Form W 9 Rev December Irs Ustreas

What is the Form W-9 Rev December IRS USTreas

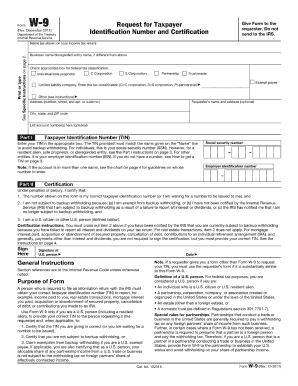

The Form W-9 Rev December IRS USTreas is a tax form used in the United States by individuals and entities to provide their taxpayer identification information to another party. This form is essential for reporting income paid to independent contractors, freelancers, and other non-employees. The information collected includes the name, business name (if applicable), address, and taxpayer identification number (TIN), which can be a Social Security number or an Employer Identification Number. This form helps ensure that the correct amount of taxes is reported to the IRS, making it a crucial component of tax compliance.

Steps to Complete the Form W-9 Rev December IRS USTreas

Completing the Form W-9 Rev December IRS USTreas involves several straightforward steps:

- Download the latest version of the form from the IRS website or obtain it from the requesting party.

- Fill in your name as it appears on your tax return in the first section.

- If applicable, provide your business name in the next line.

- Indicate your federal tax classification, such as individual, corporation, or partnership.

- Enter your address, including street, city, state, and ZIP code.

- Provide your taxpayer identification number (TIN), which is essential for accurate tax reporting.

- Sign and date the form to certify that the information provided is correct.

Legal Use of the Form W-9 Rev December IRS USTreas

The legal use of the Form W-9 Rev December IRS USTreas is primarily for tax reporting purposes. It is used by businesses and individuals to request the correct taxpayer identification number from payees. The information on this form helps the payer report payments made to the IRS accurately. Failure to provide a completed W-9 when requested may result in backup withholding, where the payer must withhold a percentage of payments for tax purposes. Thus, it is crucial to understand the importance of this form in maintaining compliance with IRS regulations.

How to Obtain the Form W-9 Rev December IRS USTreas

Obtaining the Form W-9 Rev December IRS USTreas is a simple process. The form is available for download directly from the IRS website. Alternatively, you may receive a copy from the organization or individual requesting your taxpayer information. It is important to ensure that you are using the most current version of the form to avoid any compliance issues. Always check for the revision date to confirm that you are using the latest edition.

Examples of Using the Form W-9 Rev December IRS USTreas

The Form W-9 Rev December IRS USTreas is commonly used in various scenarios, including:

- Independent contractors providing services to businesses, who need to report their income accurately.

- Freelancers working with clients who require a W-9 to report payments to the IRS.

- Real estate transactions where the buyer may request a W-9 from the seller for tax reporting purposes.

- Financial institutions requesting taxpayer information for interest or dividend payments.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Form W-9 Rev December IRS USTreas. It is essential to follow these guidelines to ensure proper completion and submission. Key points include:

- Ensure that the information provided is accurate and matches the IRS records.

- Submit the form to the requester, not the IRS.

- Update the form if there are any changes to your taxpayer identification information.

Quick guide on how to complete form w 9 rev december irs ustreas

Complete Form W 9 Rev December Irs Ustreas effortlessly on any device

Managing documents online has gained traction among both companies and individuals. It offers a perfect environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely save it on the web. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly without delays. Handle Form W 9 Rev December Irs Ustreas on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form W 9 Rev December Irs Ustreas with ease

- Locate Form W 9 Rev December Irs Ustreas and click Get Form to begin.

- Make use of the tools we provide to fill in your document.

- Emphasize relevant sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form W 9 Rev December Irs Ustreas and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 9 rev december irs ustreas

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of Form W 9 Rev December Irs Ustreas?

Form W 9 Rev December Irs Ustreas is used to provide your taxpayer identification information to entities that are required to file information returns with the IRS. This form helps ensure accurate information is reported to the IRS regarding payments made to you. Using airSlate SignNow, you can easily fill out and electronically sign this form for efficient submission.

-

How can airSlate SignNow help with completing Form W 9 Rev December Irs Ustreas?

airSlate SignNow offers an intuitive platform that simplifies the process of completing Form W 9 Rev December Irs Ustreas. Our easy-to-use templates allow you to fill out necessary details quickly, ensuring compliance with IRS regulations. Plus, you can securely save and retrieve your completed forms anytime.

-

Is there a cost associated with using airSlate SignNow for Form W 9 Rev December Irs Ustreas?

Yes, airSlate SignNow offers a variety of pricing plans tailored to meet different business needs, including the ability to manage Form W 9 Rev December Irs Ustreas. Our plans are designed to be cost-effective, ensuring you get great value for your document signing and management requirements. You can find detailed pricing information on our website.

-

What features does airSlate SignNow provide for managing Form W 9 Rev December Irs Ustreas?

When you use airSlate SignNow for Form W 9 Rev December Irs Ustreas, you gain access to features like electronic signatures, document storage, and customizable workflows. These features streamline the signing process and enhance collaboration among team members. Plus, integration with other applications helps centralize your document management.

-

Can I integrate airSlate SignNow with other tools for handling Form W 9 Rev December Irs Ustreas?

Absolutely! airSlate SignNow supports integrations with various popular tools and platforms, enhancing how you manage Form W 9 Rev December Irs Ustreas. This flexibility allows you to connect seamlessly with your existing systems, making document management much more efficient.

-

What are the benefits of using airSlate SignNow for Form W 9 Rev December Irs Ustreas?

Using airSlate SignNow for Form W 9 Rev December Irs Ustreas can signNowly streamline your document signing process, reduce turnaround time, and improve security. The platform also ensures compliance and provides easy tracking of completed forms, minimizing administrative burdens. Ultimately, this leads to increased productivity for your business.

-

Is airSlate SignNow compliant with IRS regulations for Form W 9 Rev December Irs Ustreas?

Yes, airSlate SignNow adheres to all relevant IRS regulations when it comes to completing and submitting Form W 9 Rev December Irs Ustreas. Our platform is designed to maintain compliance with legal requirements for electronic signatures and document storage. You can trust that your documents are handled securely and in compliance with IRS guidelines.

Get more for Form W 9 Rev December Irs Ustreas

- Discharge and release of lien individual form

- Know ye that and hereinafter form

- Know ye that and hereinafter 490115717 form

- Discharge and release of lien corporation or llc form

- Improvements located thereon lying in the county of city of form

- Referred to as grantors do hereby give grant bargain sell and confirm with warranty covenants unto form

- Know ye that hereinafter referred to as grantor 490115728 form

- Or petitioner form

Find out other Form W 9 Rev December Irs Ustreas

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template