St387 Form

What is the St387

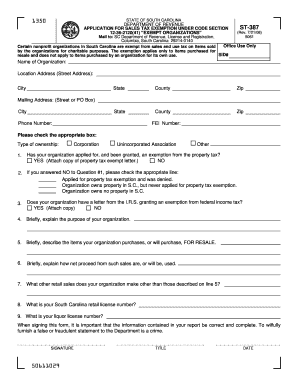

The St387 is a specific form used primarily in the context of tax and compliance within the United States. It serves as a declaration or application for certain tax-related purposes, often required by businesses or individuals to report income or claim deductions. Understanding the St387 is essential for ensuring compliance with federal and state regulations.

How to use the St387

Using the St387 involves several key steps. First, you must determine your eligibility to file the form based on your specific circumstances, such as your business structure or income type. Next, gather all necessary documentation that supports your claims or declarations on the form. Once you have completed the form accurately, you can submit it either electronically or via mail, depending on the submission guidelines provided by the issuing authority.

Steps to complete the St387

Completing the St387 requires careful attention to detail. Follow these steps:

- Review the instructions provided with the form to understand the requirements.

- Fill out the form with accurate information, ensuring all fields are completed.

- Attach any required documentation that supports your claims.

- Double-check your entries for accuracy and completeness.

- Submit the form according to the specified method, either online or by mail.

Legal use of the St387

The legal use of the St387 hinges on compliance with relevant tax laws and regulations. For the form to be considered valid, it must be filled out correctly and submitted within the designated time frame. Additionally, any claims made on the form should be substantiated with appropriate documentation to avoid potential legal issues or penalties.

Key elements of the St387

Several key elements must be included when completing the St387. These include:

- Personal or business identification information.

- Details regarding income sources or deductions being claimed.

- Signature and date to validate the submission.

Ensuring that all key elements are accurately represented is crucial for the form's acceptance and for avoiding delays in processing.

Filing Deadlines / Important Dates

Filing deadlines for the St387 can vary based on the specific tax year and the type of submission. It is important to be aware of these dates to avoid late penalties. Typically, forms must be filed by the end of the tax year or as specified by the IRS. Keeping a calendar of important dates can help ensure timely submissions.

Form Submission Methods (Online / Mail / In-Person)

The St387 can be submitted through various methods, including:

- Online submission via the appropriate government portal.

- Mailing the completed form to the designated address.

- In-person submission at local tax offices, if applicable.

Choosing the right submission method can depend on personal preference and the specific requirements of the issuing authority.

Quick guide on how to complete st387

Complete St387 with ease on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents rapidly without delays. Manage St387 on any device with airSlate SignNow Android or iOS applications and simplify any document-centric operation today.

How to alter and eSign St387 effortlessly

- Obtain St387 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant parts of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that task.

- Form your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all details and click on the Done button to preserve your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign St387 and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st387

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is St387 and how does it relate to airSlate SignNow?

St387 is a vital component for businesses looking to streamline their document signing processes. With airSlate SignNow, St387 serves as a reliable reference point for companies aiming to adopt efficient eSigning solutions that meet compliance and efficiency needs.

-

What are the pricing options for airSlate SignNow's St387 eSigning features?

airSlate SignNow offers flexible pricing plans tailored to fit various business needs and sizes. The St387 features are included in all plans, ensuring that organizations can effectively manage their document workflows without breaking the budget.

-

What key features does St387 provide in the airSlate SignNow platform?

St387 offers numerous features including customizable templates, advanced security protocols, and real-time tracking of document status. These capabilities enable businesses to enhance their document management processes and optimize productivity.

-

How can St387 enhance my document management process with airSlate SignNow?

Utilizing St387 within airSlate SignNow can signNowly reduce turnaround times for document approvals. This enhanced efficiency allows teams to focus on core business activities while maintaining seamless communication and collaboration.

-

What benefits does St387 bring to businesses using airSlate SignNow?

The integration of St387 provides businesses with improved compliance, enhanced security, and reduced operational costs. By utilizing airSlate SignNow’s features backed by St387, companies can accelerate their digital transformation journeys.

-

Can St387 integrate with other software tools?

Yes, St387 seamlessly integrates with various popular applications such as CRM systems, marketing tools, and cloud storage solutions. This interoperability ensures that airSlate SignNow fits perfectly within existing business workflows.

-

Is St387 suitable for businesses of all sizes?

Absolutely! St387 is designed to cater to the needs of businesses ranging from small startups to large enterprises. With customizable features, airSlate SignNow through St387 meets diverse operational requirements across different industries.

Get more for St387

- Aging parent package alaska form

- Sale of a business package alaska form

- Legal documents for the guardian of a minor package alaska form

- New state resident package alaska form

- Commercial property sales package alaska form

- General partnership package alaska form

- Ak contract deed form

- Power of attorney forms package alaska

Find out other St387

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP