S Knad Om Skattekort for Utenlandske Borgere Skatteetaten Form

What is the søknad om skattekort for utenlandske borgere skatteetaten?

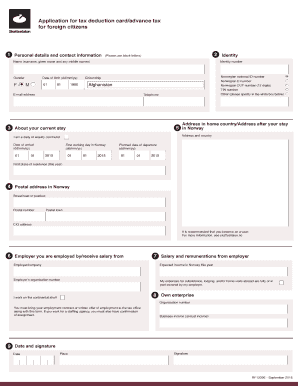

The søknad om skattekort for utenlandske borgere skatteetaten is an application form required for foreign citizens who need a tax card in Norway. This document is essential for individuals working or earning income in Norway, as it determines the correct tax deductions from their earnings. Without a valid skattekort, foreign workers may face higher tax rates, which can significantly impact their financial situation.

How to obtain the søknad om skattekort for utenlandske borgere skatteetaten

To obtain the søknad om skattekort for utenlandske borgere skatteetaten, individuals must first ensure they have the necessary identification and documentation. This typically includes proof of residency, employment contracts, and identification documents. Once you have gathered these materials, you can access the form through the Skatteetaten website or visit a local tax office. It is important to complete the application accurately to avoid delays in processing.

Steps to complete the søknad om skattekort for utenlandske borgere skatteetaten

Completing the søknad om skattekort for utenlandske borgere skatteetaten involves several steps:

- Gather all required documents, including proof of identity and employment.

- Access the application form online or in person at a tax office.

- Fill out the form with accurate information, ensuring all sections are completed.

- Submit the form either electronically or in person, depending on your preference.

- Wait for confirmation from Skatteetaten regarding the status of your application.

Legal use of the søknad om skattekort for utenlandske borgere skatteetaten

The legal use of the søknad om skattekort for utenlandske borgere skatteetaten is governed by Norwegian tax laws. This form must be filled out truthfully and accurately, as any discrepancies can lead to penalties or legal issues. It is essential to ensure that the information provided aligns with official documents to maintain compliance with tax regulations.

Required documents for the søknad om skattekort for utenlandske borgere skatteetaten

When applying for the søknad om skattekort for utenlandske borgere skatteetaten, applicants need to provide several key documents:

- Valid identification, such as a passport or national ID card.

- Proof of employment or a contract from a Norwegian employer.

- Documentation of residency in Norway, such as a lease agreement or utility bill.

Eligibility criteria for the søknad om skattekort for utenlandske borgere skatteetaten

Eligibility for the søknad om skattekort for utenlandske borgere skatteetaten typically includes the following criteria:

- The applicant must be a foreign citizen working or planning to work in Norway.

- The individual must have a valid employment contract with a Norwegian employer.

- Proof of residency in Norway is required to establish eligibility.

Quick guide on how to complete s knad om skattekort for utenlandske borgere skatteetaten

Effortlessly Prepare S Knad Om Skattekort For Utenlandske Borgere Skatteetaten on Any Device

Digital document management has become increasingly favored by both businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents quickly and efficiently. Manage S Knad Om Skattekort For Utenlandske Borgere Skatteetaten on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

Edit and eSign S Knad Om Skattekort For Utenlandske Borgere Skatteetaten with Ease

- Find S Knad Om Skattekort For Utenlandske Borgere Skatteetaten and click Get Form to begin.

- Utilize our tools to complete your form.

- Emphasize relevant sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click the Done button to save your changes.

- Choose how you would like to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow manages all your document management needs in a few clicks from any device you prefer. Modify and electronically sign S Knad Om Skattekort For Utenlandske Borgere Skatteetaten while ensuring effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the s knad om skattekort for utenlandske borgere skatteetaten

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 'søknad om skattekort forskuddsskatt for utenlandske borgere'?

'søknad om skattekort forskuddsskatt for utenlandske borgere' refers to the application process for tax cards and advance tax payments for foreign citizens working in Norway. It is essential for ensuring proper tax management and compliance with local regulations. Using airSlate SignNow can simplify this application process signNowly.

-

How can airSlate SignNow help with 'søknad om skattekort forskuddsskatt for utenlandske borgere'?

airSlate SignNow provides a user-friendly platform to fill out and eSign documents related to 'søknad om skattekort forskuddsskatt for utenlandske borgere'. The easy-to-use interface allows foreign citizens to complete their applications quickly and efficiently while ensuring that all required documents are submitted accurately.

-

Is airSlate SignNow cost-effective for managing 'søknad om skattekort forskuddsskatt for utenlandske borgere'?

Yes, airSlate SignNow offers a cost-effective solution for handling 'søknad om skattekort forskuddsskatt for utenlandske borgere'. With flexible pricing plans and no hidden fees, businesses can manage their document workflows without straining their budgets.

-

What features does airSlate SignNow provide for 'søknad om skattekort forskuddsskatt for utenlandske borgere'?

airSlate SignNow includes features such as eSigning, document templates, and secure storage, which are all beneficial for 'søknad om skattekort forskuddsskatt for utenlandske borgere'. These features streamline the application process, making it faster and more organized.

-

Can I integrate airSlate SignNow with my existing systems for processing 'søknad om skattekort forskuddsskatt for utenlandske borgere'?

Yes, airSlate SignNow can seamlessly integrate with various third-party applications and systems, allowing for efficient processing of 'søknad om skattekort forskuddsskatt for utenlandske borgere'. This flexibility ensures that you can incorporate our solution into your current workflows.

-

What are the benefits of using airSlate SignNow for foreign citizens applying for tax cards?

Using airSlate SignNow for 'søknad om skattekort forskuddsskatt for utenlandske borgere' provides several benefits, including time savings, reduced paperwork, and enhanced security. The platform ensures that applications are completed and submitted accurately, reducing the likelihood of delays or errors.

-

How secure is airSlate SignNow for submitting 'søknad om skattekort forskuddsskatt for utenlandske borgere'?

airSlate SignNow prioritizes security, ensuring that all documents related to 'søknad om skattekort forskuddsskatt for utenlandske borgere' are encrypted and stored securely. Users can trust that their sensitive information is protected throughout the application process.

Get more for S Knad Om Skattekort For Utenlandske Borgere Skatteetaten

- Required unemployment insurance contributions form

- The contract shall not be sold or assigned without the written consent of the buyer form

- You the owner are entitled to receive written lien waivers from all contractors subcontractors and form

- When partial payments are made at various stages of the project to the extend required by the construction form

- Mentioned building permits form

- Material suppliers a at or prior to the time final payment is made on the construction contract and b form

- The insurance or protection is furnished by someone other than the contractor form

- The terms conditions and limitations are as follows form

Find out other S Knad Om Skattekort For Utenlandske Borgere Skatteetaten

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free