Rc4031 Form

What is the Rc4031

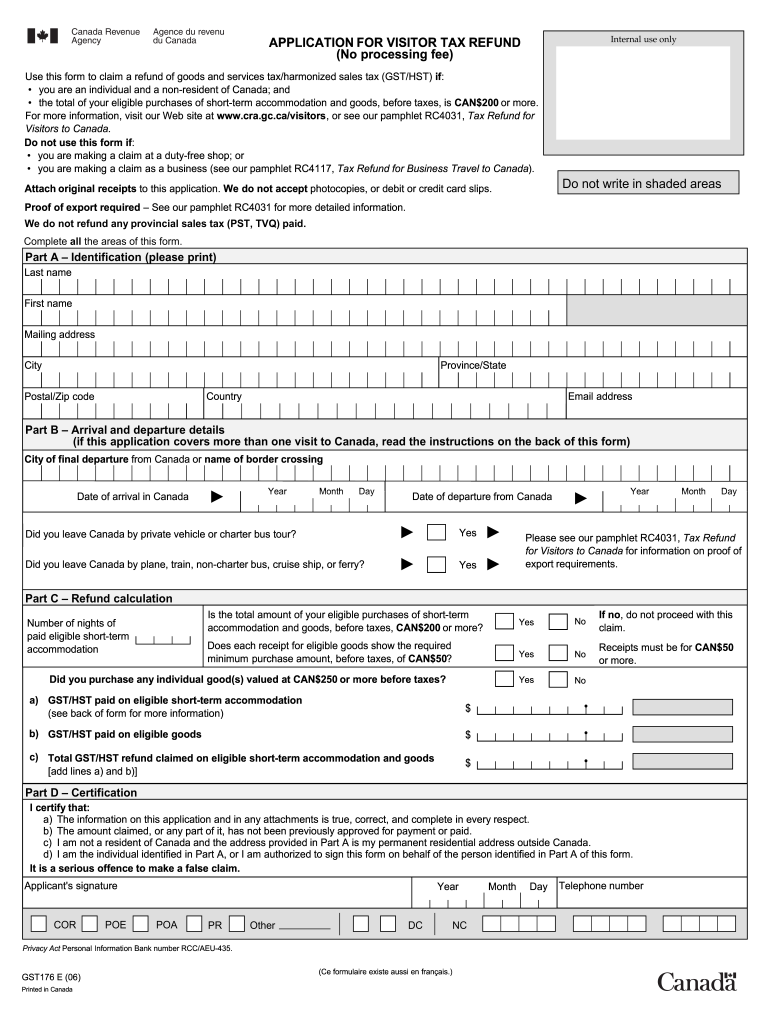

The Rc4031 is a tax refund form specifically designed for visitors to Canada. It allows non-residents to claim a refund on certain taxes paid on goods and services during their stay. This form is essential for individuals who have purchased items in Canada and are eligible for a refund of the Goods and Services Tax (GST) or the Harmonized Sales Tax (HST). By completing the Rc4031, visitors can ensure that they receive the appropriate tax refunds they are entitled to upon leaving Canada.

How to use the Rc4031

Using the Rc4031 involves several straightforward steps. First, gather all necessary receipts for purchases made during your visit to Canada. Ensure that these receipts clearly show the GST or HST paid. Next, fill out the Rc4031 form with accurate information, including your personal details and the total amount of tax you are claiming. After completing the form, submit it along with your receipts to the appropriate tax authority. This process can often be completed online, making it convenient for travelers.

Steps to complete the Rc4031

Completing the Rc4031 requires careful attention to detail. Here are the steps to follow:

- Collect all relevant receipts that indicate the GST or HST paid.

- Download the Rc4031 form from the Canada Revenue Agency (CRA) website.

- Fill in your personal information, including your name, address, and contact details.

- List the items purchased and the corresponding taxes paid on each receipt.

- Calculate the total amount of tax you are claiming for a refund.

- Review the completed form for accuracy before submission.

Legal use of the Rc4031

The Rc4031 is legally recognized under Canadian tax law, allowing non-residents to reclaim taxes paid on eligible purchases. To ensure that the claim is valid, it is crucial to adhere to the guidelines set forth by the Canada Revenue Agency. This includes submitting the form within the specified time frame and providing accurate documentation to support your claim. Compliance with these regulations helps protect the rights of visitors and ensures a smooth refund process.

Eligibility Criteria

To be eligible to use the Rc4031, individuals must meet specific criteria. Primarily, the claimant must be a non-resident of Canada who has purchased goods and paid GST or HST during their visit. Additionally, the items must be intended for personal use and not for resale. Visitors should also ensure that they complete the form and submit it before leaving Canada, as there are deadlines for filing claims. Understanding these criteria is essential for a successful refund application.

Required Documents

When submitting the Rc4031, certain documents are required to support your claim. These include:

- Completed Rc4031 form with accurate personal details.

- Original receipts showing the GST or HST paid on purchases.

- Proof of non-residency, such as a passport or travel document.

Having these documents ready will facilitate a smoother refund process and help ensure that your claim is processed efficiently.

Quick guide on how to complete rc4031

Effortlessly Prepare Rc4031 on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without hold-ups. Manage Rc4031 from any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to Modify and Electronically Sign Rc4031 with Ease

- Find Rc4031 and click Get Form to commence.

- Make use of the tools available to fill out your document.

- Emphasize pertinent sections or obscure confidential information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the concerns of lost or misfiled documents, the hassle of searching for forms, or the need to reprint incorrect copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Edit and electronically sign Rc4031 to ensure seamless communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rc4031

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is rc4031 and how does it relate to airSlate SignNow?

The rc4031 is a powerful feature of airSlate SignNow that enables users to seamlessly manage their electronic signatures and document workflows. This feature helps businesses streamline their processes by providing intuitive tools for eSigning documents. With rc4031, you can enhance productivity and ensure that all your important documents are securely signed.

-

What are the pricing options for airSlate SignNow that include the rc4031 functionality?

airSlate SignNow offers several pricing plans that include the rc4031 functionality, making it accessible for businesses of all sizes. Our pricing is designed to be cost-effective, ensuring you receive great value while utilizing rc4031 features. You can find detailed information on our website regarding each plan, including monthly and annual billing options.

-

What features are included in airSlate SignNow's rc4031?

The rc4031 includes a host of features such as customizable templates, automated workflows, and secure cloud storage. Users can easily track document status and receive notifications, which enhances accountability in signing processes. These features combined make the rc4031 an essential tool for efficient document management.

-

How does using rc4031 benefit my business?

Utilizing the rc4031 feature in airSlate SignNow can signNowly reduce the time and resources spent on document processing. Businesses can enjoy faster turnaround times for contracts and agreements, leading to improved customer satisfaction. Moreover, the reliable security measures embedded in rc4031 ensure that your documents are protected.

-

Can airSlate SignNow's rc4031 integrate with other software?

Yes, airSlate SignNow's rc4031 can easily integrate with various software applications, enhancing your existing workflows. This flexibility allows businesses to connect their document management processes with CRMs, project management tools, and more. Integration with rc4031 ensures a seamless user experience and improved data synchronization.

-

Is training available for using the rc4031 feature in airSlate SignNow?

Absolutely! airSlate SignNow offers comprehensive training resources for users to make the most out of the rc4031 feature. These resources include webinars, tutorials, and customer support, guiding you through all functionalities. With these training tools, you will be equipped to efficiently utilize rc4031 in your business.

-

Is there a free trial available for airSlate SignNow's rc4031?

Yes, airSlate SignNow provides a free trial that allows you to explore the functionalities of rc4031 without any commitment. This trial is an excellent opportunity for businesses to assess how rc4031 fits into their operations before making a purchasing decision. Experience the benefits firsthand by signing up for the trial.

Get more for Rc4031

- Of which we bind ourselves and our successors heirs executors and administrators jointly and severally form

- On hearing in open court the application of the above fiduciary for authority to administer decedents estate the form

- Probate court of county ohio estate of deceased case no form

- T s c of o supreme court of form

- Control number oh name 3 form

- If married or divorceddissolution please provide the following information

- Probatecomestate planning ampampamp probate lawyers form

- Application for change of name of adult clermont county form

Find out other Rc4031

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now