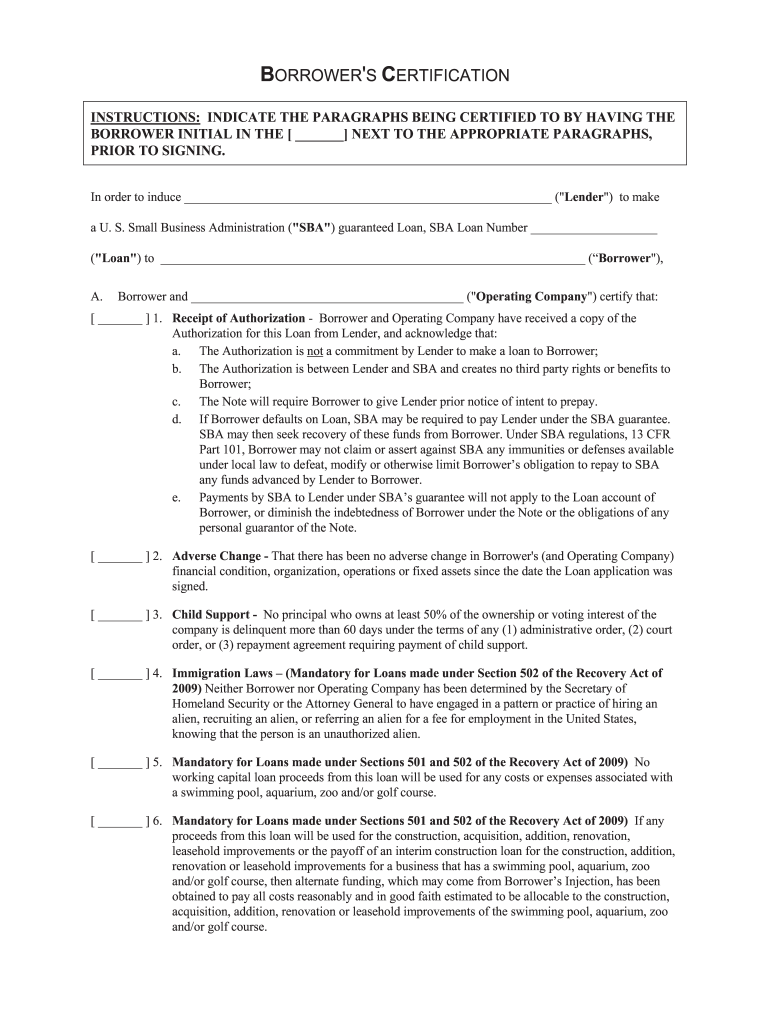

Borrower Certification Form

What is the Borrower Certification

The Borrower Certification is a critical document used in the mortgage process, confirming the borrower's identity and financial status. This form typically includes essential information such as the borrower's name, address, Social Security number, and income details. It serves to validate the borrower's eligibility for a mortgage, ensuring that all information provided is accurate and complete. By signing this certification, borrowers affirm that they understand their obligations and the terms of the mortgage agreement.

Steps to Complete the Borrower Certification

Completing the Borrower Certification involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including personal identification and financial documents. Next, carefully fill out the form, making sure to provide truthful and up-to-date information. After completing the form, review it for any errors or omissions. Finally, sign the document electronically using a secure platform, which provides a legally-binding eSignature. This process not only streamlines your mortgage application but also helps maintain the integrity of your financial information.

Legal Use of the Borrower Certification

The Borrower Certification must be used in accordance with federal and state laws governing mortgage lending. It is essential that borrowers understand their rights and responsibilities when submitting this form. The certification serves as a legal affirmation of the information provided, which can be subject to verification by lenders. Misrepresentation or inaccuracies can lead to serious legal consequences, including penalties or denial of the mortgage application. Therefore, it is crucial to ensure that all details are correct and that the form is submitted in compliance with applicable regulations.

Required Documents

To complete the Borrower Certification, several documents are typically required. These may include:

- Proof of identity (e.g., driver's license or passport)

- Social Security number documentation

- Income verification (e.g., pay stubs, tax returns)

- Bank statements

- Details of any outstanding debts or financial obligations

Having these documents ready can facilitate a smoother completion process and enhance the accuracy of the information provided.

Who Issues the Form

The Borrower Certification is typically issued by the lender or financial institution handling the mortgage application. Each lender may have its own version of the form, tailored to meet specific requirements and regulations. It is important for borrowers to use the correct form provided by their lender to ensure compliance with all necessary guidelines. In some cases, the form may also be part of a larger mortgage application package that includes additional documentation and disclosures.

Penalties for Non-Compliance

Failure to comply with the requirements of the Borrower Certification can result in significant penalties. These may include the rejection of the mortgage application, legal action for misrepresentation, and potential financial liabilities. Lenders rely on the accuracy of the information provided in the certification to make informed decisions about loan approvals. Therefore, borrowers must take care to complete the form truthfully and ensure that all information is accurate to avoid any adverse consequences.

Quick guide on how to complete borrower certification form

A straightforward guide on how to create Borrower Certification

Submitting digital documents has shown to be more effective and secure than conventional pen-and-paper techniques. Unlike the process of manually entering information into physical copies, correcting a typographical error or placing data in the wrong field is quite simple. Such errors can lead to signNow delays when preparing applications and requests. Consider employing airSlate SignNow for finalizing your Borrower Certification. Our robust, intuitive, and compliant electronic signature solution will streamline this process for you.

Follow our steps to swiftly complete and endorse your Borrower Certification using airSlate SignNow:

- Verify the purpose of your chosen document to ensure it’s what you need, and click Get Form if it suits your requirements.

- Find your template uploaded in our editor and explore what our tool provides for document modification.

- Populate empty fields with your details and check boxes using Check or Cross options.

- Insert Text boxes, replace existing content, and place Images wherever necessary.

- Utilize the Highlight button to emphasize what you want to stand out, and conceal irrelevant information using the Blackout tool.

- In the sidebar, create additional fillable fields designated for specific parties as needed.

- Secure your document with watermarks or set a password after finishing the edits.

- Add Date, click Sign → Add signature and choose your signing option.

- Draw, type, upload, or generate your legally binding electronic signature with a QR code or via your device’s camera.

- Review your responses and click Done to complete editing and move on to sharing the document.

Utilize airSlate SignNow to create your Borrower Certification and manage other professional fillable documents safely and efficiently. Sign up today!

Create this form in 5 minutes or less

FAQs

-

How do I get the educational loan for my higher studies?

MS applicants spend considerable time and resources preparing for the GRE, shortlisting and applying to schools, and choosing a final school (when lucky enough to receive multiple admits).The best idea is to gain an understanding of financing options while preparing applications and waiting for University responses. Knowing the options empowers MS aspirants to make the best decisions for the academic and financial futures.Type of Loans-Public sector banks: Collateral loansA number of banks offer education loans with collateral for MS studies abroad. Key features of such loan offers include:Up to 90% CoA cover. In some countries, the remaining 10% must be paid up front into the bank by the borrower; this is sometimes known as margin money.A variable interest rate of ~10.5%. In some cases, a discount may be applied for taking insurance against the loan. For, example, you may receive a 0.5% discount for such insurance although this is still an additional cost which factors into the total cost of a loan.In some countries, public sector banks require both collateral and a co-signer for loans. It’s important to be prepared for extensive paperwork and a long loan approval period.While it’s not a universal norm, the collateral requested in some countries requires a parental property to be put on the line - an option that isn’t available to everyone.Non-Banking Financial Corporation (NBFCs): co-signer loansNBFCs in some countries are enabled to provide financing for international education. Typical features of these loan offers include:An offer of up to 100% CoA cover, though a co-signer is always required, and collateral is often required for high-value loans.A proprietary interest rate which isn’t defined by a governing financial institute. It’s important to understand the full cost of any loan (including factors in hidden fees like loan sanction letter fee and currency conversion charges) to enable loan comparison.Loans might be assessed on the basis of co-signer credit score, as well as their salary and other credentials. This can be a real challenge for MS applicants whose co-signers are retired or have not built their credit histories.International lenders: No co-signer, collateral-free loansSome lenders, such as Prodigy Finance, provide loans to international students, often in the currency of the study destination country. Key features of such loan offers include:Loan cover up to 100% CoA without collateral or co-signers; these are merit-based loans provided on the basis of admission to a top-ranked international school.Customized interest rates that have a fixed component and a variable component – which is often the LIBOR rate of the loan currency.Online application processes that are often quicker than other loan providers - and typically more transparent as well.Prodigy Finance’s future earnings model assess your potential based on your post-masters income and career direction.In addition to no co-signer, collateral-free loans, Prodigy Finance borrowers are also eligible for value-added benefits like scholarships and careers support.Keep in mind that every loan offer has its own merits - and you should consider all of your options carefully. This quick guide is just a jumping off point to get you started. Education is an investment and study loans are a commitment; you’ll want to consider the future as well as the present because that acceptance letter is just the beginning.Want to see the terms Prodigy Finance can offer you?Applying for Prodigy Finance’s no-cosigner, collateral-free loans takes just 30 minutes. And, with no obligation to accept a provisional loan offer, there’s no reason to wait.Check more about Prodigy Finance- Prodigy Finance Answers your Top 10 Education-Loan Questions | YocketYou can decide about which type of Educational Loan you want as per your requirements.Share and upvote if helpful.

-

When do I have to file for an exam center in NISM certification?

I assume your question is “When should I ideally make online enrollment for an NISM Certification Examination?”As per NISM website, more than 200 NISM Test Centres are available across India. Each exam centre has specific dates for exam depending on the demand at that particular Test Centre.For example, NISM Test Centre in Delhi (CP) has 150 seats every Saturday and Sunday, whereas NSEiT - Agra Centre has limited exam seats 3 to 4 times in a month.Generally, you will find that sufficient seats are available if you are planning to take NISM Exam after 15–20 days. It may be possible that seats may get filled up as you approach closer to the exam date. This is similar to a seat booking for Indian Railways except the fact that there is no waiting list :)Therefore, once you have prepared yourself for the exam, you can make online enrollment 15–20 days in advance and utilize the time for revision and taking mock tests.You can take NISM Mock Tests and Download NISM Study Material freely online.

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

-

Where can I get the form for migration certificate?

Migration is issued by the Universities themselves.The best way is to inquire your college they will guide you further.In case you happen to be from A.P.J Abdul Kalam Technical Universityhere is the link to get it issued online.Hope it helpsStudent Service (Dashboard) Dr. A.P.J. Abdul Kalam Technical University (Lucknow)Regards

Create this form in 5 minutes!

How to create an eSignature for the borrower certification form

How to make an eSignature for the Borrower Certification Form in the online mode

How to create an electronic signature for the Borrower Certification Form in Chrome

How to generate an eSignature for putting it on the Borrower Certification Form in Gmail

How to create an electronic signature for the Borrower Certification Form right from your smart phone

How to generate an electronic signature for the Borrower Certification Form on iOS

How to generate an eSignature for the Borrower Certification Form on Android OS

People also ask

-

What is Borrower Certification in airSlate SignNow?

Borrower Certification in airSlate SignNow refers to the process of verifying a borrower's information and intentions through electronically signed documents. This feature streamlines the documentation process, ensuring that all necessary certifications are captured efficiently and securely, enhancing the overall borrower experience.

-

How does airSlate SignNow simplify the Borrower Certification process?

airSlate SignNow simplifies the Borrower Certification process by allowing users to create, send, and eSign documents in a digital format. With intuitive templates and automated workflows, businesses can easily manage borrower certifications without the hassle of traditional paperwork, saving time and reducing errors.

-

What are the pricing options for using Borrower Certification with airSlate SignNow?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including features for Borrower Certification. Users can choose from monthly or annual subscriptions, with options that include additional users and advanced features to optimize their certification processes.

-

Can I integrate airSlate SignNow with other tools for Borrower Certification?

Yes, airSlate SignNow supports integrations with numerous business applications, enhancing the Borrower Certification process. Whether it's CRM systems, document management tools, or financial software, these integrations allow for seamless data transfer and improved efficiency in managing borrower certifications.

-

What benefits does Borrower Certification provide for lenders?

Borrower Certification through airSlate SignNow provides lenders with increased accuracy, faster processing times, and improved compliance. By automating the certification process, lenders can focus on building relationships with borrowers while ensuring all documentation is handled securely and efficiently.

-

Is Borrower Certification secure with airSlate SignNow?

Absolutely! airSlate SignNow implements industry-standard security measures to protect Borrower Certification data, including encryption and secure authentication. This ensures that all signed documents and personal information remain confidential and protected against unauthorized access.

-

Can I track the status of Borrower Certification documents in airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for Borrower Certification documents. Users can easily monitor the status of each document, from sent to signed, allowing for better management and follow-up on outstanding certifications.

Get more for Borrower Certification

- How to file an appearance of counsel form eleventh circuit

- Bonds notes mortgages debts due to the decedent form

- Certificate of residency form university of the virgin islands

- Forms banking onewest bank

- Claim against estate informal and formal administration

- Pulaski county merchant license application form

- Ree 013 18 form

- Hebrew style guide microsoft download center form

Find out other Borrower Certification

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast