Bonds, Notes, Mortgages, Debts Due to the Decedent 2016-2026

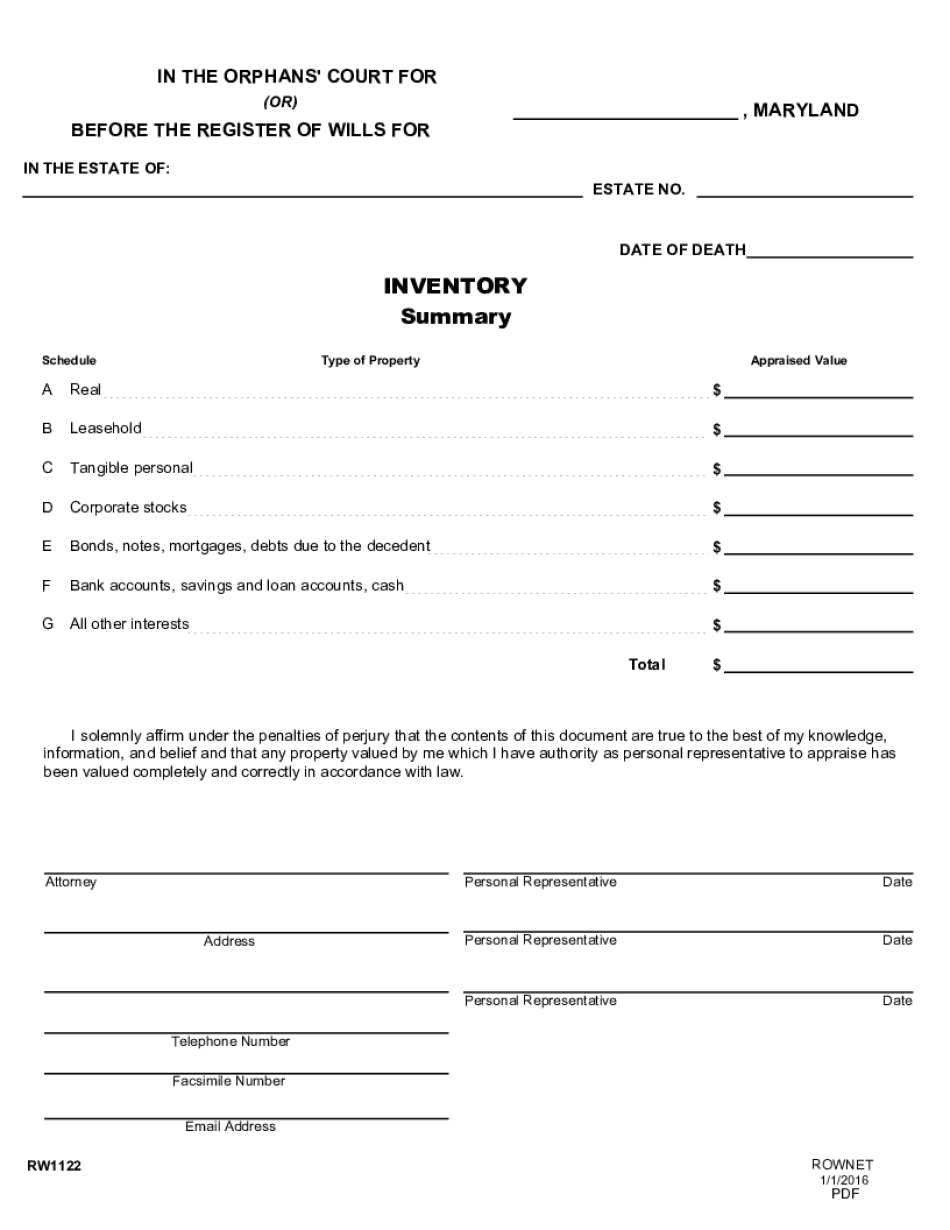

What is the inventory form 1122 with 1123?

The inventory form 1122 with 1123 is a crucial document used in the context of estate management. It is designed to report the bonds, notes, mortgages, and debts that are due to a decedent. This form assists in the accurate accounting of a deceased individual's financial assets and liabilities, ensuring that all relevant information is documented for probate proceedings. By providing a clear overview of what is owed to the estate, the form plays a vital role in the distribution of assets among beneficiaries.

Steps to complete the inventory form 1122 with 1123

Completing the inventory form 1122 with 1123 involves several important steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents related to the decedent's assets and debts. This may include bank statements, loan agreements, and any relevant correspondence. Next, fill out the form by listing each asset and liability clearly, providing detailed descriptions and values. It is essential to ensure that all entries are accurate, as discrepancies can lead to complications during the probate process. Finally, review the completed form for completeness and accuracy before submitting it.

Legal use of the inventory form 1122 with 1123

The inventory form 1122 with 1123 holds significant legal weight in the probate process. It must be completed in accordance with state laws and regulations governing estate management. The form serves as an official record that can be used in court to validate the claims of creditors and beneficiaries. It is important to understand that any inaccuracies or omissions may lead to legal challenges or penalties. Therefore, utilizing a reliable electronic signature solution can help ensure that the form is executed properly and securely, maintaining compliance with relevant eSignature regulations.

Required documents for the inventory form 1122 with 1123

To successfully complete the inventory form 1122 with 1123, several supporting documents are typically required. These may include:

- Death certificate of the decedent

- Financial statements from banks and financial institutions

- Loan documents and mortgage agreements

- Any relevant appraisals of property or assets

- Correspondence related to debts owed to the decedent

Having these documents on hand will facilitate the accurate completion of the form and help avoid potential issues during the probate process.

Who issues the inventory form 1122 with 1123?

The inventory form 1122 with 1123 is typically issued by state probate courts or relevant estate management authorities. Each state may have its own specific requirements and variations of the form, so it is important to ensure that the correct version is used. This form is essential for the legal process of settling an estate, and it must be filed within a specified timeframe to comply with state regulations.

Filing deadlines for the inventory form 1122 with 1123

Filing deadlines for the inventory form 1122 with 1123 can vary by state, but it is generally required to be submitted within a few months following the decedent's death. It is advisable to check with the local probate court for specific deadlines to ensure compliance. Missing these deadlines can result in penalties or delays in the probate process, affecting the timely distribution of assets to beneficiaries.

Quick guide on how to complete bonds notes mortgages debts due to the decedent

Complete Bonds, Notes, Mortgages, Debts Due To The Decedent seamlessly on any device

Digital document management has gained traction among both businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents rapidly without delays. Manage Bonds, Notes, Mortgages, Debts Due To The Decedent on any device with airSlate SignNow’s Android or iOS applications and enhance any document-focused process today.

The easiest way to edit and eSign Bonds, Notes, Mortgages, Debts Due To The Decedent effortlessly

- Locate Bonds, Notes, Mortgages, Debts Due To The Decedent and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that function.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the information and then click on the Done button to secure your changes.

- Choose how you wish to send your form: via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, frustrating form navigation, or errors that necessitate printing out new copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Edit and eSign Bonds, Notes, Mortgages, Debts Due To The Decedent to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bonds notes mortgages debts due to the decedent

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the inventory form 1122 with 1123?

The inventory form 1122 with 1123 is a document used for reporting and documenting the inventory of assets within a business. It helps organizations maintain accurate records of their inventory, ensuring compliance and financial accuracy.

-

How does airSlate SignNow streamline the process of using the inventory form 1122 with 1123?

airSlate SignNow allows users to easily upload, send, and eSign the inventory form 1122 with 1123 securely. This streamlining reduces paperwork, saves time, and enhances operational efficiency by enabling digital signatures.

-

What are the pricing options for airSlate SignNow when using the inventory form 1122 with 1123?

airSlate SignNow offers flexible pricing plans tailored to various business needs, allowing users to choose the best fit based on their usage of the inventory form 1122 with 1123 and other documents. You can easily review these plans on our website for more details.

-

Can I integrate airSlate SignNow with other software to manage the inventory form 1122 with 1123?

Yes, airSlate SignNow supports integration with various accounting and inventory management software. This allows users to seamlessly manage their inventory form 1122 with 1123 alongside other business processes, enhancing productivity.

-

What are the key features of airSlate SignNow related to the inventory form 1122 with 1123?

Key features of airSlate SignNow include secure eSigning, document sharing, and customizable templates specifically for the inventory form 1122 with 1123. These features ensure that the process is efficient and compliant with industry standards.

-

How does using the inventory form 1122 with 1123 benefit my business?

Utilizing the inventory form 1122 with 1123 simplifies inventory tracking and ensures accuracy in reporting. This leads to better financial management and helps businesses in making informed decisions based on reliable data.

-

Is there customer support available for issues related to the inventory form 1122 with 1123?

Absolutely! AirSlate SignNow provides comprehensive customer support for users managing the inventory form 1122 with 1123. Our team is ready to assist via chat, email, or phone to address any queries or challenges.

Get more for Bonds, Notes, Mortgages, Debts Due To The Decedent

Find out other Bonds, Notes, Mortgages, Debts Due To The Decedent

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free