Form N 11 Rev

What is the Form N 11 Rev

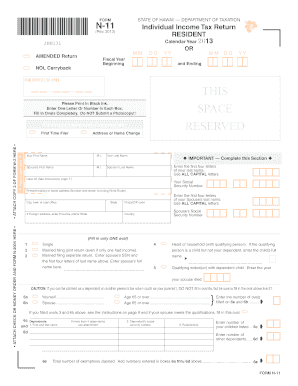

The Form N 11 Rev is the state of Hawaii tax form used by residents to report their income for tax purposes. This form is specifically designed for individuals who are not claimed as dependents on someone else's tax return. The N 11 form allows taxpayers to calculate their state income tax liability based on their earnings and applicable deductions. It is essential for ensuring compliance with state tax laws and for determining the correct amount of tax owed or refund due.

Steps to complete the Form N 11 Rev

Completing the Form N 11 Rev involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2s, 1099s, and any other income statements. Next, fill out personal information, including your name, address, and Social Security number. Then, report your total income, including wages, dividends, and interest. After calculating your adjusted gross income, apply any deductions and credits you may qualify for. Finally, review the form for accuracy before signing and submitting it.

How to obtain the Form N 11 Rev

The Form N 11 Rev can be obtained through the Hawaii Department of Taxation's official website. It is available for download in a fillable format, allowing users to complete the form electronically. Additionally, physical copies of the form can be requested from local tax offices or obtained at public libraries. Ensuring you have the most recent version of the form is crucial for compliance with current tax regulations.

Legal use of the Form N 11 Rev

To ensure the legal use of the Form N 11 Rev, it must be completed accurately and submitted by the designated deadline. The form must be signed by the taxpayer, and electronic submissions should utilize a compliant eSignature solution to maintain legal validity. Adhering to the guidelines set forth by the Hawaii Department of Taxation is essential for the form to be recognized as legally binding and for the taxpayer to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The Form N 11 Rev can be submitted through various methods to accommodate different preferences. Taxpayers may file online through the Hawaii Department of Taxation's e-filing system, which offers a streamlined process and faster processing times. Alternatively, the form can be mailed to the appropriate tax office address provided on the form. For those who prefer in-person submissions, visits to local tax offices are also an option, allowing for immediate assistance if needed.

Filing Deadlines / Important Dates

Filing deadlines for the Form N 11 Rev are crucial for compliance. Typically, the form must be submitted by April 20 of the year following the tax year. However, if April 20 falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply, as well as deadlines for making payments to avoid interest and penalties.

Quick guide on how to complete form n 11 rev

Complete Form N 11 Rev effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle Form N 11 Rev on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to edit and eSign Form N 11 Rev with ease

- Find Form N 11 Rev and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Select important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form N 11 Rev to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form n 11 rev

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is n 11 and how does it integrate with airSlate SignNow?

n 11 is a powerful feature within airSlate SignNow that facilitates seamless document signing processes. This integration allows users to sign documents electronically and manage their workflow efficiently. By utilizing n 11, businesses can enhance their productivity and ensure secure documentation.

-

How can airSlate SignNow help reduce costs related to document management?

By using n 11 in airSlate SignNow, businesses can signNowly cut down on paper and printing costs associated with traditional document management. The platform eliminates the need for physical signatures and allows for quick turnaround times on contracts and agreements, saving time and money.

-

What are the key features of n 11 in airSlate SignNow?

Key features of n 11 include advanced eSigning capabilities, customizable templates, and easy integration with other applications. These features make it simple for businesses to create, send, and sign documents securely, streamlining their operations.

-

Is the pricing for airSlate SignNow competitive for small businesses?

Yes, airSlate SignNow with n 11 offers flexible pricing plans suitable for small businesses. The cost-effective solutions ensure that even smaller organizations can access robust electronic signature capabilities without breaking the bank.

-

Can n 11 be integrated with third-party applications?

Absolutely! n 11 within airSlate SignNow is designed to seamlessly integrate with various third-party applications such as Google Drive, Salesforce, and more. This flexibility allows businesses to utilize their existing tools in conjunction with airSlate SignNow.

-

What benefits does n 11 offer for remote teams?

n 11 enhances collaboration for remote teams by enabling them to sign documents online from anywhere in the world. This functionality ensures that all team members can participate in document transactions without the need for physical presence, speeding up workflows and enhancing efficiency.

-

How secure is the document signing process with n 11 in airSlate SignNow?

The document signing process with n 11 in airSlate SignNow is highly secure, utilizing encryption and authentication methods to protect sensitive information. This security allows businesses to manage their documents confidently, knowing that their data is safeguarded.

Get more for Form N 11 Rev

- Xhibit b form

- Enpro industries incplan for salaried employees secgov form

- Financial advisors ampamp insurance in newfoundland ampamp labrador form

- How does a thrift savings plan tsp work investopedia form

- Corporate governance chubb limited investor relations form

- Xidex corporation form

- Sec filing consolidated edison inc form

- Gilbert associates inc form

Find out other Form N 11 Rev

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure

- Send Sign Document iOS

- Send Sign Document iPad

- How To Send Sign Document

- Fax Sign PDF Online

- How To Fax Sign PDF