Valic Payroll Deduction Forms

What is the Valic Payroll Deduction Forms

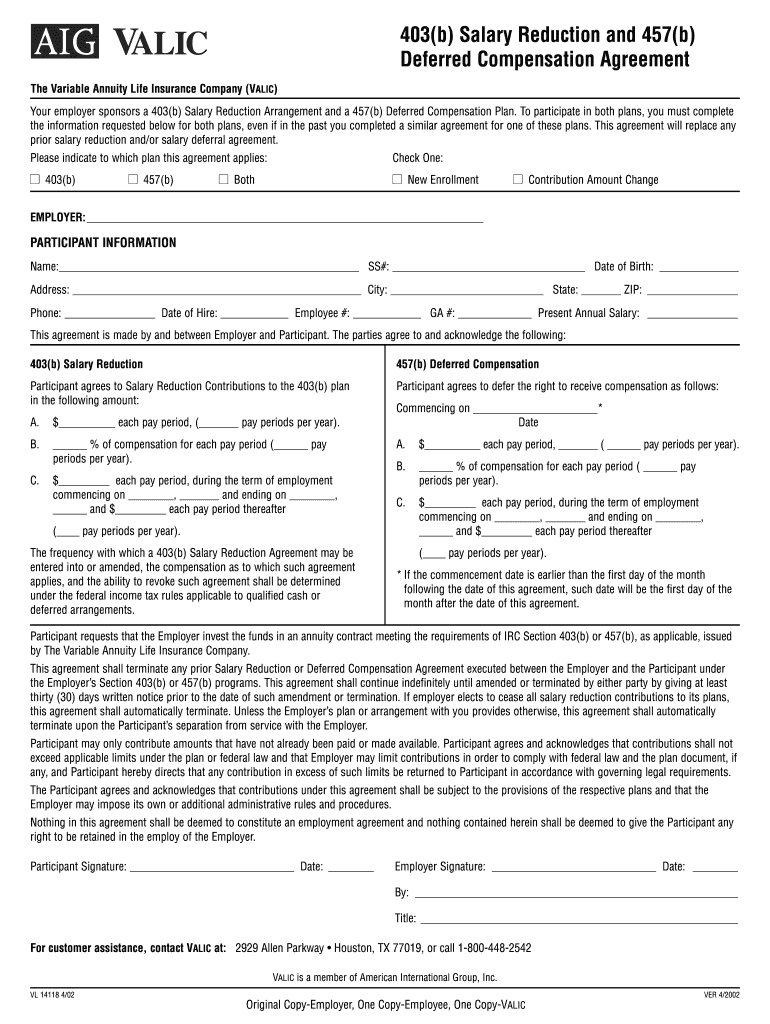

The Valic Payroll Deduction Forms are essential documents that enable employees to authorize their employers to deduct specific amounts from their paychecks. These deductions may be for various purposes, such as retirement contributions, insurance premiums, or other benefits. The forms ensure that the process is transparent and legally compliant, providing a clear record of the employee's consent.

How to use the Valic Payroll Deduction Forms

Using the Valic Payroll Deduction Forms involves several straightforward steps. First, employees must obtain the correct form from their employer or the Valic website. Once acquired, they should fill out the required fields, including personal information and the specific deduction amounts. After completing the form, employees should review it for accuracy before submitting it to their employer's payroll department for processing.

Steps to complete the Valic Payroll Deduction Forms

Completing the Valic Payroll Deduction Forms requires attention to detail. Here are the steps to follow:

- Obtain the form from your employer or the Valic website.

- Fill in your personal information, including your name, employee ID, and contact details.

- Specify the deduction amounts and the purpose of each deduction.

- Review the form for any errors or omissions.

- Sign and date the form to validate your request.

- Submit the completed form to your employer's payroll department.

Legal use of the Valic Payroll Deduction Forms

The legal use of the Valic Payroll Deduction Forms is governed by various regulations that ensure the protection of employee rights. These forms must be completed accurately and submitted with the employee's consent. Failure to comply with legal standards can lead to disputes regarding payroll deductions, making it crucial for both employees and employers to maintain proper documentation and adhere to applicable laws.

Key elements of the Valic Payroll Deduction Forms

Key elements of the Valic Payroll Deduction Forms include:

- Employee Information: Personal details such as name, employee ID, and contact information.

- Deduction Details: Specific amounts and purposes for each deduction.

- Authorization: Employee's signature and date, confirming consent.

- Employer Information: Details of the employer processing the deductions.

Form Submission Methods

The Valic Payroll Deduction Forms can typically be submitted through various methods, depending on the employer's policies. Common submission methods include:

- Online: Many employers allow digital submission through their payroll systems.

- Mail: Employees may send the completed forms via postal service.

- In-Person: Submitting the form directly to the payroll department is often an option.

Quick guide on how to complete valic payroll deduction forms

Complete Valic Payroll Deduction Forms effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, modify, and electronically sign your documents swiftly without delays. Manage Valic Payroll Deduction Forms on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to modify and eSign Valic Payroll Deduction Forms with ease

- Locate Valic Payroll Deduction Forms and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools specially designed by airSlate SignNow for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as an old-fashioned handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misplaced documents, time-consuming form searches, or mistakes that necessitate reprinting new document versions. airSlate SignNow fulfills all your document management needs within a few clicks from any device you prefer. Edit and eSign Valic Payroll Deduction Forms to ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the valic payroll deduction forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Valic Payroll Deduction Forms, and why are they important?

Valic Payroll Deduction Forms are essential documents that outline the terms for employee contributions to retirement accounts or other benefits through payroll deductions. They ensure clarity and compliance, making it easy for both employers and employees to manage contributions effectively. Using airSlate SignNow simplifies the process of creating and managing these forms.

-

How can airSlate SignNow help with Valic Payroll Deduction Forms?

airSlate SignNow offers a user-friendly platform to create, send, and eSign Valic Payroll Deduction Forms quickly and securely. With templates and easy editing features, businesses can streamline their form management processes, ensuring timely and accurate payroll deductions. This efficiency can lead to better employee satisfaction and reduced administrative overhead.

-

Are there any costs associated with using airSlate SignNow for Valic Payroll Deduction Forms?

Yes, airSlate SignNow offers flexible pricing plans to suit various business needs, including those requiring Valic Payroll Deduction Forms. Each plan provides essential features such as document templates, unlimited signing, and cloud storage. Businesses can choose a suitable plan based on their volume and functionality requirements.

-

What features does airSlate SignNow provide for managing Valic Payroll Deduction Forms?

AirSlate SignNow provides features like customizable templates, live tracking, and secure cloud storage for Valic Payroll Deduction Forms. The platform also supports automated workflows, ensuring documents are sent and signed promptly. This enhances compliance and reduces delays in payroll processes.

-

Can I integrate airSlate SignNow with other software for handling Valic Payroll Deduction Forms?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions like payroll systems and HR platforms. This integration facilitates the automatic flow of information, making it easier to manage Valic Payroll Deduction Forms alongside other business operations efficiently.

-

How does airSlate SignNow ensure the security of Valic Payroll Deduction Forms?

AirSlate SignNow employs industry-leading security protocols to protect sensitive information within Valic Payroll Deduction Forms. With features like end-to-end encryption and multi-factor authentication, users can trust that their data is safe from unauthorized access. Compliance with industry regulations further enhances security.

-

Is it easy to customize Valic Payroll Deduction Forms with airSlate SignNow?

Yes, customizing Valic Payroll Deduction Forms with airSlate SignNow is straightforward. Users can edit templates to include specific fields, branding, and other crucial details. This flexibility ensures that businesses can create forms that meet their unique requirements and represent their brand effectively.

Get more for Valic Payroll Deduction Forms

- District of columbia general 497301759 form

- Small business accounting package district of columbia form

- Company employment policies and procedures package district of columbia form

- Dc child form

- Newly divorced individuals package district of columbia form

- Dc statutory form

- Contractors forms package district of columbia

- Power of attorney for sale of motor vehicle district of columbia form

Find out other Valic Payroll Deduction Forms

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT