Jordan Tax Forms

What is the Jordan Tax Identification Number Format?

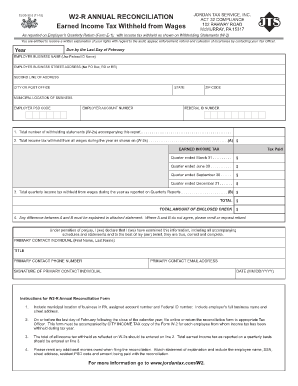

The Jordan tax identification number format is a specific structure used for identifying taxpayers within the Jordanian tax system. This number is essential for various tax-related activities, including filing tax returns and ensuring compliance with tax regulations. Typically, the format consists of a series of digits that may include both letters and numbers, depending on the specific requirements set by the Jordanian tax authorities.

How to Use the Jordan Tax Forms

Using the Jordan tax forms involves several steps to ensure that all necessary information is accurately captured. First, identify the specific form required for your tax situation, such as individual income tax or business tax forms. Next, gather all relevant documentation, including income statements and identification numbers. Once you have the necessary information, complete the form carefully, ensuring that the Jordan tax identification number is correctly entered in the designated field. Finally, review the form for accuracy before submission.

Steps to Complete the Jordan Tax Forms

Completing the Jordan tax forms can be streamlined by following these steps:

- Identify the correct form based on your tax situation.

- Collect all necessary documentation, including income records and identification.

- Fill out the form, ensuring the Jordan tax identification number is accurate.

- Double-check all entries for completeness and correctness.

- Submit the form through the appropriate channels, whether online, by mail, or in person.

Legal Use of the Jordan Tax Forms

The legal use of the Jordan tax forms is governed by specific regulations set forth by the Jordanian tax authorities. These forms must be filled out accurately and submitted within the designated time frames to avoid penalties. The information provided on these forms is used to assess tax liabilities and ensure compliance with local tax laws. It is crucial to use the correct format and provide truthful information to maintain legal standing.

Examples of Using the Jordan Tax Forms

Examples of using the Jordan tax forms include filing annual income tax returns, reporting business earnings, and claiming deductions or credits. For instance, an individual may use the appropriate form to report their salary and any additional income from freelance work. Similarly, a business entity would complete the relevant tax form to declare its revenue and expenses, ensuring that the Jordan tax identification number is included for accurate processing.

Filing Deadlines / Important Dates

Filing deadlines for the Jordan tax forms are critical to ensure compliance and avoid penalties. Typically, individual taxpayers must file their income tax returns by a specific date each year, while businesses may have different deadlines based on their fiscal year. It is important to stay informed about these dates and plan accordingly to avoid last-minute submissions. Marking these deadlines on a calendar can help taxpayers manage their filing responsibilities effectively.

Quick guide on how to complete jordan tax forms

Effortlessly Prepare Jordan Tax Forms on Any Device

Digital document management has gained traction among enterprises and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed paperwork, as you can easily locate the right template and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents rapidly without hindrances. Handle Jordan Tax Forms on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

How to modify and electronically sign Jordan Tax Forms with ease

- Locate Jordan Tax Forms and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal standing as a conventional wet ink signature.

- Review all the details and click on the Done button to secure your changes.

- Select how you wish to share your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, exhausting form searches, or errors that require printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign Jordan Tax Forms to ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the jordan tax forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Jordan Tax Forms and how can airSlate SignNow help?

Jordan Tax Forms are essential documentation required for tax filings in Jordan. With airSlate SignNow, businesses can easily send and eSign these forms electronically, ensuring that the process is streamlined and efficient. Our platform simplifies the task of managing Jordan Tax Forms, making compliance easier than ever.

-

How does airSlate SignNow ensure the security of my Jordan Tax Forms?

At airSlate SignNow, we prioritize the security of your Jordan Tax Forms. Our platform uses advanced encryption methods to protect sensitive information and offers secure access controls. This commitment to security ensures that your documents remain confidential and protected from unauthorized access.

-

What features does airSlate SignNow offer for managing Jordan Tax Forms?

airSlate SignNow provides various features tailored for Jordan Tax Forms, including customizable templates, automated workflows, and real-time tracking. Users can create and manage forms efficiently, helping to reduce paperwork and save time. Our platform is designed to simplify the entire process of handling tax forms.

-

Is there a free trial available for airSlate SignNow for Jordan Tax Forms?

Yes, airSlate SignNow offers a free trial that allows you to explore the platform's capabilities for managing Jordan Tax Forms. This trial provides you with the opportunity to test out features such as eSigning and document management without any financial commitment. You can evaluate how our solution meets your needs before deciding on a subscription.

-

What are the pricing options for airSlate SignNow related to Jordan Tax Forms?

airSlate SignNow offers various pricing plans tailored for businesses needing to manage Jordan Tax Forms. These plans are designed to be cost-effective, providing a range of features suitable for different business sizes and needs. You can choose the plan that aligns best with your usage requirements and budget.

-

Can airSlate SignNow integrate with other tools for handling Jordan Tax Forms?

Absolutely! airSlate SignNow supports integrations with numerous applications, allowing you to seamlessly manage your Jordan Tax Forms alongside other business tools. This flexibility enhances your workflow and improves overall efficiency by connecting document signing with other software you may already be using.

-

How can airSlate SignNow help save time when processing Jordan Tax Forms?

Using airSlate SignNow can signNowly reduce the time spent on processing Jordan Tax Forms. Our platform automates many aspects of the eSigning process, enabling quick updates, instant notifications, and efficient document routing. This level of automation allows your team to focus more on core tasks rather than administrative paperwork.

Get more for Jordan Tax Forms

- Split custody form

- Utah form

- In consideration of this guaranty lessor has agreed to grant or agreed to continue without 490241223 form

- Chapter 3 divorce utah legislature form

- Joint physical custody form

- Tenant unless the application is approved form

- Decision with respect to granting or denying your application to enter into a lease form

- Please take notice that form

Find out other Jordan Tax Forms

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation