Form E 1

What is the Form E 1

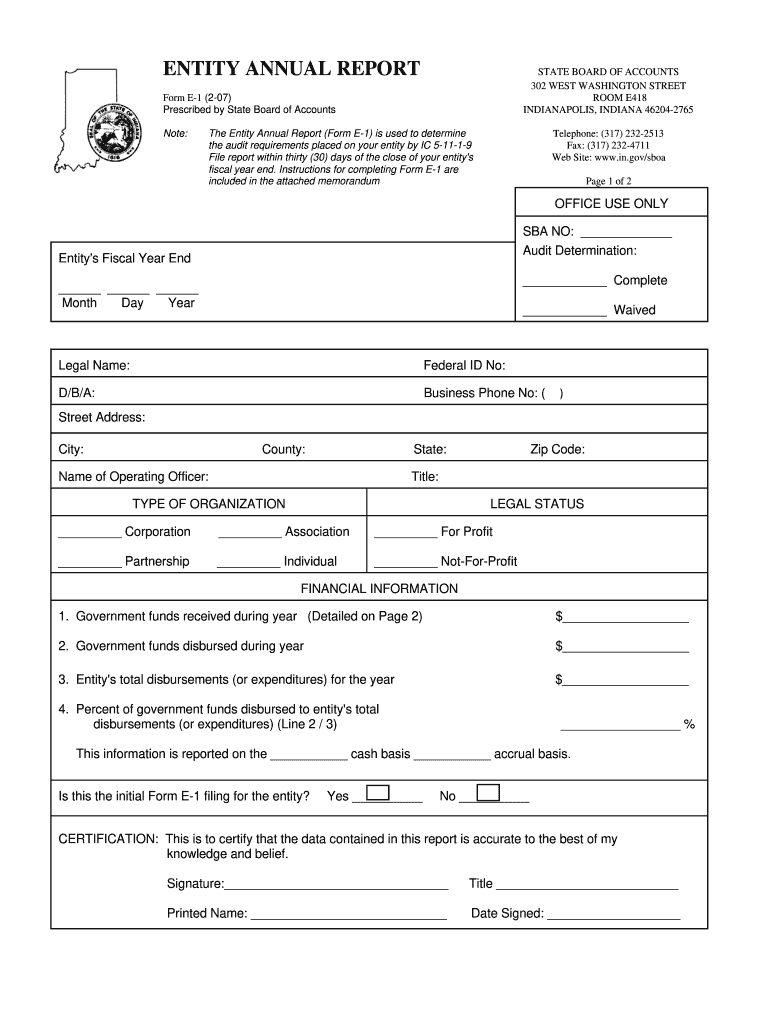

The Indiana entity annual report form E 1 is a required document that businesses must file annually to maintain their legal status in the state of Indiana. This form provides essential information about the entity, including its name, address, and the names of its officers or directors. Filing the form ensures compliance with state regulations and helps to keep the business in good standing.

Steps to Complete the Form E 1

Completing the Indiana entity annual report form E 1 involves several straightforward steps:

- Gather necessary information, including the entity's legal name, address, and details of its officers or directors.

- Access the form through the Indiana Secretary of State's website or other authorized sources.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the information for accuracy and completeness before submission.

- Submit the form electronically or by mail, depending on your preference.

How to Obtain the Form E 1

The Indiana entity annual report form E 1 can be obtained online through the Indiana Secretary of State's website. It is available in a downloadable format, allowing businesses to fill it out digitally. Alternatively, paper copies may be requested through the same official channels if needed.

Legal Use of the Form E 1

Filing the form E 1 is legally mandated for all business entities operating in Indiana. It serves as a declaration of the entity's ongoing existence and compliance with state laws. Failure to file this form can result in penalties, including the potential dissolution of the business entity.

Filing Deadlines / Important Dates

Businesses must submit the Indiana entity annual report form E 1 by the due date specified by the state, typically within a specific timeframe after the end of the fiscal year. It is crucial to be aware of these deadlines to avoid late fees or other penalties. The exact date may vary based on the entity type, so checking the Indiana Secretary of State's website for the most current information is advisable.

Form Submission Methods

The Indiana entity annual report form E 1 can be submitted through various methods:

- Online: Businesses can file electronically via the Indiana Secretary of State's website, which is often the fastest method.

- By Mail: Completed forms can be printed and mailed to the appropriate state office.

- In-Person: Entities may also choose to deliver the form in person at designated state offices.

Quick guide on how to complete form e 1

Complete Form E 1 effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly and without delays. Manage Form E 1 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Form E 1 with ease

- Obtain Form E 1 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Form E 1 and guarantee effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form e 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Indiana entity annual report form E 1?

The Indiana entity annual report form E 1 is a required document for businesses operating in Indiana to report their financial and operational information annually. This form helps maintain compliance with state regulations, ensuring your business remains in good standing.

-

How can airSlate SignNow help me with the Indiana entity annual report form E 1?

airSlate SignNow simplifies the process of completing the Indiana entity annual report form E 1 by allowing you to fill, sign, and send the document electronically. Our platform is user-friendly, ensuring you can manage your reports without any hassle.

-

What are the costs associated with using airSlate SignNow for the Indiana entity annual report form E 1?

airSlate SignNow offers a variety of pricing plans that cater to different business needs. The pricing is competitive, and you can choose a plan that suits your budget while efficiently managing your Indiana entity annual report form E 1 and other documents.

-

Is airSlate SignNow secure for submitting the Indiana entity annual report form E 1?

Absolutely! airSlate SignNow employs top-notch security measures to ensure your Indiana entity annual report form E 1 and other sensitive documents are protected. Our encryption protocols and secure access prevent unauthorized access to your data.

-

What features does airSlate SignNow provide for managing the Indiana entity annual report form E 1?

With airSlate SignNow, you can automate the completion of the Indiana entity annual report form E 1, track document status, and set reminders for filing deadlines. These features streamline your workflow, saving time and reducing the risk of errors.

-

Can airSlate SignNow integrate with other tools for managing the Indiana entity annual report form E 1?

Yes, airSlate SignNow offers various integrations with tools like Google Drive, Dropbox, and CRM systems. These integrations allow you to manage your Indiana entity annual report form E 1 seamlessly alongside other business processes.

-

What are the benefits of using airSlate SignNow for my Indiana entity annual report form E 1?

Using airSlate SignNow for your Indiana entity annual report form E 1 provides convenience, as it speeds up completion and submission. Additionally, the eSigning feature enhances collaboration among team members, leading to faster turnaround times and less paperwork.

Get more for Form E 1

- Maryland wedding planning or consultant package form

- Maryland commercial property sales package form

- Maryland satisfaction form

- Maryland roofing contractor package form

- Maryland contractor form

- Maryland option form

- Maine residential landlord tenant rental lease forms and agreements package

- Maine essential legal life documents for newlyweds form

Find out other Form E 1

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online