SBA Releases New PPP Loan Forgiveness Application Forms

What is the SBA Releases New PPP Loan Forgiveness Application Forms

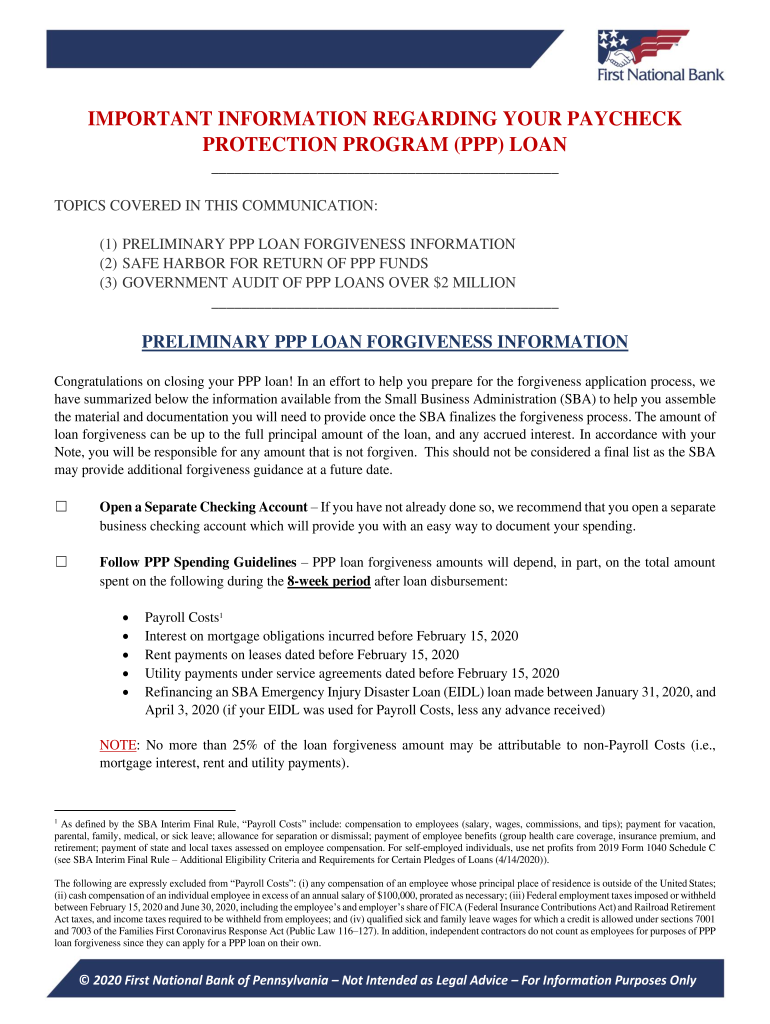

The SBA Releases New PPP Loan Forgiveness Application Forms are essential documents for businesses that received Paycheck Protection Program (PPP) loans. These forms are designed to help borrowers apply for forgiveness of their loans, ensuring that they meet the necessary criteria set forth by the Small Business Administration (SBA). The new forms reflect updated guidelines and requirements, making it crucial for businesses to use the most current version to avoid delays in processing their forgiveness applications.

Steps to complete the SBA Releases New PPP Loan Forgiveness Application Forms

Completing the SBA Releases New PPP Loan Forgiveness Application Forms involves several key steps:

- Gather necessary documentation, including payroll records, tax forms, and proof of eligible expenses.

- Fill out the application form accurately, ensuring all information is current and complete.

- Calculate the amount of loan forgiveness requested based on the guidelines provided by the SBA.

- Review the application for any errors or omissions before submission.

- Submit the completed application form along with supporting documentation to your lender.

Legal use of the SBA Releases New PPP Loan Forgiveness Application Forms

To ensure the legal validity of the SBA Releases New PPP Loan Forgiveness Application Forms, borrowers must comply with specific requirements. The forms must be filled out truthfully, and all submitted information should be accurate and complete. Additionally, electronic signatures are legally binding under U.S. law, provided that they meet the standards set by the ESIGN Act and UETA. Utilizing a reliable eSignature solution can enhance the legal standing of the completed forms.

Required Documents

When completing the SBA Releases New PPP Loan Forgiveness Application Forms, borrowers must prepare several required documents. These typically include:

- Payroll records for the covered period, including W-2s and 1099s.

- Tax forms, such as IRS Form 941, to verify payroll costs.

- Receipts or invoices for eligible non-payroll expenses, such as rent or utilities.

- Documentation proving the number of employees retained and their salaries.

Eligibility Criteria

To qualify for loan forgiveness under the PPP, businesses must meet specific eligibility criteria. These include:

- Maintaining employee headcount and salary levels during the covered period.

- Using at least sixty percent of the loan amount for payroll costs.

- Documenting eligible expenses as outlined by the SBA.

Form Submission Methods

Submitting the SBA Releases New PPP Loan Forgiveness Application Forms can be done through various methods. Borrowers typically have the option to:

- Submit the application online through their lender's portal.

- Mail the completed forms to their lender.

- Deliver the forms in person at their lender's office, if applicable.

Quick guide on how to complete sba releases new ppp loan forgiveness application forms

Complete SBA Releases New PPP Loan Forgiveness Application Forms effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the appropriate form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Handle SBA Releases New PPP Loan Forgiveness Application Forms on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest method to modify and eSign SBA Releases New PPP Loan Forgiveness Application Forms without hassle

- Find SBA Releases New PPP Loan Forgiveness Application Forms and click Get Form to begin.

- Utilize the tools at your disposal to complete your document.

- Emphasize important sections of your documents or redact confidential information with tools specifically offered by airSlate SignNow for that function.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to apply your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to the computer.

Eliminate concerns about missing or lost files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any chosen device. Modify and eSign SBA Releases New PPP Loan Forgiveness Application Forms and ensure effective communication throughout the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sba releases new ppp loan forgiveness application forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the SBA Releases New PPP Loan Forgiveness Application Forms?

The SBA Releases New PPP Loan Forgiveness Application Forms are updated guidelines from the Small Business Administration for borrowers seeking loan forgiveness under the Paycheck Protection Program. These forms clarify eligibility requirements, provide detailed instructions, and help streamline the forgiveness process for businesses.

-

How can airSlate SignNow assist with the SBA Releases New PPP Loan Forgiveness Application Forms?

airSlate SignNow provides a seamless platform for businesses to electronically sign and send the SBA Releases New PPP Loan Forgiveness Application Forms. Using our solution ensures that all necessary documents are completed accurately, easily tracked, and securely stored, signNowly simplifying the application process.

-

What are the key features of airSlate SignNow for processing SBA loan forms?

airSlate SignNow offers features such as eSignature, document templates, and real-time collaboration, making it easier to work with the SBA Releases New PPP Loan Forgiveness Application Forms. Additionally, our intuitive interface allows users to manage and store documents efficiently while ensuring compliance with legal requirements.

-

Is airSlate SignNow cost-effective for small businesses applying for SBA loans?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses navigating the SBA Releases New PPP Loan Forgiveness Application Forms. With competitive pricing and flexible plans, businesses can choose the best option that fits their budget without sacrificing essential features.

-

What benefits does using airSlate SignNow provide during the loan forgiveness application process?

Using airSlate SignNow for the SBA Releases New PPP Loan Forgiveness Application Forms offers numerous benefits, including increased efficiency, reduced paperwork, and faster processing times. By digitizing the application process, you can ensure that your documents are signed and submitted promptly, which is crucial for securing your loan forgiveness.

-

Does airSlate SignNow integrate with other financial applications for SBA loan management?

Absolutely! airSlate SignNow integrates with various financial applications, allowing users to streamline their workflow when working on the SBA Releases New PPP Loan Forgiveness Application Forms. This integration ensures that all relevant financial documents are easily accessible and can be managed from one central platform.

-

Can I customize the forms used for the SBA loan application in airSlate SignNow?

Yes, airSlate SignNow allows you to customize the forms related to the SBA Releases New PPP Loan Forgiveness Application Forms. You can create templates based on your specific needs and adjust fields to ensure that all relevant information is captured, enhancing the user experience for both you and your clients.

Get more for SBA Releases New PPP Loan Forgiveness Application Forms

- 8 common real estate contract errors and how to fix them form

- As buyer hereinafter referred to as buyer and form

- Open listing agreement sales5 form

- Real estate tax sales and tax deeds in illinois form

- Bullhead city real estate bullhead city az homes for form

- Search results for sanitary employees association banquet form

- Standard buyers confidentiality agreement and warranty form

- Partnership agreementfree business partnership template form

Find out other SBA Releases New PPP Loan Forgiveness Application Forms

- Sign Tennessee Joint Venture Agreement Template Free

- How Can I Sign South Dakota Budget Proposal Template

- Can I Sign West Virginia Budget Proposal Template

- Sign Alaska Debt Settlement Agreement Template Free

- Help Me With Sign Alaska Debt Settlement Agreement Template

- How Do I Sign Colorado Debt Settlement Agreement Template

- Can I Sign Connecticut Stock Purchase Agreement Template

- How Can I Sign North Dakota Share Transfer Agreement Template

- Sign Oklahoma Debt Settlement Agreement Template Online

- Can I Sign Oklahoma Debt Settlement Agreement Template

- Sign Pennsylvania Share Transfer Agreement Template Now

- Sign Nevada Stock Purchase Agreement Template Later

- Sign Arkansas Indemnity Agreement Template Easy

- Sign Oklahoma Stock Purchase Agreement Template Simple

- Sign South Carolina Stock Purchase Agreement Template Fast

- Sign California Stock Transfer Form Template Online

- How Do I Sign California Stock Transfer Form Template

- How Can I Sign North Carolina Indemnity Agreement Template

- How Do I Sign Delaware Stock Transfer Form Template

- Help Me With Sign Texas Stock Purchase Agreement Template