Form 8880

What is the Form 8880

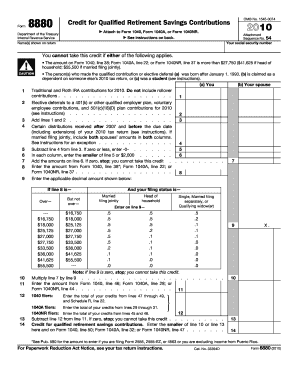

The Form 8880, officially known as the Credit for Qualified Retirement Savings Contributions, is a tax form used by eligible taxpayers to claim a credit for contributions made to retirement savings accounts. This form is particularly beneficial for low- to moderate-income individuals who contribute to their retirement plans, such as IRAs or 401(k)s. By filing this form, taxpayers can reduce their overall tax liability, making retirement savings more accessible.

How to use the Form 8880

Using the Form 8880 involves a few straightforward steps. First, gather all necessary documentation regarding your retirement contributions for the tax year. This includes any statements from your retirement accounts. Next, complete the form by providing your personal information, including your filing status and adjusted gross income. Finally, calculate the credit amount based on your contributions and income level as outlined in the form's instructions. Once completed, attach the form to your tax return.

Steps to complete the Form 8880

Completing the Form 8880 requires careful attention to detail. Here are the steps to follow:

- Gather your financial records, including retirement account contributions.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate your filing status and adjusted gross income on the form.

- Calculate your credit based on the contributions made and your income level.

- Double-check all entries for accuracy before submission.

Eligibility Criteria

To qualify for the credit claimed on Form 8880, taxpayers must meet specific eligibility criteria. These include being at least eighteen years old, not being a full-time student, and having an adjusted gross income below certain thresholds. Additionally, the contributions must be made to qualified retirement plans, such as traditional IRAs, Roth IRAs, or employer-sponsored retirement plans. Meeting these criteria is essential for successfully claiming the credit.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8880 align with the standard tax return deadlines. Typically, individual tax returns are due on April fifteenth. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should ensure that they submit their Form 8880 along with their tax return by this deadline to avoid penalties and ensure timely processing.

Legal use of the Form 8880

The legal use of Form 8880 is governed by IRS regulations. To ensure compliance, taxpayers must accurately report their contributions and adhere to the eligibility criteria. The form is legally binding, and any inaccuracies or fraudulent claims can result in penalties, including fines or additional taxes owed. Therefore, it is crucial to maintain accurate records and complete the form truthfully to avoid legal issues.

Required Documents

When completing Form 8880, several documents are necessary to support your claims. These typically include:

- Retirement account statements showing contributions made during the tax year.

- Documentation of your adjusted gross income, such as W-2 forms or 1099 statements.

- Any previous year tax returns that may provide context for your current filing.

Having these documents on hand will facilitate a smoother filing process and ensure accuracy in your claims.

Quick guide on how to complete form 8880 10004913

Complete Form 8880 seamlessly on any device

Online document oversight has gained traction among businesses and individuals. It presents an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the required form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents quickly without delays. Manage Form 8880 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and eSign Form 8880 effortlessly

- Locate Form 8880 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to preserve your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in a few clicks from any device you choose. Edit and eSign Form 8880 to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8880 10004913

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8880 and how does it relate to airSlate SignNow?

Form 8880, also known as the Credit for Qualified Retirement Savings Contributions, is an essential tax form for individuals contributing to retirement accounts. Using airSlate SignNow, you can effortlessly eSign and submit Form 8880, ensuring your retirement contributions are correctly documented, streamlining your tax filing process.

-

How can airSlate SignNow help me fill out Form 8880?

airSlate SignNow provides a user-friendly platform that guides you through filling out Form 8880 step by step. With templates and pre-filled fields for essential information, you can efficiently complete the form, ensuring you don't miss any critical details needed for tax credits.

-

What features does airSlate SignNow offer for managing Form 8880?

With airSlate SignNow, you gain access to intuitive features such as document templates, eSignatures, and real-time collaboration. These tools simplify the management of Form 8880, making it easy to share with financial advisors or co-signers while tracking all changes and signatures smoothly.

-

Is airSlate SignNow affordable for individuals needing to file Form 8880?

Yes, airSlate SignNow offers competitive pricing plans that make it accessible for individuals looking to complete Form 8880. The cost-effective solution ensures that you can manage your tax forms without overspending, providing excellent value for both personal and professional use.

-

Can airSlate SignNow integrate with other software for Form 8880?

Absolutely! airSlate SignNow integrates seamlessly with various tools like Google Drive, Dropbox, and CRM software. This integration capability ensures that your Form 8880 can be easily accessed and shared across platforms, streamlining your overall document management process.

-

Is it secure to use airSlate SignNow for signing Form 8880?

Using airSlate SignNow for signing Form 8880 is highly secure. With advanced encryption protocols and compliance with industry standards, your sensitive information is protected throughout the eSigning process, ensuring peace of mind as you handle important tax documents.

-

How can airSlate SignNow benefit tax professionals handling Form 8880?

For tax professionals, airSlate SignNow offers an efficient way to manage Form 8880 for multiple clients. With features like bulk sending and reusable templates, tax experts can save valuable time, improve client communication, and expedite the filing process for tax credits.

Get more for Form 8880

- Tennessee legal forms tennessee legal documents

- Control number tn p005 pkg form

- Control number tn p006 pkg form

- Fillable online staff application form july 2018 kings kids nz

- Of county tennessee as my attorney in fact to form

- Control number tn p011 pkg form

- Tennessee us legal forms

- Tennessee durable power of attorney for health care statute form

Find out other Form 8880

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online