Form St 44

What is the Form St 44

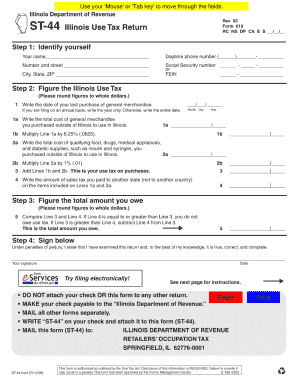

The Form St 44 is a specific document used primarily for tax-related purposes in the United States. It is often required for various transactions, including the reporting of sales tax exemptions. This form is essential for businesses and individuals who wish to claim exemptions from sales tax on certain purchases. Understanding the purpose and requirements of the Form St 44 is crucial for ensuring compliance with state tax regulations.

How to obtain the Form St 44

Obtaining the Form St 44 is a straightforward process. It is typically available through state tax authority websites or offices. Users can download the form directly from the official site, ensuring they have the most current version. In some cases, physical copies may also be available at local tax offices or government buildings. It is important to ensure that you are using the correct form for your specific state, as requirements may vary.

Steps to complete the Form St 44

Completing the Form St 44 involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your business details and the specific items for which you are claiming tax exemption. Next, fill out the form with precise information, paying attention to any required fields. After completing the form, review it for accuracy before submission. Finally, submit the form according to your state’s guidelines, which may include online submission or mailing it to the appropriate tax office.

Legal use of the Form St 44

The legal use of the Form St 44 is defined by state tax laws. This form must be filled out completely and accurately to be considered valid. It serves as a declaration of tax-exempt status for specific purchases, and improper use can lead to penalties. To ensure legal compliance, it is essential to understand the specific regulations governing the use of the Form St 44 in your state, including any supporting documentation that may be required.

Key elements of the Form St 44

Key elements of the Form St 44 include the identification of the purchaser, details about the items being purchased, and the reason for the tax exemption. The form typically requires the purchaser's name, address, and tax identification number. Additionally, it will specify the type of exemption being claimed, which must align with state tax laws. Ensuring that all key elements are correctly filled out is vital for the form's acceptance by tax authorities.

Form Submission Methods

The Form St 44 can be submitted through various methods, depending on state regulations. Common submission methods include online filing through the state tax authority's website, mailing the completed form to the appropriate office, or delivering it in person. Each method may have specific requirements regarding documentation and processing times, so it is important to check the guidelines for your state to ensure proper submission.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Form St 44 can result in significant penalties. These may include fines, back taxes owed, and interest on unpaid amounts. Additionally, improper use of the form can lead to legal repercussions, including audits or investigations by tax authorities. Understanding the potential penalties for non-compliance emphasizes the importance of accurately completing and submitting the Form St 44 in accordance with state laws.

Quick guide on how to complete form st 44

Complete Form St 44 effortlessly on any gadget

Web-based document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to acquire the necessary format and securely save it online. airSlate SignNow offers you all the tools required to generate, modify, and eSign your documents promptly without holdups. Handle Form St 44 on any device with airSlate SignNow’s Android or iOS applications and enhance any document-centric workflow today.

The easiest method to alter and eSign Form St 44 without any hassle

- Locate Form St 44 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your edits.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about missing or lost files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your preference. Edit and eSign Form St 44 and guarantee excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form st 44

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form ST 44 and how can airSlate SignNow assist with it?

Form ST 44 is a state-specific document used for tax exemption purposes. airSlate SignNow allows you to easily upload, send, and eSign your Form ST 44, streamlining the process and ensuring that all signatures are legally compliant.

-

How much does it cost to use airSlate SignNow for processing Form ST 44?

airSlate SignNow offers various pricing plans to cater to different business needs. Whether you're processing Form ST 44 sporadically or on a larger scale, there's a cost-effective plan that can help you manage your documents efficiently.

-

What features does airSlate SignNow provide for managing Form ST 44?

With airSlate SignNow, you can customize your Form ST 44, set reminders for eSigning, and track the status of your document in real-time. These features enhance your workflow, making it easier to manage important tax documents.

-

Is airSlate SignNow secure for submitting Form ST 44?

Yes, airSlate SignNow prioritizes your security with advanced encryption and compliance with international security standards. You can safely submit your Form ST 44 without worrying about the integrity of your sensitive information.

-

Can I integrate airSlate SignNow with other applications to use Form ST 44?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to incorporate Form ST 44 into your existing workflow. This capability enhances efficiency and provides a smooth user experience.

-

What are the benefits of using airSlate SignNow for Form ST 44?

Using airSlate SignNow for Form ST 44 simplifies the eSigning process, minimizes errors, and speeds up document turnaround. These benefits save you time and resources, making it an ideal choice for businesses.

-

How can I ensure my Form ST 44 is correctly filled out before sending?

airSlate SignNow offers templates and editing tools that help ensure that your Form ST 44 is filled out accurately. You can review your document before sending it for signatures, reducing the likelihood of mistakes.

Get more for Form St 44

Find out other Form St 44

- eSign New Mexico Business Insurance Quotation Form Computer

- eSign Tennessee Business Insurance Quotation Form Computer

- How To eSign Maine Church Directory Form

- How To eSign New Hampshire Church Donation Giving Form

- eSign North Dakota Award Nomination Form Free

- eSignature Mississippi Demand for Extension of Payment Date Secure

- Can I eSign Oklahoma Online Donation Form

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe