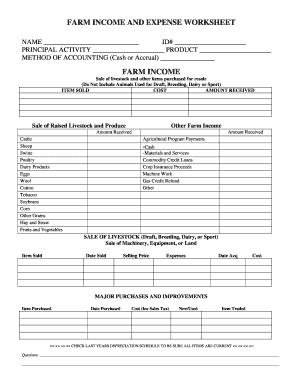

Farm Income and Expense Worksheet Form

What is the Farm Income and Expense Worksheet?

The farm income and expense worksheet is a crucial document used by farmers to track their income and expenses throughout the year. This worksheet helps in organizing financial data, making it easier to prepare tax returns and assess the overall financial health of a farming operation. It typically includes sections for recording various sources of income, such as crop sales and livestock sales, as well as expenses related to operating the farm, including equipment costs, feed, and labor. By maintaining an accurate record, farmers can make informed decisions about their business and ensure compliance with IRS regulations.

How to Use the Farm Income and Expense Worksheet

Using the farm income and expense worksheet involves several straightforward steps. First, gather all relevant financial documents, including receipts and invoices. Next, categorize your income and expenses into appropriate sections on the worksheet. For instance, list all sources of income in one area and all expenses in another. It is essential to be thorough and accurate to ensure that all financial aspects of the farm are captured. Regularly updating the worksheet throughout the year can simplify the process when it comes time to file taxes. Finally, review the completed worksheet for accuracy before submission to the IRS.

Steps to Complete the Farm Income and Expense Worksheet

Completing the farm income and expense worksheet involves a series of organized steps. Start by entering your personal information at the top of the form, including your name, address, and tax identification number. Next, proceed to the income section, where you will list all sources of income generated from your farming activities. After documenting income, move on to the expense section, where you will categorize and enter all farm-related expenses. Be sure to include direct costs, such as seeds and fertilizers, as well as indirect costs like utilities. Once all data is entered, double-check for any errors or omissions before finalizing the worksheet.

Legal Use of the Farm Income and Expense Worksheet

The farm income and expense worksheet is not only a tool for personal organization but also serves a legal purpose. When completed accurately, it can be used to substantiate income and expenses reported on tax returns. This documentation is vital in the event of an audit, as it provides a clear record of financial activities. Compliance with IRS guidelines is essential to ensure that the worksheet is legally valid. Utilizing a trusted platform like signNow for eSigning can enhance the legal standing of the completed worksheet by providing a secure and compliant method for signing and storing documents.

Key Elements of the Farm Income and Expense Worksheet

Several key elements make up the farm income and expense worksheet. These include sections for reporting gross income, which encompasses all earnings from farming activities, and detailed expense categories, such as operational costs, depreciation, and interest on loans. Additionally, the worksheet may include space for calculating net income, which is the difference between total income and total expenses. Understanding these elements is crucial for accurate reporting and effective financial management. By focusing on these components, farmers can ensure they have a comprehensive view of their financial situation.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the farm income and expense worksheet. Farmers are encouraged to familiarize themselves with these guidelines to ensure compliance when filing taxes. Key points include the requirement to report all income accurately, the necessity of keeping detailed records of expenses, and the importance of adhering to deadlines for filing tax returns. Additionally, the IRS may require the submission of supporting documentation to validate the information reported on the worksheet. Staying informed about these guidelines can help farmers avoid penalties and ensure smooth processing of their tax returns.

Quick guide on how to complete farm income and expense worksheet 367905401

Complete Farm Income And Expense Worksheet effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to access the proper form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage Farm Income And Expense Worksheet on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered activity today.

How to modify and eSign Farm Income And Expense Worksheet with ease

- Find Farm Income And Expense Worksheet and click Get Form to initiate.

- Use the tools we provide to complete your form.

- Select pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form navigation, or mistakes that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Farm Income And Expense Worksheet while ensuring exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the farm income and expense worksheet 367905401

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a farm income and expense worksheet?

A farm income and expense worksheet is a financial tool that helps farmers track their income and expenses related to farming operations. This worksheet is essential for maintaining accurate financial records, which can aid in budgeting and tax preparation. Using a digital solution like airSlate SignNow can streamline this process, making it easier to manage and update.

-

How can airSlate SignNow help with my farm income and expense worksheet?

airSlate SignNow offers an easy-to-use platform for creating, signing, and sharing your farm income and expense worksheet electronically. The robust features allow you to easily customize your worksheet, ensuring that all necessary fields are covered. Additionally, it provides secure storage and easy access from anywhere, making it a valuable tool for any farmer.

-

Is airSlate SignNow a cost-effective solution for farmers?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including farmers. With various pricing plans to fit your budget, you can choose the level of service that best meets your needs. This ensures that you can efficiently manage your farm income and expense worksheet without breaking the bank.

-

What features does airSlate SignNow offer for managing farm finances?

airSlate SignNow includes features such as customizable templates, automated reminders, and secure eSignature options, all of which are beneficial for your farm income and expense worksheet. These tools make it easy to keep all necessary documentation in order, helping you stay organized. Moreover, the user-friendly interface allows anyone to navigate it easily.

-

Can I integrate airSlate SignNow with other accounting software?

Yes, airSlate SignNow seamlessly integrates with various accounting and financial software, allowing you to import and export your farm income and expense worksheet data efficiently. This integration means you can work within your existing systems while taking advantage of airSlate SignNow's powerful features. This flexibility helps streamline financial processes.

-

How secure is my farm income and expense worksheet when using airSlate SignNow?

AirSlate SignNow prioritizes the security of your documents, including your farm income and expense worksheet. With advanced encryption methods and compliance with industry standards, your data is protected from unauthorized access. You can confidently manage your financial information knowing that it is stored securely.

-

Can I collaborate with my accountant using airSlate SignNow?

Absolutely! AirSlate SignNow allows for efficient collaboration with your accountant by enabling them to review and sign your farm income and expense worksheet to ensure accuracy. Shared access features facilitate effective communication and feedback, ensuring that all parties are on the same page for financial decisions. This can be especially useful during tax season.

Get more for Farm Income And Expense Worksheet

Find out other Farm Income And Expense Worksheet

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract