Form 109b

What is the Form 109b

The Form 109b is a tax document used in Maryland for reporting specific types of income. This form is essential for individuals and businesses that need to report income that is not typically included in standard tax forms. The Maryland Form 109b is particularly relevant for those who have received payments that may not be subject to withholding, such as certain types of contract work or freelance income. Understanding the purpose of this form is crucial for accurate tax reporting and compliance.

How to use the Form 109b

Using the Maryland Form 109b involves several steps to ensure accurate reporting of income. Taxpayers must first gather all relevant income information that needs to be reported. This includes any payments received that fall under the categories specified by the form. Once the information is collected, individuals can fill out the form by entering their details and the amounts received. It is important to double-check all entries for accuracy before submission to avoid potential issues with the Maryland State Comptroller.

Steps to complete the Form 109b

Completing the Maryland Form 109b requires careful attention to detail. Here are the key steps:

- Gather necessary documentation, including records of income received.

- Obtain the Form 109b from the Maryland State Comptroller's website or other official sources.

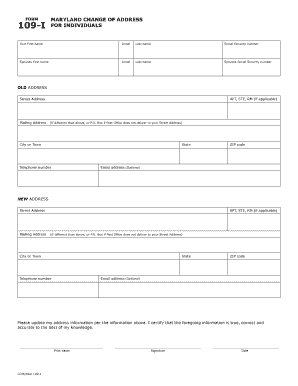

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Report the income amounts in the designated sections of the form.

- Review the completed form for accuracy and completeness.

- Submit the form according to the guidelines provided, either electronically or by mail.

Legal use of the Form 109b

The Maryland Form 109b is legally binding when completed correctly and submitted in accordance with state regulations. It is crucial to understand that any inaccuracies or omissions can lead to penalties or legal repercussions. The form must be filled out truthfully, as it serves as an official record of income for tax purposes. Compliance with the relevant tax laws ensures that the form is recognized by the Maryland State Comptroller and protects the taxpayer from potential audits or disputes.

Filing Deadlines / Important Dates

Filing deadlines for the Maryland Form 109b are critical to ensure compliance with state tax regulations. Generally, the form must be submitted by a specific date, which aligns with the annual tax filing deadline. It is advisable to check the Maryland State Comptroller's website for the most current deadlines, as these can vary from year to year. Missing the deadline may result in penalties, so timely submission is essential for all taxpayers.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Maryland Form 109b. The form can be filed online through the Maryland State Comptroller's e-filing system, which offers a convenient and secure method for submission. Alternatively, individuals can choose to mail the completed form to the appropriate address provided by the Comptroller's office. In-person submissions may also be possible at designated state offices, allowing for direct interaction with tax officials if needed. Each method has its advantages, so taxpayers should select the one that best suits their needs.

Quick guide on how to complete form 109b 21744977

Complete Form 109b effortlessly on any platform

Web-based document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the appropriate form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 109b on any platform with airSlate SignNow Android or iOS applications and streamline any document-centric procedure today.

How to modify and eSign Form 109b seamlessly

- Find Form 109b and click on Get Form to begin.

- Use the tools we offer to finish your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate issues with lost or misplaced documents, tedious form navigation, or errors that necessitate printing additional document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and eSign Form 109b and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 109b 21744977

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 109 B Maryland?

Form 109 B Maryland is a document used for reporting income and deductions in the state of Maryland. This form is essential for individuals and businesses to accurately declare their taxable income to the Maryland state revenue authorities. Understanding how to complete Form 109 B Maryland can help ensure compliance and optimize your tax return.

-

How can airSlate SignNow help with Form 109 B Maryland?

airSlate SignNow provides an efficient way to prepare, send, and eSign Form 109 B Maryland securely online. With our user-friendly platform, you can easily manage your documents and ensure your Form 109 B Maryland is signed and filed promptly. This streamlines the process and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for Form 109 B Maryland?

Yes, airSlate SignNow offers various pricing plans that cater to different needs and budgets. While there are subscription fees related to our services, our cost-effective solutions make it easy for you to handle Form 109 B Maryland without excessive expenditures. Consider our pricing options to find the plan that suits your business requirements.

-

What features does airSlate SignNow offer for handling Form 109 B Maryland?

airSlate SignNow's platform includes features such as customizable document templates, advanced eSigning capabilities, and robust tracking for Form 109 B Maryland. These tools enable users to create reliable, professional documents while keeping the process simple and efficient. This way, you can focus on your business without the hassle of complicated paperwork.

-

Can I integrate airSlate SignNow with other software to manage Form 109 B Maryland?

Yes, airSlate SignNow offers integrations with various popular software applications to help streamline your workflow. Whether you need to connect with accounting software or CRM platforms, our integrations ensure that managing Form 109 B Maryland aligns smoothly with your existing processes, saving you time and resources.

-

How secure is the handling of Form 109 B Maryland with airSlate SignNow?

Security is a top priority for airSlate SignNow, particularly when it comes to sensitive documents like Form 109 B Maryland. Our platform uses advanced encryption and secure access protocols to ensure that your data remains protected at all times. You can trust us to handle your information securely as you eSign important documents.

-

What are the benefits of using airSlate SignNow for Form 109 B Maryland?

Using airSlate SignNow for Form 109 B Maryland offers numerous benefits, including increased efficiency, reduced paper waste, and enhanced organization. The platform eliminates bottlenecks in document signing and submission, allowing you to expedite your processes. Additionally, you can manage all your documents in one place, simplifying your administrative tasks.

Get more for Form 109b

- Nebraska department of health ampamp human form

- Done freely and voluntarily form

- City nebraska or a form

- Download nebraska petition for dissolution of marriage no form

- Comes respondent having received a copy of form

- Order of transfer ingov form

- Comes petitioners who files this petition for form

- Date of final hearing form

Find out other Form 109b

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application