Michigan Individual Income Tax E File Payment Voucher Form

What is the Michigan Individual Income Tax E file Payment Voucher

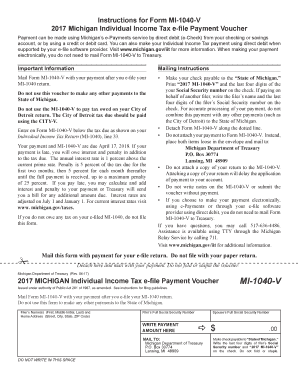

The Michigan Individual Income Tax E file Payment Voucher is a crucial document for taxpayers who need to make payments when filing their state income tax electronically. This voucher serves as a payment method for individuals who owe taxes after completing their e-filing process. It is particularly useful for those who prefer to submit their payments separately from their electronic tax returns. The voucher includes essential information such as the taxpayer's name, address, and the amount due, ensuring that payments are accurately applied to the correct account.

How to use the Michigan Individual Income Tax E file Payment Voucher

Using the Michigan Individual Income Tax E file Payment Voucher is straightforward. After completing your e-filing, you should print the voucher and fill in the required details, including your personal information and the payment amount. Once completed, you can submit the voucher along with your payment. It is important to ensure that the payment is made by the due date to avoid penalties. The voucher can be sent via mail or submitted in person at designated locations, depending on your preference.

Steps to complete the Michigan Individual Income Tax E file Payment Voucher

Completing the Michigan Individual Income Tax E file Payment Voucher involves several key steps:

- Print the voucher from your e-filing software or the Michigan Department of Treasury website.

- Enter your name, address, and Social Security number accurately on the voucher.

- Specify the amount you are paying, ensuring it matches the amount owed from your tax return.

- Choose your payment method, whether by check or money order, and attach it to the voucher.

- Mail the completed voucher and payment to the address specified on the form or deliver it in person.

Key elements of the Michigan Individual Income Tax E file Payment Voucher

The Michigan Individual Income Tax E file Payment Voucher contains several key elements that are essential for accurate processing:

- Taxpayer Information: This includes your name, address, and Social Security number.

- Payment Amount: The total amount you owe must be clearly indicated.

- Payment Method: Specify whether you are paying by check or money order.

- Submission Instructions: Detailed guidelines on how to submit the voucher are provided.

Legal use of the Michigan Individual Income Tax E file Payment Voucher

The Michigan Individual Income Tax E file Payment Voucher is legally recognized as a valid method for submitting tax payments. It complies with state regulations, ensuring that payments made via this voucher are processed correctly. To maintain compliance, it is important to follow the instructions provided on the voucher and ensure timely submission. Failure to adhere to the guidelines may result in penalties or delays in processing your payment.

Filing Deadlines / Important Dates

Timely submission of the Michigan Individual Income Tax E file Payment Voucher is critical to avoid penalties. The filing deadline for individual income tax returns typically falls on April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check the Michigan Department of Treasury's official website for any updates or changes to deadlines. Additionally, ensuring that your payment is submitted by this date will help you avoid interest and penalties on any outstanding amounts.

Quick guide on how to complete michigan 1040 instructions 2017

Complete michigan 1040 instructions 2017 effortlessly on any device

Managing documents online has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily find the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents swiftly without delays. Handle 2017 efile on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign 2017 michigan voucher seamlessly

- Find e payment voucher and click on Get Form to initiate.

- Employ the tools we provide to fill out your document.

- Emphasize signNow sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Select how you wish to send your form, either via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Edit and eSign filled payment voucher sample and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs michigan form 1040

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

If I don't earn enough money on social security to file income taxes, will I still need an income tax return to fill out a FAFSA, and other financial aid forms for my daughter?

No. Just provide the information requested on the form. If you later need proof you didn't file, you can get that from the IRS BY requesting transcripts.

-

How do I contact the IRS if overpaid my 2017 federal taxes because my accountant failed to file a form that would have reduced my income?

About Form 1040X | Internal Revenue Service is the way you contact the IRS to make a change to an already filed return. If the accountant failed to include a form, then seems like the accountant should help you with this, for free.

-

For the amended tax return, the only thing I needed to correct was the filing status. Do I still need to fill out the rest of the form involving income, etc.?

Yes, it depends what kind of income. For social security incomes, there is a different threshold amount for single and Married Filing joint. Different filing status have a certain treatment and that tax rates are different for every filing status. The filing status change goes on the very top of the 1040X. When I was a Tax Auditor for the IRS, the 1040X was one of the hardest thing to calculate. Just a few years ago, the IRS decided to change but with disastrous results- people were more confused than the original. So IRS changed the 1040X to its original. Follow your program’s instruction or go to an Enrolled Agent. I found out throughout my career that a good majority of CPA’s do not know the mechanics of the 1040X. Chances are you may need to send the returns by mail.

-

For a resident alien individual having farm income in the home country, India, how to report the agricultural income in US income tax return? Does the form 1040 schedule F needs to be filled?

The answer is yes, it should be. Remember that you will receive a credit for any Indian taxes you pay.

Related searches to michigan income tax payment

Create this form in 5 minutes!

How to create an eSignature for the michigan individual income tax

How to make an eSignature for your 2017 Michigan Individual Income Tax E File Payment Voucher online

How to generate an eSignature for the 2017 Michigan Individual Income Tax E File Payment Voucher in Chrome

How to make an eSignature for signing the 2017 Michigan Individual Income Tax E File Payment Voucher in Gmail

How to create an eSignature for the 2017 Michigan Individual Income Tax E File Payment Voucher from your smart phone

How to generate an electronic signature for the 2017 Michigan Individual Income Tax E File Payment Voucher on iOS

How to create an eSignature for the 2017 Michigan Individual Income Tax E File Payment Voucher on Android OS

People also ask michigan tax efile

-

What is the 2017 efile process?

The 2017 efile process allows individuals and businesses to electronically file their tax returns using approved e-filing software. By leveraging the 2017 efile option, users can submit their returns quickly and efficiently, ensuring compliance and reducing potential errors associated with paper filings.

-

How does airSlate SignNow support the 2017 efile?

airSlate SignNow simplifies the signing of documents required for the 2017 efile process. With its intuitive interface, users can easily add electronic signatures to tax forms and relevant documents, streamlining the e-filing experience and enhancing overall efficiency.

-

Is there a cost associated with using airSlate SignNow for 2017 efile?

AirSlate SignNow offers various pricing plans to cater to different business needs when utilizing the 2017 efile features. These plans are designed to be cost-effective, ensuring that users can manage their document signing processes without exceeding their budget.

-

What features does airSlate SignNow offer for 2017 efile users?

For the 2017 efile users, airSlate SignNow provides features such as reusable templates, automatic reminders, and comprehensive audit trails. These functionalities help ensure that important documents are signed promptly and securely, making the e-filing process more manageable.

-

Can I integrate airSlate SignNow with my existing accounting software for 2017 efile?

Yes, airSlate SignNow can seamlessly integrate with various accounting and tax software applications to facilitate the 2017 efile process. This integration enhances productivity by allowing users to manage documents and signatures all in one place, eliminating the need for manual data entry.

-

What are the benefits of using airSlate SignNow for 2017 efile?

Using airSlate SignNow for the 2017 efile offers signNow benefits, including faster turnaround times and reduced paperwork. Additionally, the platform ensures that all signatures are legally binding and can be verified, providing peace of mind during the filing process.

-

Is airSlate SignNow secure for sensitive documents related to 2017 efile?

Absolutely! airSlate SignNow prioritizes the security of your sensitive documents, implementing robust encryption and security protocols to safeguard your data during the 2017 efile process. Users can trust that their information remains confidential and protected.

Get more for payment voucher pdf

Find out other printable payment voucher

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile