Sales Tax Form

What is the Sales Tax Form

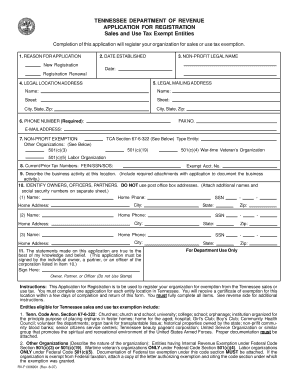

The Tennessee sales tax form is a document used by businesses and individuals to report and remit sales tax collected on taxable sales. This form is essential for compliance with state tax regulations and helps ensure that sales tax is accurately calculated and submitted to the state. The form may vary based on the specific type of transaction or exemption being claimed, making it important to select the correct version for your needs.

How to Use the Sales Tax Form

Using the Tennessee sales tax form involves several steps. First, gather all necessary information regarding sales transactions, including total sales, taxable sales, and any exemptions. Next, accurately fill out the form by entering the required details, ensuring that calculations for sales tax are correct. Finally, submit the form by the designated deadline, either online or via mail, as specified by the Tennessee Department of Revenue.

Steps to Complete the Sales Tax Form

Completing the Tennessee sales tax form requires careful attention to detail. Follow these steps:

- Gather sales records for the reporting period.

- Determine the total amount of taxable sales.

- Calculate the sales tax due based on the applicable rate.

- Fill in the form with the required information, including business details and sales figures.

- Review the form for accuracy before submission.

Legal Use of the Sales Tax Form

The Tennessee sales tax form is legally binding when filled out correctly and submitted on time. It must comply with state regulations, including accurate reporting of sales and tax amounts. Electronic signatures are accepted, provided they meet the requirements of the ESIGN Act and UETA, ensuring that the form is valid and enforceable in a court of law.

Key Elements of the Sales Tax Form

Key elements of the Tennessee sales tax form include:

- Business Information: Name, address, and tax identification number.

- Sales Data: Total sales, taxable sales, and exemptions claimed.

- Tax Calculation: Total sales tax due based on the sales figures.

- Signature: Required for verification and legal compliance.

Form Submission Methods

The Tennessee sales tax form can be submitted through various methods, including:

- Online: Via the Tennessee Department of Revenue's online portal.

- Mail: Sending a completed paper form to the appropriate state office.

- In-Person: Delivering the form directly to a local Department of Revenue office.

Quick guide on how to complete sales tax form 5449366

Effortlessly prepare Sales Tax Form on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without any delays. Manage Sales Tax Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-centered process today.

The simplest way to modify and eSign Sales Tax Form with ease

- Access Sales Tax Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal authority as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes requiring new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Sales Tax Form and guarantee exceptional communication at every stage of the form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sales tax form 5449366

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a TN sales tax form, and why do I need it?

A TN sales tax form is a document used by businesses in Tennessee to report and pay sales tax collected on taxable sales. It's essential for compliance with state tax laws, and failing to submit it can lead to penalties. Using airSlate SignNow can streamline the process of filling out and eSigning your TN sales tax form.

-

How can airSlate SignNow help me with my TN sales tax form?

airSlate SignNow provides an intuitive platform for businesses to create, fill out, and electronically sign TN sales tax forms. Our solution ensures that your forms are accurate, securely stored, and easily accessible, thus simplifying your tax filing process. Additionally, you can manage all your documents in one place.

-

What features does airSlate SignNow offer for TN sales tax forms?

airSlate SignNow offers features like customizable templates, real-time tracking, and secure eSignature options specifically for TN sales tax forms. With these tools, you can save time and reduce errors when preparing your taxes. Moreover, you can set reminders for deadlines related to sales tax submissions.

-

Is airSlate SignNow cost-effective for filing TN sales tax forms?

Yes, airSlate SignNow offers pricing plans that are competitive and designed to meet the needs of businesses filing TN sales tax forms. Our cost-effective solution provides excellent value considering the time and resources saved through efficient document management. Check our pricing page for more details.

-

Can I integrate airSlate SignNow with other accounting software for TN sales tax forms?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easy to manage your TN sales tax forms alongside your financial data. This integration helps ensure accuracy and consistency across your documents, simplifying the overall tax preparation process.

-

What are the benefits of using airSlate SignNow for TN sales tax forms?

Using airSlate SignNow for your TN sales tax forms offers several benefits, including increased efficiency, reduced paperwork, and enhanced security. The electronic signature feature ensures your documents are signed promptly, helping you meet deadlines. Ultimately, airSlate SignNow makes tax filing a hassle-free experience.

-

How do I get started with airSlate SignNow for my TN sales tax form?

Getting started with airSlate SignNow for your TN sales tax form is easy! Simply sign up for an account on our website, choose a pricing plan that fits your needs, and start creating your tax forms using our templates. You'll be guided through the process to ensure everything goes smoothly.

Get more for Sales Tax Form

Find out other Sales Tax Form

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast