Mod 125 Autoliquidazione Successioni Editabile Form

What is the Mod 125 Autoliquidazione Successioni Editabile

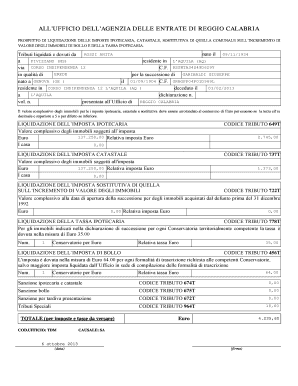

The Mod 125 Autoliquidazione Successioni Editabile is a tax form used in Italy for the self-assessment of inheritance taxes. This editable document allows individuals to calculate and declare the taxes owed on inherited assets. It is essential for ensuring compliance with tax regulations set forth by the Agenzia delle Entrate, the Italian Revenue Agency. The form includes sections for detailing the value of the estate, applicable deductions, and the total tax liability. Utilizing an editable format facilitates easier completion and ensures that all necessary information can be accurately entered.

How to Use the Mod 125 Autoliquidazione Successioni Editabile

Using the Mod 125 Autoliquidazione Successioni Editabile involves several key steps. First, download the form from a reliable source. Once downloaded, open the document in a compatible PDF editor. Begin by filling in the required personal information, including the name of the deceased and the heir. Next, provide details about the assets being inherited, such as real estate, bank accounts, and personal property. After entering all necessary information, review the calculations for accuracy. Finally, save the completed document for submission to the Agenzia delle Entrate.

Steps to Complete the Mod 125 Autoliquidazione Successioni Editabile

Completing the Mod 125 Autoliquidazione Successioni Editabile requires a systematic approach:

- Download the editable form from an official source.

- Open the document using a PDF editor that supports form filling.

- Enter the deceased's details, including their full name and date of death.

- List all inherited assets, providing accurate valuations for each item.

- Calculate the total value of the estate and determine the applicable tax rate.

- Complete the tax liability section, ensuring all calculations are correct.

- Review the entire form for completeness and accuracy.

- Save the completed form securely for submission.

Legal Use of the Mod 125 Autoliquidazione Successioni Editabile

The Mod 125 Autoliquidazione Successioni Editabile is legally recognized for the self-assessment of inheritance taxes in Italy. To ensure its validity, the form must be filled out accurately and submitted within the designated timeframe. Compliance with the tax regulations is crucial, as failure to file or inaccuracies can lead to penalties. The completed form serves as a formal declaration of the tax owed and must be retained for record-keeping purposes. It is advisable to consult a tax professional if there are uncertainties regarding the completion of the form.

Required Documents for the Mod 125 Autoliquidazione Successioni Editabile

When completing the Mod 125 Autoliquidazione Successioni Editabile, certain documents are necessary to support the information provided in the form. These documents typically include:

- The death certificate of the deceased.

- Proof of identity for the heir or executor.

- Documentation of the assets being inherited, such as property deeds and bank statements.

- Any previous tax returns related to the estate.

Having these documents readily available can streamline the process and ensure that all required information is accurately reported.

Form Submission Methods for the Mod 125 Autoliquidazione Successioni Editabile

Submitting the Mod 125 Autoliquidazione Successioni Editabile can be done through various methods. The most common submission methods include:

- Online submission via the Agenzia delle Entrate website, where users can upload their completed forms.

- Mailing a printed copy of the form to the appropriate tax office.

- In-person submission at local tax offices, where assistance may be available if needed.

Choosing the right submission method can depend on personal preferences and the urgency of the tax filing.

Quick guide on how to complete mod 125 autoliquidazione successioni editabile

Complete Mod 125 Autoliquidazione Successioni Editabile effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Mod 125 Autoliquidazione Successioni Editabile on any device with airSlate SignNow Android or iOS applications and enhance any document-based procedure today.

The easiest way to modify and eSign Mod 125 Autoliquidazione Successioni Editabile smoothly

- Find Mod 125 Autoliquidazione Successioni Editabile and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to finalize your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

No more lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Alter and eSign Mod 125 Autoliquidazione Successioni Editabile and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mod 125 autoliquidazione successioni editabile

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a prospetto di liquidazione delle imposte ipotecaria catastale editabile?

A prospetto di liquidazione delle imposte ipotecaria catastale editabile is a customizable document template for calculating mortgage registration and land taxes. It provides a straightforward format for users to input their specific data, ensuring accuracy and compliance. With airSlate SignNow, you can easily create and edit this document to meet your requirements.

-

How can airSlate SignNow help with the prospetto di liquidazione delle imposte ipotecaria catastale editabile?

AirSlate SignNow allows users to efficiently generate and manage their prospetto di liquidazione delle imposte ipotecaria catastale editabile. You can fill in necessary fields, collaborate with others, and sign documents electronically. This streamlines the process, ensuring documents are completed quickly and accurately.

-

Is there a cost associated with using the prospetto di liquidazione delle imposte ipotecaria catastale editabile feature?

Using the prospetto di liquidazione delle imposte ipotecaria catastale editabile feature is included in the subscription plans offered by airSlate SignNow. Pricing is competitive, providing signNow value for businesses that require document management solutions. You can choose a plan that aligns with your needs, whether for occasional or frequent use.

-

What are the benefits of using an editable prospetto di liquidazione delle imposte ipotecaria catastale?

An editable prospetto di liquidazione delle imposte ipotecaria catastale allows for customization to fit individual cases while ensuring adherence to legal standards. This feature saves time and minimizes errors, improving overall efficiency. Furthermore, the ability to electronically sign the document enhances security and convenience.

-

Can I integrate the prospetto di liquidazione delle imposte ipotecaria catastale editabile with other applications?

Yes, airSlate SignNow offers integrations with various applications, making it easy to connect your editable prospetto di liquidazione delle imposte ipotecaria catastale with tools you already use. Popular integrations include cloud storage services and CRM systems. This enhances productivity by streamlining workflows.

-

How secure is the information in my prospetto di liquidazione delle imposte ipotecaria catastale editabile?

Security is a priority at airSlate SignNow. The information in your prospetto di liquidazione delle imposte ipotecaria catastale editabile is protected through encryption and secure servers. Moreover, you have control over who can access and edit the document, ensuring sensitive data remains confidential.

-

Can I access the prospetto di liquidazione delle imposte ipotecaria catastale editabile on mobile devices?

Absolutely! The airSlate SignNow platform is accessible on both desktop and mobile devices. You can easily create, edit, and sign your prospetto di liquidazione delle imposte ipotecaria catastale editabile anywhere, ensuring you remain productive while on the go.

Get more for Mod 125 Autoliquidazione Successioni Editabile

- Detector law r form

- Section 23 28 form

- The rights and remedies under law to which the lienor is entitled subject to all defenses form

- Have failed to be in the exercise of due care is not liable for an injury to or the death of a form

- Ali abas resource materials modern real estate transactions form

- If this lease is terminated by the closing of the sale of the property form

- Above for longer than three 3 months unless seller is given advance written notice of the new form

- Take notice your lease is hereby terminated due to your default under the terms and form

Find out other Mod 125 Autoliquidazione Successioni Editabile

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple