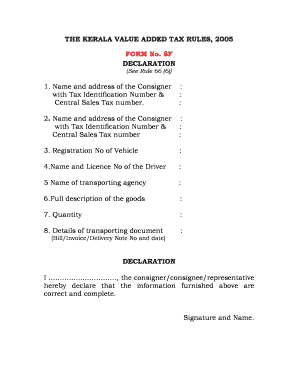

Kerala Taxes Form

What is the Kerala Taxes

The Kerala taxes refer to the various tax obligations that individuals and businesses must fulfill in the state of Kerala, India. These taxes can include income tax, property tax, sales tax, and other local levies. Understanding these taxes is crucial for compliance and effective financial planning. Each tax type has its own regulations, rates, and deadlines, which can vary based on the taxpayer's circumstances.

Steps to complete the Kerala Taxes

Completing the Kerala taxes involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, property records, and previous tax returns. Next, determine the appropriate tax forms required for your situation, which may vary based on your income sources and business structure. After filling out the forms, review them for accuracy and completeness. Finally, submit the forms either online or through traditional mail, ensuring you meet any specified deadlines.

Legal use of the Kerala Taxes

The legal use of the Kerala taxes is governed by state tax laws and regulations. It is essential for taxpayers to understand their obligations under these laws to avoid penalties. Filing taxes accurately and on time is not only a legal requirement but also contributes to the state's revenue, which supports public services. Compliance with tax laws helps maintain the integrity of the tax system and ensures that all citizens contribute fairly.

Filing Deadlines / Important Dates

Filing deadlines for the Kerala taxes can vary based on the type of tax and the taxpayer's status. Generally, income tax returns must be filed by July 31 for individuals and by September 30 for businesses. Property tax payments may have different deadlines depending on local regulations. It is vital to stay informed about these dates to avoid late fees and penalties. Keeping a calendar of important tax dates can help ensure timely compliance.

Required Documents

To complete the Kerala taxes, several documents are typically required. These may include:

- Income statements such as salary slips or profit and loss statements for businesses

- Previous tax returns for reference

- Property documents for property tax calculations

- Receipts for deductible expenses

Having these documents organized and readily available can streamline the tax preparation process and reduce the likelihood of errors.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Kerala taxes can be done through various methods, depending on the taxpayer's preference and the specific tax type. Online submission is often the most convenient option, allowing for quick processing and confirmation. Alternatively, taxpayers can mail their completed forms to the appropriate tax office or submit them in person. Each method has its own advantages, and choosing the right one can depend on individual circumstances and comfort with technology.

Quick guide on how to complete kerala taxes

Effortlessly Prepare Kerala Taxes on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents rapidly without delays. Handle Kerala Taxes on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to Modify and eSign Kerala Taxes with Ease

- Locate Kerala Taxes and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal weight as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select your preferred method of delivering your form, either via email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Kerala Taxes and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kerala taxes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Kerala taxes and who needs to pay them?

Kerala taxes refer to the various taxes imposed by the government in the state of Kerala on individuals and businesses. This includes income tax, sales tax, and property tax, among others. Understanding Kerala taxes is essential for anyone operating a business or residing in the state, as non-compliance can result in penalties.

-

How can airSlate SignNow help in managing Kerala taxes?

airSlate SignNow provides a streamlined approach to documenting all transactions related to Kerala taxes. With our eSignature solutions, users can easily sign and send tax-related documents securely. This ensures that your tax submissions are accurate and compliant with Kerala's regulations.

-

What is the pricing structure for airSlate SignNow?

The pricing structure for airSlate SignNow is designed to be affordable, making it accessible for businesses of all sizes. While specific pricing tiers vary, all plans include features that assist in managing documents related to Kerala taxes effectively. By using our platform, you can save time and reduce costs associated with tax documentation.

-

What features does airSlate SignNow offer for handling tax documents?

AirSlate SignNow offers several features that aid in managing tax documents, including secure eSignatures, document templates, and real-time tracking. These features ensure that your documents related to Kerala taxes are processed quickly, efficiently, and securely. Additionally, these tools improve collaboration with your team and tax advisors.

-

Can airSlate SignNow integrate with accounting software for managing Kerala taxes?

Yes, airSlate SignNow can seamlessly integrate with various accounting software solutions. This integration simplifies the process of managing Kerala taxes by allowing users to send, sign, and store tax-related documents directly within their accounting platform. By connecting these tools, you can enhance your tax management workflow signNowly.

-

What are the benefits of using airSlate SignNow for business documentation related to Kerala taxes?

Using airSlate SignNow for business documentation associated with Kerala taxes offers numerous benefits, including enhanced security, increased efficiency, and reduced paper waste. With our platform, you can handle all your signing needs digitally, ensuring compliance with Kerala tax regulations. Moreover, the intuitive interface makes it easy to keep your records organized.

-

Is airSlate SignNow suitable for freelancers handling Kerala taxes?

Absolutely! AirSlate SignNow is an excellent solution for freelancers managing Kerala taxes. Our software allows you to send and receive signed documents quickly, which is crucial for freelancers who often deal with multiple clients and tax obligations. The cost-effective nature of our service also makes it a smart choice for individual professionals.

Get more for Kerala Taxes

- Human resource resume samplesvelvet jobs form

- Managers candidate assessment form

- This book has been optimized for viewing at a monitor setting form

- Name and title of former employers representative

- Questions employers ask conducting a reference check form

- What do background check show and what do people look form

- The 10 best questions to ask when checking references form

- Employer withdraw job offer letter sample form

Find out other Kerala Taxes

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast