNow streamline the city council tax application process?

airSlate SignNow streamlines the city council tax application process by allowing users to create, send, and sign documents electronically. With features like templates and automated reminders, you can ensure timely submissions and avoid delays.

-

Is there a cost associated with using airSlate SignNow for city council tax applications?

Yes, using airSlate SignNow for city council tax applications comes at various pricing tiers based on features needed. Our plans are designed to be cost-effective while providing all the essential tools for managing applications efficiently.

-

What key features does airSlate SignNow offer for city council tax applications?

Key features of airSlate SignNow for city council tax applications include customizable templates, easy eSigning, real-time tracking, and automated workflows. These features make it easier to manage and process your applications swiftly and efficiently.

-

Can I integrate airSlate SignNow with other applications for my city council tax application?

Absolutely! airSlate SignNow integrates seamlessly with various applications to enhance your city council tax application process. Whether it's CRM software or document management systems, these integrations ensure a smooth workflow.

-

How secure is my information when using airSlate SignNow for city council tax applications?

airSlate SignNow prioritizes your privacy and data security. All documents related to your city council tax application are encrypted and stored securely, ensuring that only authorized users can access sensitive information.

-

Can I track the status of my city council tax application using airSlate SignNow?

Yes, with airSlate SignNow, you can easily track the status of your city council tax application. The platform provides real-time updates, so you know exactly where your application stands at all times.

Get more for Council Tax Refund Application

- Fillable online lakeland pittsburgh paints ie floor ampampamp deck form

- Fillable online second notice of dishonored check date to form

- Fillable online call for submissions juried exhibition fax form

- Fillable online form51 2010doc fax email print pdffiller

- The other fields form

- With links to web based paternity statutes and resources for north carolina form

- Gs97 18c and gs97 18d nc industrial form

- Form63

Find out other Council Tax Refund Application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later