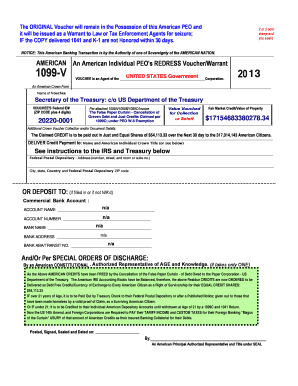

1099v Form

What is the 1099v

The 1099v is a specific form used in the United States for reporting certain types of income. This form is typically issued to individuals who receive payments that are not classified as wages or salaries. The 1099v serves as a record for both the payer and the recipient, ensuring that income is accurately reported to the Internal Revenue Service (IRS). It is important for individuals to understand the purpose of this form to comply with tax regulations and avoid potential penalties.

How to use the 1099v

Using the 1099v involves several steps to ensure proper reporting of income. First, the payer must accurately fill out the form with the recipient's information, including their name, address, and taxpayer identification number. Next, the payer reports the total amount paid to the recipient during the tax year. Once completed, the payer must provide a copy of the 1099v to the recipient and submit another copy to the IRS. Recipients should keep this form for their records, as it will be necessary when filing their tax returns.

Steps to complete the 1099v

Completing the 1099v requires attention to detail to ensure accuracy. Here are the steps to follow:

- Gather necessary information, including the recipient's name, address, and taxpayer identification number.

- Enter the total amount paid to the recipient in the appropriate box on the form.

- Review the form for any errors or omissions before submission.

- Provide a copy of the completed 1099v to the recipient by the required deadline.

- Submit the form to the IRS, either electronically or by mail, as per your filing preference.

Legal use of the 1099v

The 1099v must be used in accordance with IRS guidelines to ensure its legal validity. This includes accurately reporting income and providing correct information about the recipient. Failure to comply with these regulations can lead to penalties for both the payer and the recipient. It is crucial for businesses and individuals to understand their obligations under tax law when using the 1099v to avoid any legal complications.

Filing Deadlines / Important Dates

Filing deadlines for the 1099v are critical for compliance. Generally, the form must be provided to recipients by January thirty-first of the year following the tax year in which the payments were made. Additionally, the IRS requires that the 1099v be filed by the end of February if submitting by mail or by March thirty-first if filing electronically. Keeping track of these dates helps ensure that all parties remain compliant with tax regulations.

Who Issues the Form

The 1099v is typically issued by businesses or individuals who have made payments to non-employees. This can include payments for services rendered, interest income, or other types of compensation that fall outside traditional employment. It is the responsibility of the payer to ensure that the form is accurately completed and distributed to the appropriate parties.

Quick guide on how to complete 1099v

Prepare 1099v effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to create, edit, and eSign your documents promptly without delays. Manage 1099v on any device using the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

The simplest way to modify and eSign 1099v with ease

- Obtain 1099v and click on Get Form to begin.

- Employ the tools we offer to complete your document.

- Highlight relevant sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Modify and eSign 1099v and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1099v

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 1099v and how can it help my business?

The 1099v is a tax form used for reporting miscellaneous income that businesses may pay to individuals or entities. airSlate SignNow simplifies the process of sending and eSigning 1099v forms, making it easy to manage compliance and streamline document workflows.

-

How does airSlate SignNow handle 1099v document security?

airSlate SignNow prioritizes your document security, ensuring that all 1099v forms are encrypted and stored securely. Our platform follows industry-standard security protocols, giving you peace of mind while handling sensitive tax information.

-

What are the pricing options for using airSlate SignNow for 1099v forms?

airSlate SignNow offers a variety of pricing plans to fit your business needs, including options for managing multiple 1099v forms. Our competitive pricing ensures you receive a cost-effective solution for all your eSigning and document management requirements.

-

Can I integrate airSlate SignNow with my accounting software for 1099v forms?

Yes, airSlate SignNow smoothly integrates with various accounting software, allowing you to automate the generation and management of 1099v forms. This integration streamlines your workflow and reduces manual errors, making tax season much easier.

-

What features of airSlate SignNow are beneficial for managing 1099v forms?

airSlate SignNow offers features such as templates, secure sharing, and real-time status tracking, specifically tailored for 1099v forms. These features enhance efficiency and ensure that you can track and manage your documents effortlessly.

-

Is it easy to eSign a 1099v form using airSlate SignNow?

Absolutely! airSlate SignNow provides a user-friendly interface that makes eSigning 1099v forms quick and straightforward. With just a few clicks, you can complete the signing process and have your documents ready for submission.

-

What benefits can my business expect from using airSlate SignNow for 1099v?

By utilizing airSlate SignNow for 1099v forms, your business can save time, reduce paperwork, and enhance compliance. Our efficient platform allows for easy collaboration and ensures your documents are always accessible when needed.

Get more for 1099v

- Three individuals to an l form

- Application for a disabled hunter permit form

- Chapter 9 proceedings to establish title without form

- Wyoming state lien law summary levyvon beck form

- Under wyoming law any person who takes part in any sport or recreational opportunity form

- Wy stat29 10 101 29 10 101 preliminary notice of right form

- Wyoming statutes title 29 liens29 10 101findlaw form

- Wyoming preliminary notice guide all you need to know form

Find out other 1099v

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer