Debt to Income Ratio Worksheet Form

What is the Debt To Income Ratio Worksheet

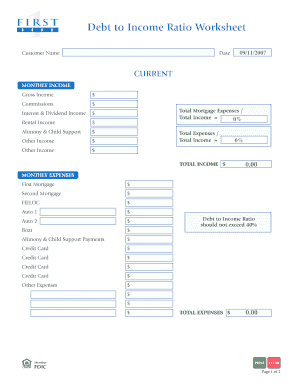

The debt to income ratio worksheet is a financial tool used to assess an individual's or household's ability to manage monthly debt payments in relation to their gross monthly income. This ratio is crucial for lenders when evaluating loan applications, particularly for mortgages. It helps determine how much debt an individual can afford based on their income level. The worksheet typically includes sections for listing all sources of income and detailing monthly debt obligations, allowing users to calculate their DTI ratio easily.

How to Use the Debt To Income Ratio Worksheet

Using the debt to income ratio worksheet involves several steps. First, gather all relevant financial documents, including pay stubs, bank statements, and existing loan agreements. Next, list all sources of income, such as salaries, bonuses, and any additional earnings. Following this, detail all monthly debt obligations, including mortgage payments, credit card bills, and personal loans. Finally, calculate the DTI ratio by dividing total monthly debt by gross monthly income. This ratio will provide insight into financial health and borrowing capacity.

Steps to Complete the Debt To Income Ratio Worksheet

Completing the debt to income ratio worksheet requires a systematic approach:

- Collect financial documents that outline income and debts.

- Input all sources of income into the designated section.

- List all monthly debt payments accurately.

- Calculate total monthly income and total monthly debt.

- Divide total monthly debt by total monthly income to determine the DTI ratio.

Ensure all figures are accurate to reflect a true picture of financial standing.

Key Elements of the Debt To Income Ratio Worksheet

Several key elements make up the debt to income ratio worksheet. These include:

- Income Section: A comprehensive listing of all income sources, including salaries, bonuses, and other earnings.

- Debt Section: A detailed account of all monthly debt obligations, such as mortgages, credit cards, and loans.

- Calculation Area: A section for calculating the DTI ratio, which is essential for assessing borrowing capacity.

These elements ensure that users can accurately assess their financial situation.

Legal Use of the Debt To Income Ratio Worksheet

The debt to income ratio worksheet is legally recognized as a financial assessment tool, especially in the context of loan applications. While it is not a legal document in itself, the information it contains can influence lending decisions and is often required by financial institutions. To ensure compliance, users should maintain accurate records and provide truthful information, as discrepancies may lead to penalties or denial of credit.

Examples of Using the Debt To Income Ratio Worksheet

Examples of using the debt to income ratio worksheet can vary based on individual circumstances. For instance, a first-time homebuyer may use the worksheet to determine how much they can afford in monthly mortgage payments based on their current income and debt levels. Similarly, someone looking to refinance may assess their DTI ratio to understand if they qualify for better loan terms. Each scenario highlights the worksheet's utility in making informed financial decisions.

Quick guide on how to complete debt to income ratio worksheet

Complete Debt To Income Ratio Worksheet effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without delays. Manage Debt To Income Ratio Worksheet on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to edit and eSign Debt To Income Ratio Worksheet with minimal effort

- Obtain Debt To Income Ratio Worksheet and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from a device of your choice. Edit and eSign Debt To Income Ratio Worksheet and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the debt to income ratio worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a DTI worksheet and how can it help my business?

A DTI worksheet, or Debt-to-Income worksheet, is a tool that calculates a person's debt-to-income ratio. This is crucial for understanding your financial health, particularly when seeking loans or credit. By utilizing an efficient DTI worksheet with airSlate SignNow, you can seamlessly integrate financial documentation into your workflow.

-

How does airSlate SignNow simplify the DTI worksheet process?

airSlate SignNow simplifies the DTI worksheet process by providing intuitive document creation and eSigning features. You can easily create, share, and eSign your DTI worksheets, making it accessible for all parties involved. This efficiency helps streamline your financial assessments and decision-making.

-

Is airSlate SignNow cost-effective for businesses using a DTI worksheet?

Yes, airSlate SignNow offers a cost-effective solution for businesses utilizing a DTI worksheet. Our pricing plans are designed to accommodate different business sizes while ensuring you get the best value for your money. With reductions in administrative time and enhanced productivity, airSlate SignNow pays for itself quickly.

-

Can I integrate airSlate SignNow with my existing tools for managing the DTI worksheet?

Absolutely! airSlate SignNow offers integrations with various popular tools and platforms, enabling you to manage your DTI worksheet alongside your other business applications. Integration options include CRM software, document management systems, and productivity tools, ensuring a seamless workflow.

-

How secure is my data when using the DTI worksheet with airSlate SignNow?

Your data security is our top priority. When you use the DTI worksheet with airSlate SignNow, your documents are encrypted and stored securely in compliance with industry standards. Additionally, we implement robust authentication processes to protect sensitive information.

-

Are there templates available for the DTI worksheet within airSlate SignNow?

Yes, airSlate SignNow offers customizable templates for DTI worksheets, making it easy to get started. You can modify these templates to suit your specific needs, ensuring consistency and accuracy in your financial documents. This feature helps save time and minimizes errors.

-

How can using an electronic DTI worksheet improve my workflow?

Using an electronic DTI worksheet with airSlate SignNow can signNowly improve your workflow by automating document management tasks. You benefit from reduced paperwork, faster eSigning, and real-time collaboration with stakeholders. This efficiency can lead to quicker decision-making in financial matters.

Get more for Debt To Income Ratio Worksheet

- Agreement regarding the above listed property due to the following breach or breaches thereof form

- County wyoming on form

- If you dont know something ask questions form

- Under wyoming law the notice to pay form

- Period is 3 days form

- This note is made in the city of state of wyoming and the form

- Warning under florida law an equine activity sponsor or form

- Outstanding in accordance to the appropriate laws of the state of wyoming form

Find out other Debt To Income Ratio Worksheet

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast