Form 843 Instructions

What is the Form 843 Instructions

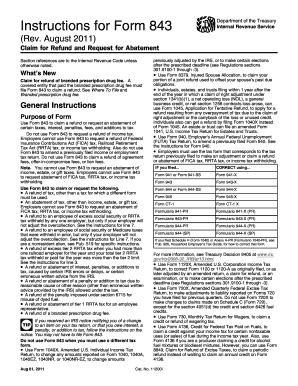

The Form 843 Instructions provide guidance on how to complete Form 843, which is used to claim a refund or request an abatement of certain taxes, penalties, or interest. This form is particularly relevant for taxpayers who believe they have overpaid their taxes or have incurred penalties that they believe are unjustified. Understanding the purpose and requirements of this form is crucial for ensuring that your request is processed efficiently.

Steps to complete the Form 843 Instructions

Completing the Form 843 requires careful attention to detail. Here are the essential steps:

- Begin by downloading the Form 843 from the IRS website or obtaining a physical copy.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Clearly state the reason for your request in the appropriate section, providing any necessary details to support your claim.

- Attach any required documentation that substantiates your request, such as proof of payment or correspondence with the IRS.

- Review your completed form for accuracy and completeness before submission.

Legal use of the Form 843 Instructions

The legal use of Form 843 is defined by IRS regulations. To ensure that your submission is valid, it is essential to comply with all relevant guidelines. This includes providing accurate information, submitting the form within the designated time frames, and adhering to any specific instructions related to your tax situation. Failure to follow these legal requirements may result in delays or denial of your request.

How to obtain the Form 843 Instructions

To obtain the Form 843 Instructions, you can visit the IRS website, where the form and its accompanying instructions are available for download. Additionally, you may request a physical copy by contacting the IRS directly. It is important to ensure that you are using the most current version of the form and instructions to avoid any complications during the submission process.

Filing Deadlines / Important Dates

Filing deadlines for Form 843 can vary based on the specific circumstances of your request. Generally, it is advisable to submit your form as soon as you identify an overpayment or penalty issue. The IRS typically allows a limited time frame for claims, so being aware of these deadlines is crucial. Check the IRS guidelines for any specific dates related to your situation to ensure timely submission.

Examples of using the Form 843 Instructions

Examples of situations where Form 843 may be used include:

- Requesting a refund for overpaid taxes due to an error in reporting income.

- Seeking abatement of penalties for late filing due to reasonable cause.

- Claiming a refund for taxes paid on a transaction that was later deemed non-taxable.

Each example illustrates how the form can be effectively utilized to address specific tax-related issues.

Quick guide on how to complete form 843 instructions

Complete Form 843 Instructions effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides all the tools you need to generate, modify, and eSign your documents quickly without holdups. Manage Form 843 Instructions on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign Form 843 Instructions with ease

- Obtain Form 843 Instructions and select Get Form to begin.

- Use the tools we offer to fill out your form.

- Mark important sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your amendments.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device you choose. Modify and eSign Form 843 Instructions and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 843 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Form 843 instructions for completing the form properly?

The Form 843 instructions provide detailed guidance on how to fill out the form, including which sections to complete and the types of claims you can make. It’s crucial to follow these instructions closely to ensure that your claim is accepted without delay. In addition to the instructions, you can often find examples and tips to help you navigate any complexities.

-

How can airSlate SignNow help with submitting Form 843?

airSlate SignNow streamlines the process of submitting Form 843 by allowing you to eSign documents securely and send them directly to the IRS. Our easy-to-use interface guides you through the process, making it simple to upload and sign your forms online. With airSlate SignNow, you can ensure your Form 843 is submitted efficiently and accurately.

-

What features does airSlate SignNow offer for handling Form 843?

airSlate SignNow offers a range of features to facilitate the handling of Form 843, including templates for common forms, secure document storage, and in-app eSignature capabilities. These features eliminate the hassle of printing and scanning while ensuring that your Form 843 is completed and filed without errors. You can also track your submissions to guarantee timely delivery.

-

Is airSlate SignNow a cost-effective solution for managing Form 843 submissions?

Yes, airSlate SignNow is a cost-effective solution for managing Form 843 submissions. With various pricing tiers available, businesses of all sizes can find a plan that fits their budget and document needs. By reducing the time spent on paperwork, airSlate SignNow allows you to focus on more important business tasks.

-

Can I integrate airSlate SignNow with other systems to manage Form 843?

Absolutely! airSlate SignNow offers seamless integrations with various CRM and document management systems, allowing you to manage Form 843 and other documents efficiently. This integration helps streamline workflows and ensures that all your documents are easily accessible across platforms.

-

What benefits does airSlate SignNow provide for businesses dealing with Form 843?

By using airSlate SignNow to manage Form 843, businesses benefit from improved efficiency, reduced errors, and faster processing times. The platform’s user-friendly design makes it easy for all team members to use, regardless of their technical skills. Ultimately, this leads to faster claims resolution and better compliance.

-

Are there tutorials available for Form 843 instructions on airSlate SignNow?

Yes, airSlate SignNow provides comprehensive tutorials and resources to help users understand Form 843 instructions. These resources include step-by-step guides, video tutorials, and FAQs that simplify the process of completing and submitting the form. Users can access these guides directly from our platform.

Get more for Form 843 Instructions

- Clerk of the superior court of form

- 1 e rev form

- Nc gov cooper letter request form nc governor roy

- Article 9 district attorneys and prosecutorial districts7a 60 form

- Notary public of form

- Hunting fishing and boating offenses for which court form

- Sample bylaws w notes doc nonprofit ally form

- Article 8 directors and officers part 1 board of directors form

Find out other Form 843 Instructions

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free