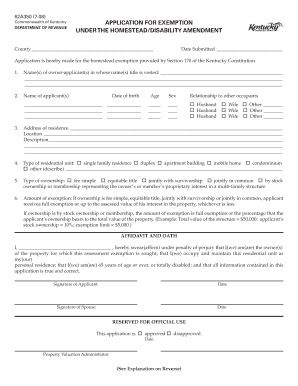

Ky Dept of Revenue Form 62a350

What is the Ky Dept Of Revenue Form 62a350

The Ky Dept of Revenue Form 62A350 is a specific tax form used in the state of Kentucky. This form is primarily utilized for reporting certain tax obligations, including those related to income or business activities. Understanding the purpose of this form is essential for compliance with state tax regulations. It serves as a formal declaration of income, expenses, and any applicable deductions, ensuring that taxpayers accurately report their financial activities to the state.

How to use the Ky Dept Of Revenue Form 62a350

Using the Ky Dept of Revenue Form 62A350 involves several key steps. First, ensure that you have the correct version of the form, which can be obtained from the Kentucky Department of Revenue's official website or other authorized sources. Next, carefully fill out the required fields, providing accurate information regarding your financial situation. It is important to double-check all entries for accuracy, as mistakes can lead to delays or penalties. Once completed, the form can be submitted electronically or via traditional mail, depending on your preference and the guidelines provided by the state.

Steps to complete the Ky Dept Of Revenue Form 62a350

Completing the Ky Dept of Revenue Form 62A350 requires following a structured approach to ensure accuracy and compliance. Here are the steps to follow:

- Gather all necessary financial documents, including income statements and receipts.

- Obtain the latest version of the form from the Kentucky Department of Revenue.

- Fill in your personal and business information as required.

- Report your income, expenses, and any deductions accurately.

- Review the completed form for any errors or omissions.

- Submit the form electronically or mail it to the appropriate address.

Legal use of the Ky Dept Of Revenue Form 62a350

The legal use of the Ky Dept of Revenue Form 62A350 is crucial for maintaining compliance with Kentucky tax laws. This form must be filled out truthfully and submitted by the designated deadlines to avoid penalties. The information provided on the form is subject to verification by the Kentucky Department of Revenue, and any discrepancies can lead to legal consequences. Therefore, it is important to ensure that all data is accurate and complete before submission.

Required Documents

To successfully complete the Ky Dept of Revenue Form 62A350, certain documents are required. These typically include:

- Income statements, such as W-2s or 1099s.

- Receipts for deductible expenses.

- Previous tax returns, if applicable.

- Any relevant documentation supporting claims made on the form.

Form Submission Methods

The Ky Dept of Revenue Form 62A350 can be submitted through various methods, providing flexibility for taxpayers. The available submission options include:

- Online submission via the Kentucky Department of Revenue's e-filing system.

- Mailing a hard copy of the completed form to the designated address.

- In-person submission at local tax offices, if preferred.

Quick guide on how to complete ky dept of revenue form 62a350

Effortlessly Prepare Ky Dept Of Revenue Form 62a350 on Any Device

Digital document management has become increasingly popular among organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct template and safeguard it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Manage Ky Dept Of Revenue Form 62a350 on any device using the airSlate SignNow applications for Android or iOS and streamline any document-related processes today.

The easiest way to adjust and eSign Ky Dept Of Revenue Form 62a350 without any hassle

- Obtain Ky Dept Of Revenue Form 62a350 and click Get Form to begin.

- Utilize the available tools to complete your form.

- Highlight important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes only seconds and carries the same legal validity as a handwritten signature.

- Review the details and then click on the Done button to finalize your changes.

- Choose how you wish to send your form, whether via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign Ky Dept Of Revenue Form 62a350 and maintain outstanding communication at any point in the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ky dept of revenue form 62a350

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ky dept of revenue form 62a350 used for?

The ky dept of revenue form 62a350 is utilized for reporting specific tax obligations in Kentucky. This form is essential for individuals and businesses to ensure compliance with state tax regulations. Understanding its purpose helps streamline your tax processes and avoid potential penalties.

-

How can airSlate SignNow assist with the ky dept of revenue form 62a350?

airSlate SignNow empowers users to easily complete and eSign the ky dept of revenue form 62a350 online. Its user-friendly interface simplifies the process of filling out and submitting this important document. By using our platform, you can save time and reduce errors associated with manual completion.

-

What are the pricing plans for using airSlate SignNow?

airSlate SignNow offers competitive pricing plans to fit different needs, including options for individuals and teams. The plans include features for document management, electronic signatures, and integrations. You can choose the best plan that accommodates your frequency of use, especially for handling the ky dept of revenue form 62a350.

-

Can I integrate airSlate SignNow with my existing systems?

Yes, airSlate SignNow provides seamless integrations with various business applications. You can connect it with CRM systems, cloud storage services, and other tools to enhance your workflow. This integration capability makes managing documents like the ky dept of revenue form 62a350 much easier.

-

Is airSlate SignNow secure for handling sensitive forms?

Absolutely, airSlate SignNow prioritizes security, ensuring that your documents, including the ky dept of revenue form 62a350, are protected. We employ advanced encryption methods and follow rigorous compliance standards. Your sensitive information remains secure throughout the signing process.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow for eSigning brings numerous benefits, such as increased efficiency and cost savings. It allows you to sign documents like the ky dept of revenue form 62a350 from anywhere, eliminating the need for physical paperwork. This not only speeds up transactions but also contributes to a more environmentally friendly approach.

-

Can I track the status of my ky dept of revenue form 62a350 during the signing process?

Yes, airSlate SignNow includes tracking features that allow you to monitor the status of your documents, including the ky dept of revenue form 62a350. You’ll receive notifications when the document is viewed, signed, or completed. This transparency helps you stay informed throughout the process.

Get more for Ky Dept Of Revenue Form 62a350

Find out other Ky Dept Of Revenue Form 62a350

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now