Form 760ES Virginia Estimated Income Tax Voucher Form 760ES Virginia Estimated Income Tax Voucher Tax Virginia

What is the Form 760ES Virginia Estimated Income Tax Voucher?

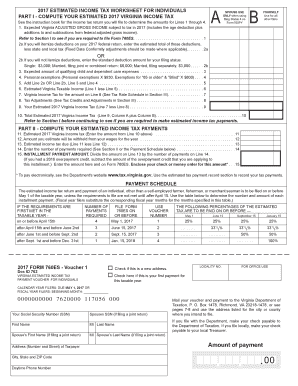

The Form 760ES is a Virginia Estimated Income Tax Voucher used by taxpayers to make estimated tax payments throughout the year. This form is essential for individuals who expect to owe tax of $150 or more when they file their annual tax return. By submitting the 760ES, taxpayers can avoid penalties associated with underpayment of taxes. This form is specifically designed for Virginia residents and is aligned with the state's tax regulations, ensuring compliance with local tax laws.

Steps to Complete the Form 760ES

Completing the Form 760ES involves several straightforward steps:

- Gather your financial information, including your expected income and deductions for the year.

- Calculate your estimated tax liability using the appropriate tax rates.

- Fill out the form with your personal information, including your name, address, and Social Security number.

- Enter the calculated estimated tax amount for each quarter.

- Review the form for accuracy to ensure all information is correct.

- Submit the form either online or via mail, depending on your preference.

Legal Use of the Form 760ES

The Form 760ES is legally binding when completed and submitted according to Virginia tax laws. To ensure its validity, taxpayers must adhere to specific guidelines, such as submitting the form by the designated deadlines and ensuring the accuracy of the reported information. Additionally, electronic submissions are accepted, provided they comply with the state's eSignature regulations. This ensures that the form holds legal weight in the eyes of the Virginia Department of Taxation.

Filing Deadlines for the Form 760ES

Timely submission of the Form 760ES is crucial to avoid penalties. The deadlines for estimated tax payments are typically set for the 15th day of April, June, September, and January of the following year. Taxpayers should mark these dates on their calendars to ensure they make payments on time. Missing these deadlines can result in interest and penalties, making it essential to stay informed about the filing schedule.

Key Elements of the Form 760ES

The Form 760ES includes several key elements that taxpayers must complete:

- Personal Information: Name, address, and Social Security number.

- Estimated Tax Amount: The total estimated tax liability for the year.

- Payment Schedule: Amount due for each quarter.

- Signature: Required to validate the form, confirming that the information provided is accurate.

How to Obtain the Form 760ES

The Form 760ES can be easily obtained through the Virginia Department of Taxation's official website. Taxpayers can download a printable version of the form or fill it out electronically. Additionally, tax preparation software often includes the 760ES, making it accessible for those who prefer digital solutions. Ensuring you have the latest version of the form is important for compliance with current tax regulations.

Quick guide on how to complete form 760es virginia estimated income tax voucher form 760es virginia estimated income tax voucher tax virginia

Effortlessly Prepare Form 760ES Virginia Estimated Income Tax Voucher Form 760ES Virginia Estimated Income Tax Voucher Tax Virginia on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly and without delays. Manage Form 760ES Virginia Estimated Income Tax Voucher Form 760ES Virginia Estimated Income Tax Voucher Tax Virginia on any platform using the airSlate SignNow applications for Android or iOS and simplify any document-related tasks today.

How to Adjust and Electronically Sign Form 760ES Virginia Estimated Income Tax Voucher Form 760ES Virginia Estimated Income Tax Voucher Tax Virginia with Ease

- Locate Form 760ES Virginia Estimated Income Tax Voucher Form 760ES Virginia Estimated Income Tax Voucher Tax Virginia and click on Get Form to begin.

- Utilize the resources we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information using tools specifically designed for that purpose provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, text message (SMS), or invitation link, or download it onto your computer.

Eliminate concerns about lost or misplaced documents, tiring form searches, or errors that necessitate printing additional copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device of your choice. Adjust and electronically sign Form 760ES Virginia Estimated Income Tax Voucher Form 760ES Virginia Estimated Income Tax Voucher Tax Virginia to maintain seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 760es virginia estimated income tax voucher form 760es virginia estimated income tax voucher tax virginia

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 760es solution offered by airSlate SignNow?

The 760es solution from airSlate SignNow is designed to simplify the process of sending and eSigning documents. It provides businesses with an efficient, cost-effective method to manage paperwork electronically, ensuring security and compliance.

-

How much does the 760es service cost?

The pricing for the 760es service varies based on the selected plan and features. airSlate SignNow offers competitive pricing tiers to fit different business needs, ensuring that you get a valuable solution without breaking the bank.

-

What are the key features of 760es?

The key features of the 760es solution include customizable templates, advanced security measures, and seamless integration with popular business applications. These features help streamline document workflows, making eSigning fast and easy for users.

-

How can 760es benefit my business?

Using the 760es solution can signNowly enhance your business's operational efficiency. It reduces the time spent on document handling, lowers costs associated with paper-based processes, and improves overall customer satisfaction with faster transactions.

-

Can I integrate 760es with other software?

Yes, the 760es solution from airSlate SignNow easily integrates with a variety of software applications, including CRM, ERP, and project management tools. This interoperability allows for a smoother workflow and helps you manage documents more effectively within your existing technology stack.

-

Is support available for 760es users?

Absolutely! airSlate SignNow offers dedicated customer support for all 760es users. Whether you need assistance during setup or have questions about features, our team is here to help you maximize your experience with our solution.

-

What security measures does 760es provide?

The 760es solution takes security seriously, implementing advanced encryption protocols and compliance with industry standards. This ensures that all documents signed and sent through airSlate SignNow are protected from unauthorized access.

Get more for Form 760ES Virginia Estimated Income Tax Voucher Form 760ES Virginia Estimated Income Tax Voucher Tax Virginia

- Marital legal separation and property settlement agreement where no children or no joint property or debts and divorce action 497303911 form

- Marital legal separation and property settlement agreement minor children no joint property or debts where divorce action filed 497303912 form

- Marital legal separation and property settlement agreement minor children no joint property or debts effective immediately 497303913 form

- Marital legal separation and property settlement agreement minor children parties may have joint property or debts where 497303914 form

- Marital legal separation and property settlement agreement minor children parties may have joint property or debts effective 497303915 form

- Marital legal separation and property settlement agreement for persons with no children no joint property or debts effective 497303916 form

- Marital legal separation and property settlement agreement no children parties may have joint property or debts where divorce 497303917 form

- Agreement no children 497303918 form

Find out other Form 760ES Virginia Estimated Income Tax Voucher Form 760ES Virginia Estimated Income Tax Voucher Tax Virginia

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now