Rita Form 48

What is the Rita Form 48

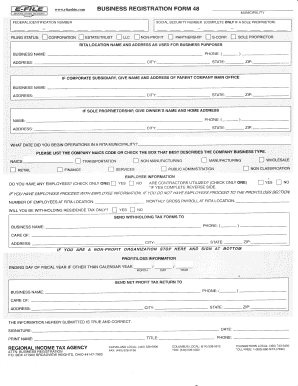

The Rita Form 48 is a specific document used in various legal and administrative processes. It is primarily utilized for purposes related to tax filings, compliance, or other official submissions. Understanding the nature of this form is essential for individuals and businesses to ensure they meet regulatory requirements. The form may require personal information, financial data, or other details pertinent to the filing process.

How to use the Rita Form 48

Using the Rita Form 48 involves several key steps. First, gather all necessary information and documents that will be required for completion. This may include identification numbers, financial records, and any relevant supporting documents. Next, fill out the form carefully, ensuring accuracy in all entries. Once completed, review the form for any errors or omissions before submission. It is also advisable to keep a copy for personal records.

Steps to complete the Rita Form 48

Completing the Rita Form 48 can be broken down into a series of straightforward steps:

- Obtain the latest version of the form from an official source.

- Read the instructions carefully to understand the requirements.

- Fill in personal and financial information as required.

- Double-check all entries for accuracy.

- Sign and date the form where indicated.

- Submit the form through the appropriate channels, whether online or by mail.

Legal use of the Rita Form 48

The legal use of the Rita Form 48 hinges on compliance with applicable laws and regulations. When completed correctly, the form can serve as a legally binding document. It is essential to ensure that all information is accurate and that the form is submitted in accordance with the relevant guidelines. Failure to comply with these requirements may lead to penalties or legal complications.

Key elements of the Rita Form 48

Key elements of the Rita Form 48 include:

- Personal identification information, such as name and address.

- Financial details relevant to the purpose of the form.

- Signature of the individual completing the form.

- Date of completion.

- Any additional documentation required to support the submission.

Form Submission Methods

The Rita Form 48 can be submitted through various methods, depending on the requirements set forth by the issuing authority. Common submission methods include:

- Online submission through a designated portal.

- Mailing a physical copy to the appropriate office.

- In-person delivery to a local office or agency.

Filing Deadlines / Important Dates

Filing deadlines for the Rita Form 48 can vary based on the specific purpose of the form. It is crucial to be aware of any important dates associated with the submission to avoid penalties. Keeping track of these deadlines ensures compliance and helps maintain good standing with regulatory authorities.

Quick guide on how to complete rita form 48 23516191

Effortlessly Prepare Rita Form 48 on Any Device

Managing documents online has gained traction among organizations and individuals alike. It serves as an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without any hiccups. Handle Rita Form 48 on any platform using the airSlate SignNow applications for Android or iOS and streamline your document-related tasks today.

How to Edit and eSign Rita Form 48 with Ease

- Obtain Rita Form 48 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you want to send your form - via email, text message (SMS), invitation link, or download it to your computer.

No more worrying about misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Rita Form 48 to ensure exceptional communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rita form 48 23516191

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the rita form 48?

The rita form 48 is a specific document used for various administrative purposes. It helps streamline the process of document signing and is optimized for businesses looking to enhance their workflows. Utilizing airSlate SignNow, you can easily manage and eSign the rita form 48 digitally.

-

How much does it cost to use the rita form 48 with airSlate SignNow?

airSlate SignNow offers competitive pricing plans tailored to different business needs. You can get started with our free trial, and plans begin at a cost-effective rate that allows for unlimited eSigning of documents, including the rita form 48. Visit our pricing page for detailed information.

-

What features are included when using the rita form 48 in airSlate SignNow?

When using the rita form 48 in airSlate SignNow, you gain access to a variety of features such as secure eSigning, document templates, and real-time status tracking. These features enhance collaboration and efficiency, making it easier to manage your documents seamlessly.

-

Can I integrate the rita form 48 with other applications?

Yes, airSlate SignNow allows you to integrate the rita form 48 with various applications like Google Drive, Dropbox, and CRM systems. This helps ensure that your document management workflow is cohesive and connects with the tools you already use, enhancing productivity.

-

What are the benefits of using the rita form 48 with airSlate SignNow?

Using the rita form 48 with airSlate SignNow offers several benefits, including increased efficiency, reduced paper usage, and enhanced security. Our platform ensures documents are signed in a timely manner while keeping them safe, thus simplifying your administrative processes.

-

Is it easy to use the rita form 48 in airSlate SignNow?

Absolutely! airSlate SignNow is designed to be user-friendly, allowing anyone to easily upload, edit, and eSign the rita form 48 without any technical expertise. Our intuitive interface ensures that you can navigate through the signing process smoothly.

-

How long does it take to complete the rita form 48 using airSlate SignNow?

Completing the rita form 48 using airSlate SignNow is quick and efficient. Typically, users can finalize the signing process in just a few minutes, allowing you to focus on other important tasks while ensuring your documents are handled promptly.

Get more for Rita Form 48

- An introduction to the uses of mediation and other forms of jstor

- Access to the courts by form

- Los procedimientos del ttulo ii de la ada del poder judicial de form

- Note in a tax court complaint form

- Formulario de demanda de accin civil debe estar completamente lleno y firmado

- Por lo tanto no anote en el mismo ningn identificador personal como por ejemplo el nmero de seguridad form

- Controlled substances administration log form

- Controlled substances record administration log form

Find out other Rita Form 48

- Sign Nebraska Contract Safe

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now