Form 10f Filled Form

What is the Form 10f Filled Form

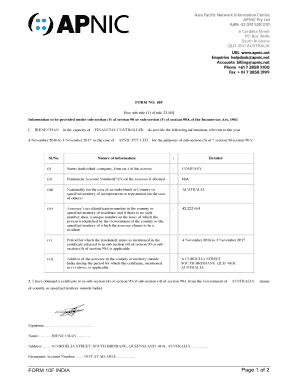

The Form 10F is a crucial document used in India for claiming tax benefits under the Double Taxation Avoidance Agreement (DTAA) between India and other countries. This form is primarily used by non-residents to provide necessary information to the Indian tax authorities, ensuring that they are eligible for reduced tax rates or exemptions on income sourced from India. The filled Form 10F serves as proof of residency in the foreign country and details the nature of income, thus facilitating the correct application of tax treaties.

Steps to Complete the Form 10f Filled Form

Completing the Form 10F requires careful attention to detail. Here are the essential steps:

- Gather Required Information: Collect all necessary personal and tax-related information, including your name, address, country of residence, and tax identification number.

- Fill in the Form: Accurately input your details into the form. Ensure that all sections are completed, including the declaration of the nature of income.

- Sign the Form: After filling out the form, sign it to validate the information provided. This signature confirms that the details are correct and that you are eligible for the benefits claimed.

- Submit the Form: Depending on the requirements, submit the filled Form 10F to the relevant tax authorities or the entity requesting it.

Legal Use of the Form 10f Filled Form

The legal use of the Form 10F is significant in ensuring compliance with Indian tax laws. When properly filled and submitted, the form allows non-residents to benefit from reduced withholding tax rates as per the applicable tax treaty. It is essential that the form is completed accurately, as any discrepancies may lead to delays in processing or denial of tax benefits. Legal validity is maintained when the form adheres to the guidelines set forth by the Indian tax authorities.

Key Elements of the Form 10f Filled Form

The Form 10F consists of several key elements that must be accurately filled out:

- Personal Information: This includes the taxpayer's name, address, and country of residence.

- Tax Identification Number: The foreign tax identification number must be provided to establish residency.

- Nature of Income: Clearly specify the type of income for which the tax benefits are being claimed.

- Signature: The form must be signed by the taxpayer to validate the information.

How to Obtain the Form 10f Filled Form

Obtaining the Form 10F is straightforward. The form can typically be downloaded from the official website of the Indian tax department or obtained through financial institutions that facilitate international transactions. It is essential to ensure that you are using the most current version of the form to avoid any compliance issues.

Examples of Using the Form 10f Filled Form

There are various scenarios where the Form 10F is utilized:

- Foreign Investors: Non-resident investors receiving dividends from Indian companies may use Form 10F to claim reduced tax rates.

- Consultants: Foreign consultants providing services in India can use this form to ensure that their income is taxed at the correct rate.

- Royalties: Non-residents receiving royalties from Indian entities can also benefit from the tax treaty provisions by submitting Form 10F.

Quick guide on how to complete form 10f filled form

Complete Form 10f Filled Form seamlessly on any platform

Digital document management has become widely embraced by businesses and individuals alike. It offers a perfect environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the accurate form and securely archive it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and electronically sign your documents swiftly without issues. Handle Form 10f Filled Form on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to adjust and electronically sign Form 10f Filled Form effortlessly

- Obtain Form 10f Filled Form and click Get Form to begin.

- Use the tools we offer to finalize your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Form 10f Filled Form to ensure outstanding communication at every phase of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 10f filled form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form 10F sample?

A form 10F sample is a document that enables non-residents of India to claim benefits under tax treaties. This sample outlines the necessary information required for tax concession, ensuring compliance with Indian tax laws. Utilizing a form 10F sample can streamline your tax documentation process.

-

How can airSlate SignNow assist with a form 10F sample?

airSlate SignNow offers a user-friendly platform to easily fill, send, and eSign your form 10F sample. With customizable templates and secure cloud storage, you can efficiently manage your tax-related documents. Integrating signNow into your workflow simplifies the entire signing process.

-

Is airSlate SignNow affordable for small businesses needing form 10F samples?

Yes, airSlate SignNow provides cost-effective pricing plans tailored to small businesses. By choosing our services to manage form 10F samples, you benefit from a budget-friendly solution that ensures professional document handling. Our competitive pricing makes it accessible for all businesses.

-

What features does airSlate SignNow provide for handling form 10F samples?

Our platform offers features such as customizable templates, secure online storage, and real-time tracking for form 10F samples. Additionally, you can collect eSignatures seamlessly, making the entire process efficient. These features greatly enhance the experience when managing important tax documents.

-

Can I integrate airSlate SignNow with other applications for form 10F samples?

Absolutely! airSlate SignNow easily integrates with popular applications such as Google Drive, Salesforce, and Dropbox. This allows for smoother workflows and better management of your form 10F samples. Such integrations ensure that your documentation process is streamlined and efficient.

-

What are the benefits of using airSlate SignNow for form 10F samples?

Using airSlate SignNow for form 10F samples enhances efficiency and compliance while reducing administrative burden. You can manage documents securely and access them anytime, anywhere, which is essential for tax purposes. Ultimately, our platform simplifies the signing process and saves time.

-

How does airSlate SignNow ensure the security of my form 10F samples?

We prioritize your data security with advanced encryption and secure storage for all your form 10F samples. Our platform complies with international security standards, ensuring that your sensitive information is protected. You can trust that your documents are safe with airSlate SignNow.

Get more for Form 10f Filled Form

- Plumbing contractor package alaska form

- Brick mason contractor package alaska form

- Roofing contractor package alaska form

- Electrical contractor package alaska form

- Sheetrock drywall contractor package alaska form

- Flooring contractor package alaska form

- Trim carpentry contractor package alaska form

- Fencing contractor package alaska form

Find out other Form 10f Filled Form

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History