IRS Tax Transcript Sample Sample Tax Return Verification from the IRS Form

What is the IRS Tax Transcript Sample?

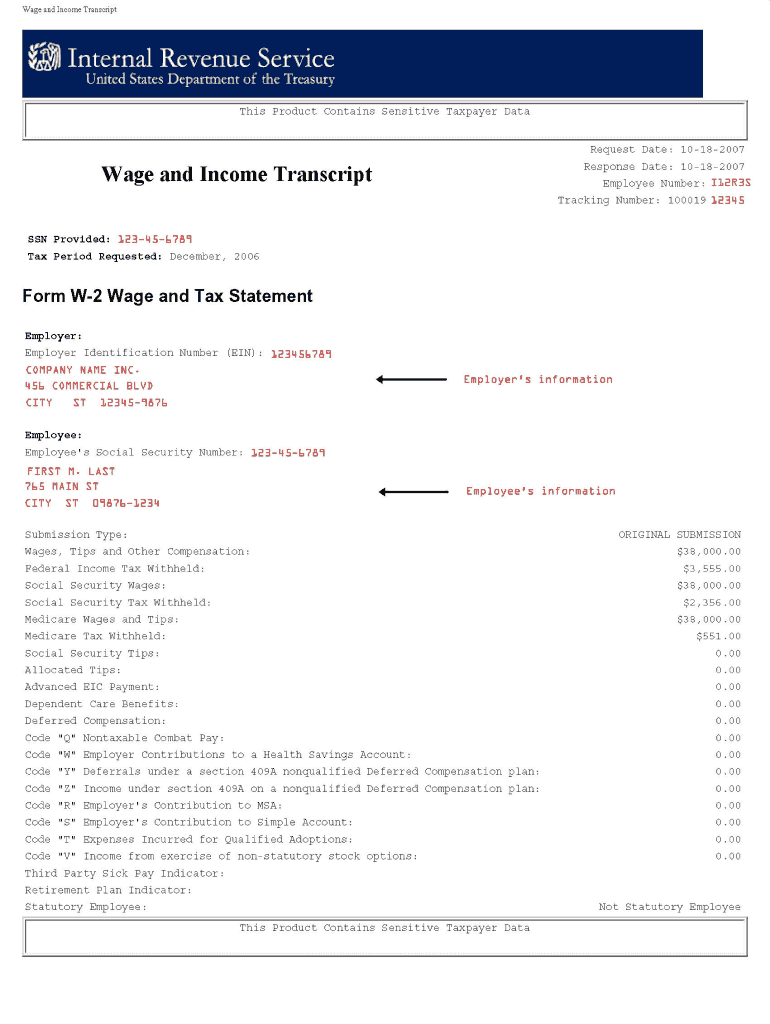

The IRS tax transcript sample serves as an official document that summarizes your tax return information. It provides a detailed account of your income, deductions, and tax liabilities as reported on your tax return. This document is essential for various purposes, including loan applications, income verification, and tax audits. The IRS offers different types of transcripts, including the tax return transcript, which reflects the information from your filed return, and the wage and income transcript, which details your income as reported by third parties, such as employers and financial institutions.

How to Obtain the IRS Tax Transcript Sample

Obtaining an IRS tax transcript is a straightforward process. You can request it online through the IRS website, by mail, or by phone. To request online, you need to create an account on the IRS portal, where you can access and download your transcript immediately. If you prefer to request it by mail, you can complete Form 4506-T and send it to the IRS. Alternatively, you can call the IRS at their toll-free number and follow the prompts to receive your transcript by mail. Keep in mind that it may take several days for the IRS to process your request and send the document.

Key Elements of the IRS Tax Transcript Sample

Understanding the key elements of the IRS tax transcript sample is crucial. The document typically includes:

- Your personal information: Name, Social Security number, and address.

- Tax year: The specific year for which the transcript is generated.

- Filing status: Your filing status, such as single, married filing jointly, or head of household.

- Income details: Total income, adjusted gross income, and taxable income.

- Deductions and credits: Any deductions or credits claimed on your return.

- Tax liability: The total amount of tax owed or refunded.

Steps to Complete the IRS Tax Transcript Sample

Completing the IRS tax transcript sample involves several steps. First, ensure you have all necessary personal information and tax details at hand. If you are filling out a form to request the transcript, complete it accurately, providing your name, Social Security number, and the tax year you need. If using the online method, log into your IRS account, navigate to the transcript section, and select the type of transcript you require. Review the information provided to ensure accuracy before submitting your request. After submission, monitor the status of your request if applicable.

Legal Use of the IRS Tax Transcript Sample

The IRS tax transcript sample is legally recognized and can be used for various purposes, including:

- Loan applications: Lenders often require a tax transcript to verify income.

- Financial aid: Educational institutions may request transcripts for student aid eligibility.

- Tax audits: The IRS may request your transcript during an audit for verification purposes.

It is important to ensure that the transcript is complete and accurate, as discrepancies can lead to complications in legal or financial matters.

Examples of Using the IRS Tax Transcript Sample

There are several scenarios where an IRS tax transcript sample may be utilized:

- Self-employed individuals: May use the transcript to demonstrate income when applying for business loans.

- Students: Often need transcripts to confirm income for financial aid applications.

- Homebuyers: Lenders may require tax transcripts to assess income stability and eligibility for mortgages.

In each case, having an accurate and accessible tax transcript can facilitate smoother processes in financial and legal transactions.

Quick guide on how to complete irs tax transcript sample sample tax return verification from the irs

Effortlessly complete IRS Tax Transcript Sample Sample Tax Return Verification From The IRS on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without holdups. Handle IRS Tax Transcript Sample Sample Tax Return Verification From The IRS on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to modify and electronically sign IRS Tax Transcript Sample Sample Tax Return Verification From The IRS with ease

- Locate IRS Tax Transcript Sample Sample Tax Return Verification From The IRS and then click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Review all the details then click the Done button to save your modifications.

- Select how you would like to share your form—via email, text message (SMS), an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and electronically sign IRS Tax Transcript Sample Sample Tax Return Verification From The IRS and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs tax transcript sample sample tax return verification from the irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax transcript example?

A tax transcript example is a document that provides a summary of your tax return information as filed with the IRS. It serves as an official record that can be requested for various purposes, such as applying for loans or verifying income. Understanding how to interpret a tax transcript example can help you manage your finances better.

-

How does airSlate SignNow support signing tax transcripts?

airSlate SignNow allows users to easily upload and eSign tax transcript examples securely. It simplifies the process of obtaining signatures from multiple parties, ensuring that your documents are legally binding and compliant with regulations. Additionally, the straightforward interface helps users manage their documents effectively.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans designed to fit different business needs. Pricing is based on the number of users and features included, such as templates and integrations. When you consider the value provided, especially for managing important documents like tax transcript examples, it's a cost-effective solution.

-

Can airSlate SignNow integrate with other software for handling tax transcripts?

Yes, airSlate SignNow integrates seamlessly with numerous applications, allowing you to manage your tax transcript examples alongside other business tools. Integrations with platforms like Google Drive, Salesforce, and Zapier enhance productivity by connecting your workflow. This means you can access, send, and store documents efficiently.

-

What benefits does airSlate SignNow offer for managing tax documents?

Using airSlate SignNow for managing tax documents, including tax transcript examples, enhances security and compliance. The platform features audit trails and encryption, ensuring that your documents are protected. Additionally, the user-friendly design allows any team member to navigate the signing process with ease.

-

Is there a mobile app for signing tax transcripts?

Yes, airSlate SignNow offers a mobile app that allows you to sign tax transcript examples on the go. The app provides full functionality, enabling you to send, sign, and manage your documents from any mobile device. This convenience allows you to keep your business operations running smoothly, no matter where you are.

-

What security measures does airSlate SignNow implement for sensitive documents?

airSlate SignNow ensures the utmost security for sensitive documents such as tax transcript examples. It employs strong encryption protocols for data in transit and at rest, along with secure user authentication processes. These measures guarantee that your sensitive information is safeguarded against unauthorized access.

Get more for IRS Tax Transcript Sample Sample Tax Return Verification From The IRS

- Enhanced life estate form

- Florida warranty deed blank form

- Quitclaim deed form 481377165

- Florida share form

- Florida quitclaim deed from individual to corporation form

- Florida lady bird deed form

- Limited liability company 481377171 form

- Florida warranty deed for parent to child reserving life estates to parent form

Find out other IRS Tax Transcript Sample Sample Tax Return Verification From The IRS

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF