Itr 2 Form Download

Understanding the ITR 2 Form

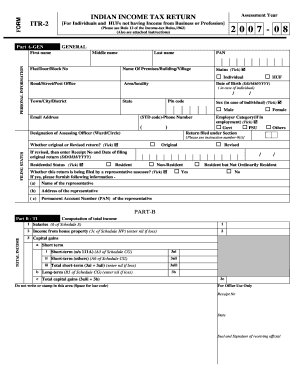

The ITR 2 form is a crucial document for individuals in the United States who need to report their income, especially those with income from sources other than business or profession. This form is often used by individuals who have earned income from salaries, house property, capital gains, and other sources. Unlike the ITR 1 form, which is simpler and meant for individuals with basic income sources, the ITR 2 form accommodates more complex financial situations. It is essential for taxpayers to understand the specific requirements and sections of the ITR 2 form to ensure accurate reporting and compliance with tax regulations.

Key Elements of the ITR 2 Form

The ITR 2 form consists of several key sections that need to be filled out accurately. These include:

- Personal Information: This section requires details such as name, address, and PAN (Permanent Account Number).

- Income Details: Taxpayers must report income from various sources, including salaries, rental income, and capital gains.

- Deductions: This section allows taxpayers to claim deductions under various sections of the Income Tax Act, such as Section 80C, which pertains to investments.

- Tax Computation: Here, taxpayers calculate their total tax liability based on the reported income and applicable deductions.

- Verification: The form must be signed and dated to verify that the information provided is accurate and complete.

Steps to Complete the ITR 2 Form

Completing the ITR 2 form involves several steps to ensure that all necessary information is accurately reported. Here’s a simplified process:

- Gather all relevant financial documents, including income statements, investment proofs, and deduction receipts.

- Fill in your personal information, ensuring that your name and PAN are correctly entered.

- Report your income from various sources in the designated sections of the form.

- Claim deductions as applicable, ensuring you have the necessary documentation to support your claims.

- Calculate your total tax liability and ensure that all figures are accurate.

- Sign and date the form to complete the verification process.

Legal Use of the ITR 2 Form

The ITR 2 form is legally binding and must be filled out in compliance with the regulations set by the Internal Revenue Service (IRS). It is essential to ensure that all information is truthful and complete, as inaccuracies can lead to penalties or legal repercussions. The form serves as an official record of income and taxes paid, and it may be required for various legal and financial processes, such as applying for loans or mortgages.

Filing Deadlines and Important Dates

Timely filing of the ITR 2 form is crucial to avoid penalties. The general deadline for filing individual tax returns in the United States is April fifteenth of each year. However, if you file for an extension, you may have until October fifteenth. It is important to keep track of these dates to ensure compliance and avoid late fees.

Required Documents for the ITR 2 Form

When preparing to fill out the ITR 2 form, certain documents are essential to ensure accuracy and compliance. These typically include:

- W-2 forms from employers

- 1099 forms for other income sources

- Receipts for deductible expenses

- Bank statements

- Investment statements

Quick guide on how to complete itr 2 form download

Accomplish Itr 2 Form Download seamlessly on any gadget

Digital document organization has gained traction among businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the resources required to create, alter, and eSign your documents rapidly without complications. Oversee Itr 2 Form Download on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest method to alter and eSign Itr 2 Form Download effortlessly

- Find Itr 2 Form Download and click on Get Form to begin.

- Utilize the features we provide to finalize your document.

- Emphasize signNow sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to secure your changes.

- Choose your method of sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow attends to your document management needs in a few clicks from any device you prefer. Alter and eSign Itr 2 Form Download and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the itr 2 form download

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the itr2 form no download needed?

The itr2 form no download needed is an online document that allows users to file their income tax returns without the hassle of downloading software. With airSlate SignNow, you can easily complete and eSign the itr2 form online, streamlining your tax filing process.

-

How does airSlate SignNow support itr2 form no download needed?

airSlate SignNow provides a user-friendly platform for completing the itr2 form no download needed. Users can fill out the form directly in their browser, eliminating the need for any software installations and ensuring a quick, efficient filing experience.

-

Is the itr2 form no download needed secure?

Yes, the itr2 form no download needed is secure when using airSlate SignNow. The platform employs advanced encryption and security protocols to ensure that your personal data and tax information are protected while you fill or eSign your forms.

-

Are there any costs associated with using the itr2 form no download needed on airSlate SignNow?

airSlate SignNow offers competitive pricing plans, making it affordable to use the itr2 form no download needed. You can choose from various subscription options tailored to your business needs, ensuring value for your investment.

-

What features are included when using the itr2 form no download needed?

When using the itr2 form no download needed on airSlate SignNow, you gain access to features such as custom templates, electronic signatures, and real-time collaboration. These features help simplify your tax filing process, making it more efficient and organized.

-

Can I integrate other tools with airSlate SignNow for the itr2 form no download needed?

Yes, airSlate SignNow allows seamless integration with various tools and applications, enhancing your experience with the itr2 form no download needed. You can connect it to your CRM, document management systems, and other platforms to streamline your workflow.

-

What are the benefits of using the itr2 form no download needed with airSlate SignNow?

The primary benefits of using the itr2 form no download needed with airSlate SignNow include increased efficiency, security, and ease of use. This solution allows you to manage your tax filing process from anywhere, reducing time spent on paperwork and enhancing overall productivity.

Get more for Itr 2 Form Download

- Individual to limited liability company form

- Before me a notary public in and for said county personally appeared the above named form

- Control number oh 08 78 form

- Lawriter orc search mechanics lien ohio revised code form

- Husband and wife to limited liability company form

- Control number oh 09 78 form

- Ohio mechanics lien laws select statutes and forms

- Vaccinations veterinary care and farrier care form

Find out other Itr 2 Form Download

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile