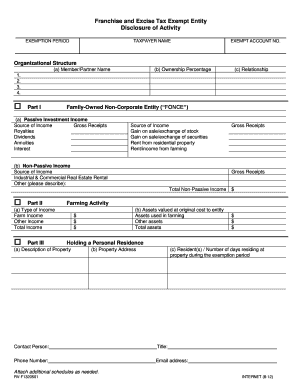

Tennessee Franchise and Excise Tax Exemption Form

What is the Tennessee Franchise And Excise Tax Exemption

The Tennessee Franchise and Excise Tax Exemption is a provision that allows certain businesses to be exempt from paying franchise and excise taxes in the state of Tennessee. This exemption is primarily aimed at non-profit organizations, certain educational institutions, and other entities that meet specific criteria set by the state. Understanding this exemption is crucial for qualifying businesses to ensure compliance with state tax laws and to take advantage of potential financial benefits.

How to Obtain the Tennessee Franchise And Excise Tax Exemption

To obtain the Tennessee Franchise and Excise Tax Exemption, businesses must first determine their eligibility based on the criteria outlined by the state. Eligible entities typically include non-profit organizations and specific types of educational institutions. Once eligibility is confirmed, businesses must complete the appropriate application form, providing necessary documentation that supports their exemption claim. This may include financial statements, proof of non-profit status, or other relevant information. Submitting the application to the Tennessee Department of Revenue is the final step in the process.

Steps to Complete the Tennessee Franchise And Excise Tax Exemption

Completing the Tennessee Franchise and Excise Tax Exemption involves several key steps:

- Determine eligibility based on the type of business or organization.

- Gather required documentation, such as financial records and proof of non-profit status.

- Fill out the exemption application form accurately.

- Submit the completed form along with supporting documents to the Tennessee Department of Revenue.

- Await confirmation of the exemption status from the state.

Key Elements of the Tennessee Franchise And Excise Tax Exemption

Several key elements define the Tennessee Franchise and Excise Tax Exemption. These include:

- Eligibility Criteria: Specific types of organizations, such as non-profits and educational institutions, may qualify.

- Documentation Requirements: Applicants must provide evidence supporting their exemption status.

- Application Process: A structured process must be followed to apply for the exemption.

- Compliance Obligations: Even with an exemption, organizations must adhere to certain regulations and reporting requirements.

Legal Use of the Tennessee Franchise And Excise Tax Exemption

The legal use of the Tennessee Franchise and Excise Tax Exemption requires strict adherence to state laws and regulations. Organizations must ensure they meet all eligibility requirements and maintain compliance with reporting obligations. Misuse or failure to comply with the exemption criteria can result in penalties or loss of exempt status. It is important for organizations to stay informed about any changes in legislation that may affect their tax exemption status.

Filing Deadlines / Important Dates

Filing deadlines for the Tennessee Franchise and Excise Tax Exemption vary depending on the type of organization and the specific tax year. Generally, applications should be submitted well in advance of the tax filing deadline to ensure timely processing. Organizations should keep track of important dates related to tax filings and renewals to maintain their exempt status and avoid any potential penalties.

Quick guide on how to complete tennessee franchise and excise tax exemption

Complete Tennessee Franchise And Excise Tax Exemption effortlessly on any device

Web-based document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your files quickly without delays. Manage Tennessee Franchise And Excise Tax Exemption on any platform using the airSlate SignNow Android or iOS applications and enhance any document-driven task today.

How to edit and eSign Tennessee Franchise And Excise Tax Exemption with ease

- Obtain Tennessee Franchise And Excise Tax Exemption and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature with the Sign feature, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your adjustments.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Edit and eSign Tennessee Franchise And Excise Tax Exemption and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tennessee franchise and excise tax exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Tennessee Franchise And Excise Tax Exemption?

The Tennessee Franchise And Excise Tax Exemption refers to the tax incentives available to certain businesses operating in Tennessee. This exemption can signNowly reduce the tax obligations for eligible organizations, allowing them to allocate more resources to growth and operations.

-

Who qualifies for the Tennessee Franchise And Excise Tax Exemption?

To qualify for the Tennessee Franchise And Excise Tax Exemption, businesses must meet specific criteria set by the state. Generally, non-profit organizations, certain manufacturing firms, and businesses in targeted industries may be eligible. Consulting a tax professional can provide guidance on eligibility.

-

How can airSlate SignNow help with the application process for Tennessee Franchise And Excise Tax Exemption?

airSlate SignNow streamlines the document signing process necessary for the Tennessee Franchise And Excise Tax Exemption application. With our easy-to-use interface, businesses can quickly prepare, send, and eSign the required documents, ensuring a more efficient submission.

-

What are the benefits of obtaining the Tennessee Franchise And Excise Tax Exemption?

Securing the Tennessee Franchise And Excise Tax Exemption can provide signNow financial relief to businesses, reducing their tax burden. This exemption can free up capital for reinvestment, enhance competitiveness in the market, and improve overall business sustainability.

-

Are there any fees associated with applying for the Tennessee Franchise And Excise Tax Exemption?

While there may not be direct application fees for the Tennessee Franchise And Excise Tax Exemption, businesses should anticipate potential costs related to professional services for guidance and document preparation. Utilizing airSlate SignNow can help minimize these costs by simplifying the paperwork process.

-

How does airSlate SignNow ensure the security of documents related to Tennessee Franchise And Excise Tax Exemption?

airSlate SignNow prioritizes document security and compliance, utilizing advanced encryption and secure hosting for all files, including those related to the Tennessee Franchise And Excise Tax Exemption. This ensures that sensitive information remains protected throughout the signing process.

-

What types of businesses benefit most from the Tennessee Franchise And Excise Tax Exemption?

Industries such as manufacturing, technology, and certain non-profits frequently benefit from the Tennessee Franchise And Excise Tax Exemption. These sectors often have higher capital expenditures and operational costs that can be alleviated through tax exemption, enhancing their financial viability.

Get more for Tennessee Franchise And Excise Tax Exemption

Find out other Tennessee Franchise And Excise Tax Exemption

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease