How to Fill Out Form it 280

What is Form IT 280?

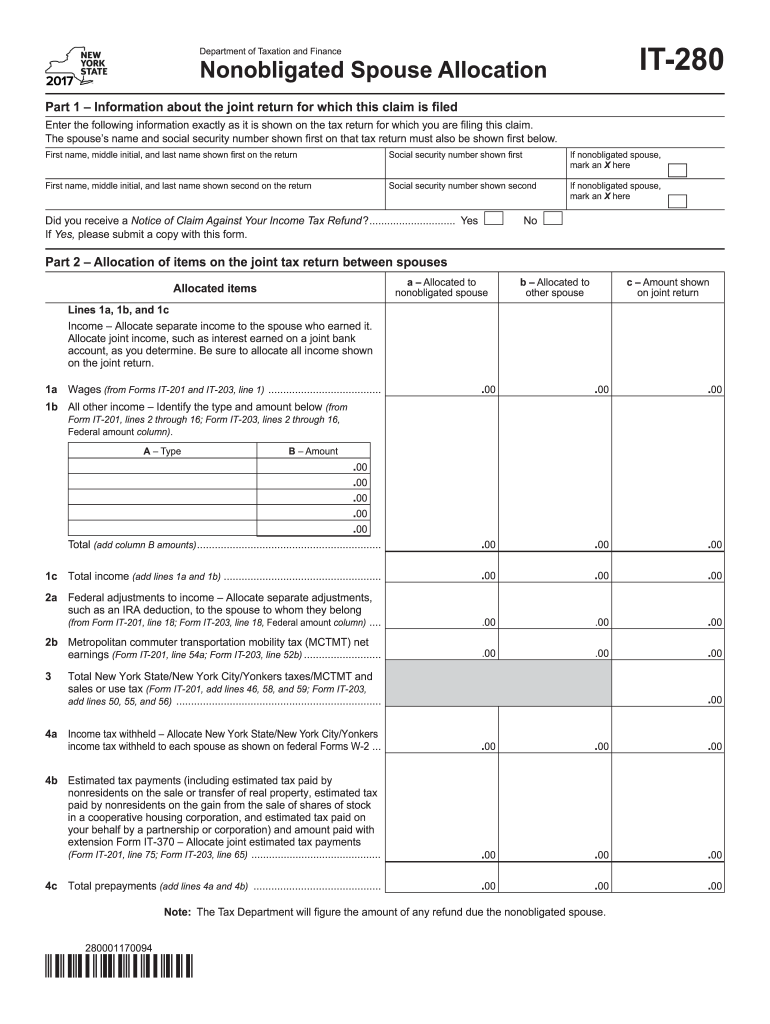

Form IT 280 is a document used by individuals and businesses in the United States to report specific tax-related information. This form is particularly relevant for taxpayers who need to provide details about their income, deductions, and credits for a given tax year. Understanding the purpose of Form IT 280 is crucial for ensuring compliance with IRS regulations and accurate reporting of financial information.

Steps to Complete Form IT 280

Filling out Form IT 280 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, such as W-2s, 1099s, and any relevant receipts for deductions. Next, follow these steps:

- Read the instructions carefully to understand the requirements for each section.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income accurately, ensuring that all sources are included.

- Detail any deductions or credits you are eligible for, providing necessary documentation.

- Review the completed form for any errors or omissions before submission.

Legal Use of Form IT 280

Form IT 280 is legally binding when completed correctly and submitted to the appropriate tax authority. To ensure its legal standing, it must be filled out in accordance with IRS guidelines. This includes providing truthful information and maintaining supporting documentation for any claims made on the form. Failure to comply with these requirements may result in penalties or legal repercussions.

Filing Deadlines / Important Dates

Timely submission of Form IT 280 is essential to avoid penalties. The IRS typically sets specific deadlines for filing tax forms, which can vary based on individual circumstances. Generally, the deadline for submitting Form IT 280 aligns with the annual tax filing deadline, which is usually April 15. It is important to stay informed about any changes to these dates and to plan accordingly to ensure compliance.

Required Documents for Form IT 280

When completing Form IT 280, several documents are necessary to support the information provided. These may include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Receipts for deductible expenses

- Previous tax returns for reference

Having these documents on hand will facilitate a smoother completion process and help ensure accuracy in reporting.

Form Submission Methods

Form IT 280 can be submitted through various methods, allowing flexibility for taxpayers. The primary submission methods include:

- Online filing through authorized e-filing services

- Mailing a paper copy to the appropriate IRS address

- In-person submission at designated IRS offices

Choosing the right method depends on personal preference and the complexity of the tax situation.

Quick guide on how to complete how to fill out form it 280

Complete How To Fill Out Form It 280 effortlessly on any device

Digital document handling has become widespread among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can locate the necessary form and store it securely online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage How To Fill Out Form It 280 on any device with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign How To Fill Out Form It 280 effortlessly

- Locate How To Fill Out Form It 280 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that intention.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious document searches, or errors that require printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Alter and eSign How To Fill Out Form It 280 to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the how to fill out form it 280

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the form it 280 instructions?

The form it 280 instructions provide detailed guidelines on how to complete and submit the relevant form accurately. By following the form it 280 instructions, you can ensure that all necessary information is included, which helps to streamline the processing of your documents.

-

How can airSlate SignNow assist with form it 280 instructions?

airSlate SignNow simplifies the process of completing form it 280 instructions by allowing you to fill out your documents electronically. With features like eSigning and real-time collaboration, airSlate SignNow ensures that your form is completed accurately and efficiently, reducing the risk of errors.

-

Is there a cost associated with accessing the form it 280 instructions on airSlate SignNow?

Accessing the form it 280 instructions through airSlate SignNow is included in our subscription plans, which are designed to be cost-effective for all businesses. We offer a variety of pricing options to cater to different business needs, ensuring you get the best value while using the form it 280 instructions.

-

What features does airSlate SignNow offer for managing form it 280 instructions?

airSlate SignNow offers a range of features that enhance the management of your form it 280 instructions. These include customizable templates, automated workflows, and extensive eSignature capabilities, which all help to streamline your document processes and improve productivity.

-

Can I integrate airSlate SignNow with other tools when following form it 280 instructions?

Yes, airSlate SignNow seamlessly integrates with various business tools and software, making it easier to incorporate the form it 280 instructions into your existing workflows. This integration allows for a smoother experience, ensuring that all related documents can be accessed and signed from one platform.

-

What are the benefits of using airSlate SignNow for form it 280 instructions?

Using airSlate SignNow for your form it 280 instructions offers numerous benefits such as increased efficiency, reduced turnaround time, and enhanced security for your documents. Additionally, the intuitive interface makes it easy for users of all technical levels to navigate and complete their forms.

-

Is customer support available for questions regarding form it 280 instructions?

Absolutely! airSlate SignNow provides robust customer support to assist with any inquiries regarding form it 280 instructions. Our support team is available via multiple channels to ensure that you're never left without assistance when navigating your documents.

Get more for How To Fill Out Form It 280

Find out other How To Fill Out Form It 280

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple