What Happens to My Car If I Get Retrenched Wesbank Form

What happens to my car if I get retrenched Wesbank?

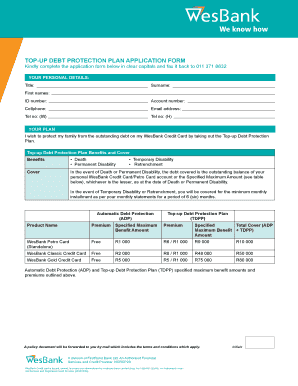

If you find yourself retrenched while holding a Wesbank vehicle finance agreement, it's essential to understand the implications for your car. Retrenchment can lead to financial strain, and without proper coverage, you may struggle to meet your monthly payments. Wesbank offers retrenchment cover for vehicle finance, which can help alleviate the burden by covering your payments during periods of unemployment. This protection ensures that your vehicle is not repossessed due to missed payments, allowing you to focus on finding new employment.

Key elements of the Wesbank vehicle finance retrenchment cover

The Wesbank vehicle finance retrenchment cover includes several critical components designed to provide financial security during challenging times. Key elements include:

- Coverage Duration: The retrenchment cover typically lasts for a specified period, ensuring your payments are covered for several months.

- Eligibility Criteria: To qualify for this cover, you must meet certain criteria, such as being a current Wesbank customer and having a valid vehicle finance agreement.

- Claim Process: In the event of retrenchment, you will need to follow a specific claim process, which includes submitting necessary documentation to prove your employment status.

- Payment Limits: There may be limits on the amount covered per month, so it’s important to review the terms to understand your benefits fully.

Steps to complete the Wesbank vehicle finance retrenchment cover application

Applying for the Wesbank vehicle finance retrenchment cover involves a few straightforward steps:

- Review Eligibility: Ensure that you meet the eligibility requirements for the retrenchment cover.

- Gather Documentation: Collect necessary documents, such as your vehicle finance agreement and proof of employment.

- Complete the Application Form: Fill out the Wesbank application form for retrenchment cover, providing accurate information.

- Submit Your Application: Send your completed application along with the required documents to Wesbank for processing.

- Await Confirmation: Once submitted, wait for confirmation from Wesbank regarding your application status.

Legal use of the Wesbank vehicle finance retrenchment cover

The Wesbank vehicle finance retrenchment cover is legally binding once you have completed the application process and received confirmation of coverage. It is crucial to understand the legal implications of this cover, including your rights and responsibilities. The cover is designed to comply with relevant financial regulations, ensuring that both parties are protected. Always keep a copy of your agreement and any correspondence with Wesbank for your records.

How to protect your Wesbank customer protection plan when filling it out online

When completing your Wesbank customer protection plan online, it is vital to ensure that your personal information is secure. Here are some steps to protect your data:

- Use Secure Connections: Always access the Wesbank website through a secure, encrypted connection.

- Enable Two-Factor Authentication: If available, enable two-factor authentication to add an extra layer of security to your account.

- Keep Software Updated: Ensure that your device's software and antivirus programs are up to date to protect against cyber threats.

- Review Privacy Policies: Familiarize yourself with Wesbank's privacy policies to understand how your data will be used and protected.

Examples of using the Wesbank vehicle finance retrenchment cover

Understanding how the Wesbank vehicle finance retrenchment cover works can be illustrated through practical examples:

- Example One: A customer loses their job due to company downsizing. They file a claim under the retrenchment cover, which pays their vehicle finance installments for three months while they seek new employment.

- Example Two: Another customer experiences a temporary layoff and uses the retrenchment cover to maintain their vehicle payments, preventing repossession until they return to work.

Quick guide on how to complete what happens to my car if i get retrenched wesbank

Manage What Happens To My Car If I Get Retrenched Wesbank effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents rapidly without waiting. Handle What Happens To My Car If I Get Retrenched Wesbank on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

How to modify and eSign What Happens To My Car If I Get Retrenched Wesbank with ease

- Find What Happens To My Car If I Get Retrenched Wesbank and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obfuscate sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Alter and eSign What Happens To My Car If I Get Retrenched Wesbank and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the what happens to my car if i get retrenched wesbank

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What happens to my car if I get retrenched from WesBank?

If you are retrenched from WesBank, it's important to understand how it affects your car financing. You may need to consider options like selling the car or negotiating with your lender. It's crucial to contact WesBank for specific guidance on your situation and discuss potential repayment plans or repossession processes.

-

Can I keep my car if I can't make payments after being retrenched?

Keeping your car after a retrenchment from WesBank largely depends on your ability to make payments. If you're unable to pay, it may lead to repossession. It's advisable to signNow out to WesBank to explore any available options that may help you retain your vehicle.

-

What options do I have if I can’t afford my car payments after retrenchment?

If you're struggling with car payments post-retrenchment, consider options like loan restructuring or refinancing with WesBank. Additionally, you might investigate selling the car to settle your debts, or if necessary, you may have to return the vehicle. Consulting with financial advisors can provide more personalized solutions.

-

Will my insurance cover my car payments during retrenchment?

Insurance typically does not cover car payments in the event of retrenchment, as it's designed for physical damages or accidents. However, some voluntary credit life insurance policies may assist in covering payments. It’s essential to review your individual policy terms and consult with your insurance provider for specifics.

-

How does retrenchment impact my credit score related to car financing?

Retrenchment can negatively impact your credit score if you miss car payments. Late payments are reported to credit bureaus, which can lower your score. It’s best to inform WesBank as soon as possible to negotiate payment options and to maintain your creditworthiness.

-

Is there a grace period for car payments if I get retrenched from WesBank?

While WesBank might offer some flexibility, there isn't a standard grace period for car payments after retrenchment. However, it’s crucial to communicate your situation to them promptly to explore any temporary relief options that they might provide in such circumstances.

-

Can I sell my car if I get retrenched while financing it through WesBank?

Yes, you can sell your car, but it's important to ensure that the sale price covers your outstanding loan with WesBank. You'll need to contact them to discuss the process of settling your loan. Be sure to clarify any terms that apply to the sale to avoid complications.

Get more for What Happens To My Car If I Get Retrenched Wesbank

- Control number pa p085 pkg form

- Control number pa p086 pkg form

- Control number pa p087 pkg form

- Control number pa p088 pkg form

- Control number pa p089 pkg form

- Control number pa p092 pkg form

- Designate your quotagentquot broad powers to handle your property which may form

- Frequently asked questions about powers of attorney form

Find out other What Happens To My Car If I Get Retrenched Wesbank

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document