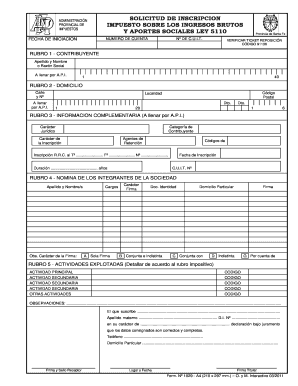

Solicitud De Inscripcion Impuesto Sobre Los Ingresos Brutos Y Aportes Sociales Ley 5110 Como Llenarlo Form

Understanding the Inscripción de Impuestos Form

The inscripción de impuestos form is essential for individuals and businesses to report their income and fulfill their tax obligations. This form collects necessary information regarding earnings, deductions, and credits, ensuring compliance with federal and state tax laws. Understanding the purpose and requirements of this form is crucial for accurate filing and avoiding penalties.

Steps to Complete the Inscripción de Impuestos Form

Completing the inscripción de impuestos form involves several key steps:

- Gather necessary documents, including income statements, previous tax returns, and any relevant identification numbers.

- Fill out personal information, ensuring accuracy in names, addresses, and Social Security numbers.

- Report all sources of income, including wages, self-employment earnings, and investment income.

- Claim deductions and credits applicable to your situation, such as education expenses or mortgage interest.

- Review the completed form for accuracy before submission.

Required Documents for the Inscripción de Impuestos Form

To successfully complete the inscripción de impuestos form, specific documents are necessary:

- W-2 forms from employers for wage earners.

- 1099 forms for self-employed individuals or freelancers.

- Receipts for deductible expenses.

- Documentation for any tax credits being claimed.

- Previous year’s tax return for reference.

Form Submission Methods

The inscripción de impuestos form can be submitted through various methods, catering to different preferences:

- Online submission via the IRS e-file system, which is secure and efficient.

- Mailing a paper form to the appropriate address based on your state.

- In-person submission at designated tax offices, which may offer assistance.

Legal Use of the Inscripción de Impuestos Form

The legal use of the inscripción de impuestos form is governed by federal and state tax regulations. Properly completing and submitting this form is essential for compliance with tax laws. Failure to do so can result in penalties, including fines and interest on unpaid taxes. It is important to ensure that all information provided is accurate and truthful to avoid legal complications.

Filing Deadlines and Important Dates

Staying informed about filing deadlines is crucial for timely submission of the inscripción de impuestos form. Typically, the deadline for individual tax returns is April 15. However, specific dates may vary based on individual circumstances, such as extensions or special circumstances. Marking these dates on your calendar can help ensure compliance and avoid late fees.

Quick guide on how to complete solicitud de inscripcion impuesto sobre los ingresos brutos y aportes sociales ley 5110 como llenarlo form

Complete Solicitud De Inscripcion Impuesto Sobre Los Ingresos Brutos Y Aportes Sociales Ley 5110 Como Llenarlo Form effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can locate the right form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents swiftly without any hold-ups. Manage Solicitud De Inscripcion Impuesto Sobre Los Ingresos Brutos Y Aportes Sociales Ley 5110 Como Llenarlo Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign Solicitud De Inscripcion Impuesto Sobre Los Ingresos Brutos Y Aportes Sociales Ley 5110 Como Llenarlo Form with ease

- Find Solicitud De Inscripcion Impuesto Sobre Los Ingresos Brutos Y Aportes Sociales Ley 5110 Como Llenarlo Form and then click Get Form to begin.

- Utilize the tools provided to fill out your document.

- Select important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Decide how you would like to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Solicitud De Inscripcion Impuesto Sobre Los Ingresos Brutos Y Aportes Sociales Ley 5110 Como Llenarlo Form and ensure outstanding communication at any step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the solicitud de inscripcion impuesto sobre los ingresos brutos y aportes sociales ley 5110 como llenarlo form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process of inscripción de impuestos using airSlate SignNow?

The process of inscripción de impuestos with airSlate SignNow is streamlined and user-friendly. You can easily upload your tax documents, eSign them, and send them securely. Our platform ensures that all your documents are compliant and accessible, simplifying your tax registration experience.

-

How does airSlate SignNow ensure the security of my inscripción de impuestos?

At airSlate SignNow, the security of your inscripción de impuestos is our top priority. We employ advanced encryption and secure cloud storage to protect your sensitive information. Additionally, our platform is compliant with industry standards, providing peace of mind during your tax filing process.

-

What are the pricing options for using airSlate SignNow for inscripción de impuestos?

airSlate SignNow offers competitive pricing plans tailored to meet your business needs for inscripción de impuestos. You can choose from various subscription levels that provide features suitable for individuals and businesses alike. Explore our flexible plans to find the best fit for your tax document management needs.

-

Can I integrate airSlate SignNow with other software for handling inscripción de impuestos?

Yes, airSlate SignNow supports integrations with various accounting and tax software platforms. This allows for seamless management of your inscripción de impuestos alongside your financial records. Our integrations enhance productivity by connecting your documents directly with the systems you already use.

-

What features does airSlate SignNow offer for efficient inscripción de impuestos?

airSlate SignNow offers several key features that enhance the efficiency of your inscripción de impuestos. These include customizable templates, bulk sending capabilities, and real-time tracking of document status. Together, these features simplify your tax filing process and save you valuable time.

-

Is there support available for questions about inscripción de impuestos?

Absolutely! airSlate SignNow provides dedicated customer support to assist you with any questions regarding inscripción de impuestos. Our knowledgeable team is ready to help you navigate the platform and ensure your tax documents are processed smoothly.

-

Are there any limitations when using airSlate SignNow for inscripción de impuestos?

While airSlate SignNow is highly versatile, it’s important to consider that certain document types might have specific requirements not suited for digital signing. However, most common tax forms can be efficiently managed using our platform. We recommend reviewing your documents to ensure they meet the necessary criteria.

Get more for Solicitud De Inscripcion Impuesto Sobre Los Ingresos Brutos Y Aportes Sociales Ley 5110 Como Llenarlo Form

Find out other Solicitud De Inscripcion Impuesto Sobre Los Ingresos Brutos Y Aportes Sociales Ley 5110 Como Llenarlo Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation