Form 3815 1996-2026

What is the Form 3815

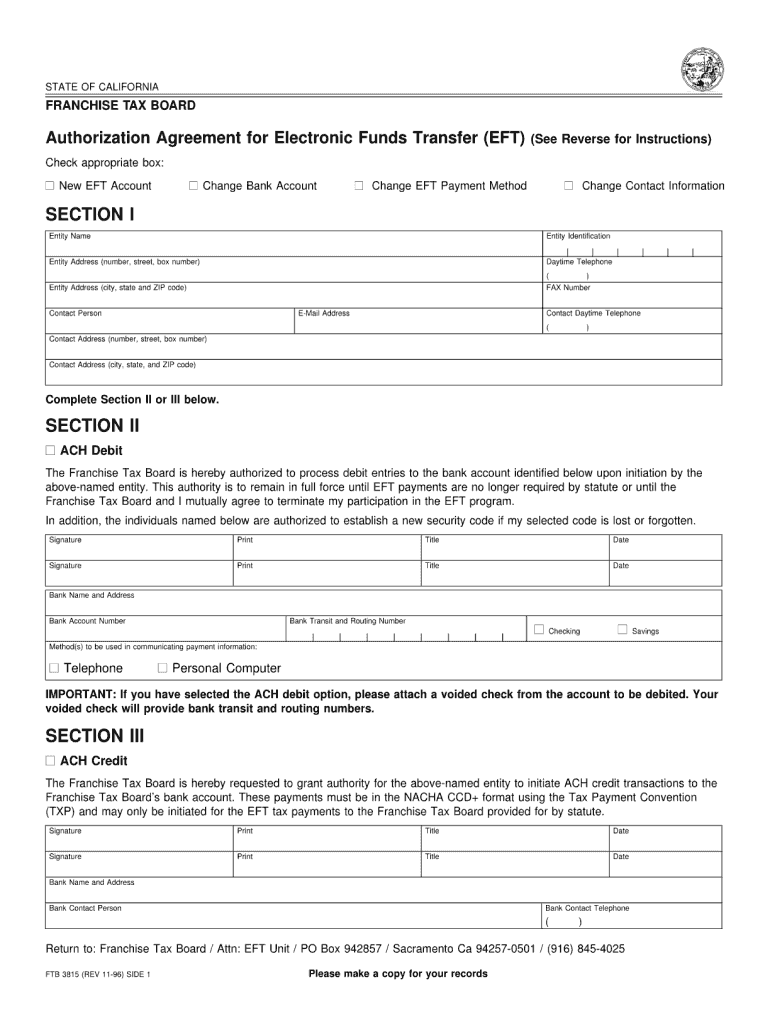

The Form 3815 is a tax form used in the United States, specifically by businesses and individuals to report certain financial activities to the state tax authority. This form is particularly relevant for franchise tax purposes and is often associated with the calculation of tax liabilities for various business entities. Understanding the purpose and requirements of Form 3815 is essential for compliance with state tax regulations.

How to use the Form 3815

Using Form 3815 involves several steps to ensure accurate reporting. First, gather all necessary financial documents, including income statements and expense reports. Next, fill out the form with the required information, ensuring that all figures are accurate and complete. After completing the form, review it for any errors before submitting it to the appropriate state tax authority. Utilizing digital tools can streamline this process and enhance accuracy.

Steps to complete the Form 3815

Completing Form 3815 requires careful attention to detail. Here are the steps to follow:

- Gather all relevant financial documentation.

- Download the Form 3815 from the state tax authority's website or access it through a digital platform.

- Fill in your business information, including name, address, and tax identification number.

- Provide financial data, such as revenue, expenses, and any applicable deductions.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or via mail, following the submission guidelines provided by the state tax authority.

Legal use of the Form 3815

The legal use of Form 3815 is governed by state tax laws, which require accurate and timely reporting of financial information. Proper execution of this form ensures compliance with legal obligations and helps avoid penalties. It is essential to understand the legal implications of submitting this form, as inaccuracies can lead to audits or legal repercussions. Utilizing a trusted digital platform can help ensure that the form is filled out correctly and securely.

Filing Deadlines / Important Dates

Filing deadlines for Form 3815 can vary depending on the state and the type of business entity. Typically, businesses must submit this form annually, with specific due dates often aligned with the state’s tax year. It is important to stay informed about these deadlines to avoid late fees or penalties. Checking with the state tax authority for the most current deadlines is advisable.

Required Documents

To complete Form 3815, several documents may be required, including:

- Previous tax returns

- Income statements

- Expense reports

- Business licenses

- Any other documentation that supports the financial information reported

Having these documents ready can facilitate a smoother completion process and ensure accuracy in reporting.

Quick guide on how to complete form 3815

Effortlessly Prepare Form 3815 on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to access the appropriate forms and securely store them online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly and without any holdups. Handle Form 3815 on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

The Easiest Way to Edit and eSign Form 3815 with Ease

- Locate Form 3815 and select Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools specially designed by airSlate SignNow for that purpose.

- Generate your signature with the Sign feature, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, whether via email, SMS, an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing out new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Edit and eSign Form 3815 to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3815

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 3815 and how does it work with airSlate SignNow?

Form 3815 is a document that can be electronically signed and managed through airSlate SignNow. This platform enables users to easily send, sign, and store form 3815 online, enhancing workflow efficiency while ensuring compliance and security.

-

Is there a cost associated with using airSlate SignNow for form 3815?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Users can choose the plan that best fits their requirements for managing form 3815 and other documents, with options ranging from small business use to enterprise solutions.

-

What features does airSlate SignNow offer for managing form 3815?

airSlate SignNow includes features such as customizable templates, real-time tracking, and advanced security measures for form 3815. These functionalities help streamline the signing process and improve overall document management efficiency.

-

How can I integrate form 3815 with other applications using airSlate SignNow?

airSlate SignNow provides seamless integrations with various applications, allowing you to easily incorporate form 3815 into your existing workflows. This ensures that your documents are accessible and manageable across different platforms, boosting productivity.

-

What are the benefits of using airSlate SignNow for form 3815?

Using airSlate SignNow for form 3815 signNowly reduces paperwork and enhances the signing experience. The platform streamlines the entire process, making it easier for users to create, send, and track their documents, ultimately saving time and resources.

-

Can I access form 3815 on mobile devices with airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile use, allowing you to manage form 3815 from anywhere. This mobile capability ensures that users can send and sign documents on-the-go, improving flexibility and responsiveness.

-

Is it secure to sign form 3815 using airSlate SignNow?

Absolutely. airSlate SignNow employs advanced security protocols to protect your form 3815 and other documents. With features like encryption and secure storage, you can trust that your sensitive information is well protected.

Get more for Form 3815

- Condolence death of employee to competitor form

- Enclosed please find an order for temporary relief relative to the above referenced matter form

- Amended loan agreement form

- Commercial lease agreement for building to be erected by lessor form

- Condolence friendcolleague in hospital form

- Sample letter of lost documents hungary skydive blog form

- Sample forms nmbar

- Agreement to continue business between surviving partners form

Find out other Form 3815

- How To Sign Delaware Trademark License Agreement

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer