Sales Tax Form Kansas St 16tel

What is the Sales Tax Form Kansas St 16tel

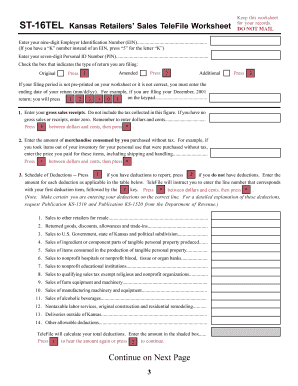

The Sales Tax Form Kansas St 16tel is a document used by businesses in Kansas to report and remit sales tax collected on taxable sales. This form is essential for compliance with state tax laws, ensuring that businesses accurately report their sales tax obligations. The St 16tel is specifically designed for retailers and is part of the Kansas Department of Revenue's efforts to streamline the sales tax filing process.

How to use the Sales Tax Form Kansas St 16tel

Using the Sales Tax Form Kansas St 16tel involves several straightforward steps. First, gather all necessary sales records for the reporting period. Next, accurately complete the form by entering the total sales, taxable sales, and the amount of sales tax collected. After filling out the form, review it for accuracy to avoid errors that could lead to penalties. Finally, submit the completed form to the Kansas Department of Revenue by the specified deadline.

Steps to complete the Sales Tax Form Kansas St 16tel

Completing the Sales Tax Form Kansas St 16tel requires attention to detail. Follow these steps:

- Collect sales records for the reporting period.

- Fill in the total sales amount on the form.

- Calculate and enter the taxable sales amount.

- Determine the total sales tax collected and input this figure.

- Double-check all entries for accuracy.

- Sign and date the form before submission.

Legal use of the Sales Tax Form Kansas St 16tel

The Sales Tax Form Kansas St 16tel is legally binding when completed in compliance with Kansas state laws. To ensure its legal validity, businesses must adhere to the regulations set forth by the Kansas Department of Revenue. This includes accurate reporting of sales and tax amounts, as well as timely submission of the form. Utilizing electronic signature solutions can also enhance the legal standing of the submitted form.

Filing Deadlines / Important Dates

Filing deadlines for the Sales Tax Form Kansas St 16tel vary depending on the frequency of your sales tax reporting. Typically, businesses must file either monthly, quarterly, or annually. It is crucial to be aware of these deadlines to avoid late fees and penalties. The Kansas Department of Revenue provides a calendar of important dates related to sales tax filings, which should be consulted regularly.

Form Submission Methods (Online / Mail / In-Person)

The Sales Tax Form Kansas St 16tel can be submitted through various methods, offering flexibility for businesses. Options include:

- Online submission through the Kansas Department of Revenue's website.

- Mailing the completed form to the appropriate address provided by the department.

- In-person submission at designated state offices.

Choosing the right method can depend on the urgency of the filing and the preferences of the business.

Quick guide on how to complete sales tax form kansas st 16tel

Complete Sales Tax Form Kansas St 16tel seamlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Handle Sales Tax Form Kansas St 16tel on any device with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Sales Tax Form Kansas St 16tel effortlessly

- Locate Sales Tax Form Kansas St 16tel and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Edit and eSign Sales Tax Form Kansas St 16tel and guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sales tax form kansas st 16tel

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the sales tax form Kansas ST 16TEL used for?

The sales tax form Kansas ST 16TEL is specifically designed for businesses to report and remit sales tax collected in Kansas. It ensures compliance with state tax regulations and helps businesses avoid penalties. Using airSlate SignNow, you can easily fill out and eSign this form online, streamlining your tax reporting processes.

-

How can I obtain the sales tax form Kansas ST 16TEL?

You can access the sales tax form Kansas ST 16TEL directly from the Kansas Department of Revenue website or through airSlate SignNow. Our platform provides easy access to the form, allowing you to fill it out electronically and ensure all necessary information is included for submission.

-

Is there a cost associated with using airSlate SignNow for the sales tax form Kansas ST 16TEL?

Yes, airSlate SignNow offers a cost-effective solution for businesses looking to eSign documents, including the sales tax form Kansas ST 16TEL. Our competitive pricing plans are designed to fit various business needs, ensuring you can submit your tax forms without breaking the bank.

-

Can I save my completed sales tax form Kansas ST 16TEL on airSlate SignNow?

Absolutely! With airSlate SignNow, you can save your completed sales tax form Kansas ST 16TEL securely in the cloud. This feature allows you to access your documents anytime, anywhere, facilitating easy reference for future submissions or audits.

-

What features does airSlate SignNow offer for eSigning the sales tax form Kansas ST 16TEL?

airSlate SignNow provides advanced eSigning features that enable you to sign the sales tax form Kansas ST 16TEL quickly and securely. You can add signatures, initials, dates, and other necessary information effortlessly, ensuring that your forms are compliant and legally binding.

-

Does airSlate SignNow integrate with other accounting software for filing the sales tax form Kansas ST 16TEL?

Yes, airSlate SignNow integrates seamlessly with various accounting software, making it easier to file your sales tax form Kansas ST 16TEL. This integration streamlines your financial processes and enables you to manage all your tax-related documents in one place.

-

What benefits does using airSlate SignNow offer for completing the sales tax form Kansas ST 16TEL?

Using airSlate SignNow to complete the sales tax form Kansas ST 16TEL offers numerous benefits, including increased efficiency, error reduction, and enhanced compliance. Our user-friendly interface simplifies the form completion process, allowing you to focus on your business instead of paperwork.

Get more for Sales Tax Form Kansas St 16tel

- Verbal emergency protection order issued pursuant to section 13 14 103 crs colorado form

- Colorado protection order form

- Instructions for protected person motion to modify dismiss protection order colorado form

- Motion dismiss order form

- Protection order application form

- Civil restraining order colorado form

- Instructions for obtaining a civil protection order spanish colorado form

- Incident checklist colorado form

Find out other Sales Tax Form Kansas St 16tel

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure