Modified Business Tax Return Form Nevada

What is the Modified Business Tax Return Form Nevada

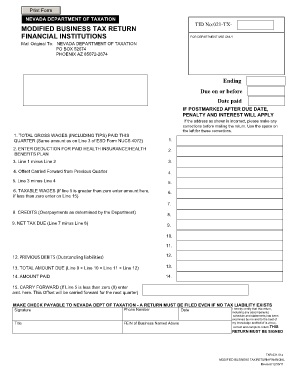

The Modified Business Tax Return Form Nevada is a state-specific tax form used by businesses operating in Nevada to report their modified business tax (MBT) obligations. This form is essential for calculating the amount of tax owed based on gross wages paid to employees, with certain deductions available. The MBT is primarily applicable to employers, and understanding this form is crucial for compliance with state tax regulations.

How to use the Modified Business Tax Return Form Nevada

Using the Modified Business Tax Return Form Nevada involves several steps. First, businesses must gather necessary financial information, including total gross wages and any applicable deductions. Next, the form must be filled out accurately, ensuring that all required sections are completed. Once filled, the form can be submitted either electronically or via mail, depending on the business's preference and compliance requirements. It is important to keep a copy of the submitted form for record-keeping purposes.

Steps to complete the Modified Business Tax Return Form Nevada

Completing the Modified Business Tax Return Form Nevada requires careful attention to detail. Follow these steps for accurate completion:

- Gather financial records, including payroll information and previous tax filings.

- Fill out the form, starting with business identification details, such as the name and address.

- Report total gross wages paid to employees in the designated section.

- Calculate any deductions applicable to your business, such as health insurance costs.

- Determine the total tax owed based on the calculations provided in the form.

- Review the completed form for accuracy before submission.

Legal use of the Modified Business Tax Return Form Nevada

The Modified Business Tax Return Form Nevada is legally binding when completed and submitted according to state regulations. To ensure its legal standing, businesses must comply with the guidelines set forth by the Nevada Department of Taxation. This includes accurate reporting of financial information and adherence to filing deadlines. Failure to comply can result in penalties or legal repercussions.

Filing Deadlines / Important Dates

It is crucial for businesses to be aware of the filing deadlines associated with the Modified Business Tax Return Form Nevada. Generally, the form must be submitted quarterly, with specific due dates established by the state. Businesses should mark their calendars to ensure timely submissions, as late filings can incur penalties and interest on unpaid taxes.

Required Documents

When preparing to file the Modified Business Tax Return Form Nevada, businesses should have several documents ready. These include:

- Payroll records detailing gross wages paid to employees.

- Documentation of any deductions claimed, such as health benefits.

- Previous tax returns for reference and accuracy.

- Any correspondence from the Nevada Department of Taxation regarding tax obligations.

Penalties for Non-Compliance

Non-compliance with the Modified Business Tax Return Form Nevada can lead to significant penalties. Businesses may face fines for late submissions, inaccuracies, or failure to file altogether. Additionally, interest may accrue on unpaid taxes, increasing the financial burden. Understanding these penalties emphasizes the importance of timely and accurate filing.

Quick guide on how to complete modified business tax return form nevada

Finalize Modified Business Tax Return Form Nevada effortlessly on any device

Digital document management has surged in popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate template and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Modified Business Tax Return Form Nevada on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and eSign Modified Business Tax Return Form Nevada with ease

- Find Modified Business Tax Return Form Nevada and click Get Form to commence.

- Utilize the tools we provide to complete your form.

- Mark signNow sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form hunting, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any chosen device. Modify and eSign Modified Business Tax Return Form Nevada and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the modified business tax return form nevada

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is mbt nevada and how does it work?

MBT Nevada refers to the Managed Business Trust program designed to streamline document management and e-signature processes. With airSlate SignNow, businesses can easily send, sign, and manage important documents electronically, ensuring a faster workflow and improved organization.

-

What are the pricing options for airSlate SignNow in relation to mbt nevada?

AirSlate SignNow offers flexible pricing plans tailored for businesses using mbt nevada. Depending on your organization's needs, you can choose from different tiers that provide various features and capabilities to enhance your document management and e-signing experience.

-

What features does airSlate SignNow offer for users utilizing mbt nevada?

AirSlate SignNow provides several features for users under mbt nevada, including customizable templates, real-time document tracking, and secure e-signature capabilities. These features enhance efficiency and ensure compliance with legal regulations, making document management seamless.

-

How does airSlate SignNow benefit businesses using mbt nevada?

Businesses utilizing mbt nevada can benefit from airSlate SignNow's cost-effectiveness and ease of use. This solution accelerates document workflow, reduces manual errors, and signNowly cuts down on the time spent on administrative tasks, allowing teams to focus on core business activities.

-

Can airSlate SignNow integrate with other tools for mbt nevada users?

Yes, airSlate SignNow offers integrations with a wide range of third-party applications, perfect for mbt nevada users. This feature allows businesses to connect their existing tools, such as CRM systems and project management software, creating a comprehensive workflow and improving overall productivity.

-

Is airSlate SignNow secure for handling sensitive documents under mbt nevada?

Absolutely. AirSlate SignNow prioritizes security, utilizing advanced encryption methods to protect sensitive information throughout the document lifecycle. For businesses operating under mbt nevada, this ensures that all e-signatures and documents are compliant with industry standards and regulations.

-

What support options are available for mbt nevada users of airSlate SignNow?

AirSlate SignNow provides comprehensive support options for mbt nevada users. This includes access to a dedicated support team, detailed tutorials, and a robust knowledge base to help users get the most out of their document management and e-signature software.

Get more for Modified Business Tax Return Form Nevada

Find out other Modified Business Tax Return Form Nevada

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT