City of Cuyahoga Falls Income Tax Forms

What is the City of Cuyahoga Falls Income Tax Forms

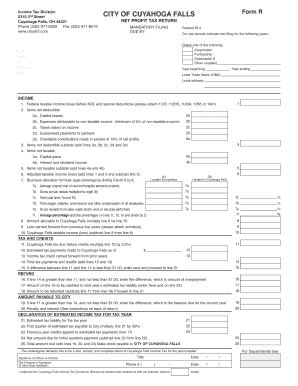

The City of Cuyahoga Falls income tax forms are official documents required for individuals and businesses to report their income and calculate the taxes owed to the city. These forms are essential for ensuring compliance with local tax regulations. The forms typically include details about the taxpayer's income, deductions, and credits applicable to the Cuyahoga Falls income tax rate. Understanding these forms is crucial for accurate tax filing and avoiding penalties.

How to Obtain the City of Cuyahoga Falls Income Tax Forms

Obtaining the City of Cuyahoga Falls income tax forms can be done through several methods. Taxpayers can visit the official city website to download the forms directly. Additionally, forms may be available at local government offices or tax assistance centers. It is important to ensure that you are using the most current version of the forms to comply with the latest tax regulations.

Steps to Complete the City of Cuyahoga Falls Income Tax Forms

Completing the City of Cuyahoga Falls income tax forms involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income, including wages, interest, and other earnings.

- Calculate any deductions or credits you may qualify for under Cuyahoga Falls tax regulations.

- Review the completed form for accuracy before submission.

Legal Use of the City of Cuyahoga Falls Income Tax Forms

To ensure the legal use of the City of Cuyahoga Falls income tax forms, it is essential to adhere to local tax laws and regulations. The forms must be filled out accurately and submitted by the designated deadlines. Electronic signatures are accepted, provided they comply with the ESIGN and UETA acts, ensuring that the forms are legally binding. Utilizing a reliable eSignature platform can enhance the security and validity of your submissions.

Filing Deadlines / Important Dates

Filing deadlines for the City of Cuyahoga Falls income tax forms are typically set annually. Taxpayers should be aware of the key dates, including:

- The annual filing deadline, usually on April fifteenth.

- Estimated tax payment deadlines for self-employed individuals or businesses.

- Extensions for filing, if applicable, and the associated deadlines.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers in Cuyahoga Falls have several options for submitting their income tax forms. These methods include:

- Online submission through the city’s official tax portal, which is often the fastest method.

- Mailing the completed forms to the designated tax office address.

- In-person submission at local government offices during business hours.

Quick guide on how to complete city of cuyahoga falls income tax forms

Prepare city of cuyahoga falls income tax forms effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-conscious alternative to conventional printed and signed paperwork, allowing you to easily locate the appropriate form and securely store it online. airSlate SignNow provides all the features necessary to create, modify, and eSign your documents swiftly without issues. Manage cuyahoga falls city tax filing on any device using airSlate SignNow's Android or iOS applications and streamline any document-focused task today.

How to alter and eSign cuyahoga falls income tax rate 2019 effortlessly

- Obtain cuyahoga falls tax rate and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature with the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form navigation, or mistakes that require new document copies to be printed. airSlate SignNow fulfills your document management needs with just a few clicks from any device you prefer. Edit and eSign cuyahoga falls city tax rate while ensuring excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to cuyahoga falls city income tax

Create this form in 5 minutes!

How to create an eSignature for the cuyahoga falls income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask cuyahoga falls city taxes

-

What is Cuyahoga Falls income tax and how does it affect businesses?

Cuyahoga Falls income tax is a local tax imposed on individuals and businesses operating within the city. For businesses, it means accounting for this tax in their overall financial planning. Compliance with Cuyahoga Falls income tax regulations can impact your business’s profitability, so understanding these requirements is crucial.

-

How can airSlate SignNow help with Cuyahoga Falls income tax documentation?

airSlate SignNow streamlines the process of signing and sending documents necessary for Cuyahoga Falls income tax compliance. By using our eSigning solution, you can quickly manage contracts and tax forms, ensuring that your documentation is both secure and compliant with local regulations.

-

What are the costs associated with using airSlate SignNow for Cuyahoga Falls income tax matters?

The pricing for airSlate SignNow is designed to be cost-effective for businesses managing Cuyahoga Falls income tax. Various plans are available to cater to different business sizes, ensuring you pay only for what you need while simplifying your compliance efforts.

-

Are there any features in airSlate SignNow that specifically assist with Cuyahoga Falls income tax?

Yes, airSlate SignNow includes features like customizable templates and automated workflows to facilitate the management of Cuyahoga Falls income tax documents. These tools help ensure your tax-related documents are completed accurately and efficiently, saving you valuable time.

-

Can I integrate airSlate SignNow with other software for Cuyahoga Falls income tax preparation?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and business applications to support your Cuyahoga Falls income tax preparation. This connectivity ensures a smooth workflow between your documents and any financial software you may use.

-

What benefits does airSlate SignNow offer for managing Cuyahoga Falls income tax?

By using airSlate SignNow for your Cuyahoga Falls income tax needs, you gain access to a user-friendly platform that enhances efficiency and reduces paperwork. The eSigning process is quick, ensuring that your tax documents are completed and submitted on time, minimizing potential penalties.

-

Is airSlate SignNow secure for handling Cuyahoga Falls income tax documents?

Yes, airSlate SignNow places a high priority on security, utilizing advanced encryption and security protocols to protect your Cuyahoga Falls income tax documents. You can confidently manage sensitive information, knowing that your data is safeguarded against unauthorized access.

Get more for cuyahoga falls tax

Find out other cuyahoga falls tax filing

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe