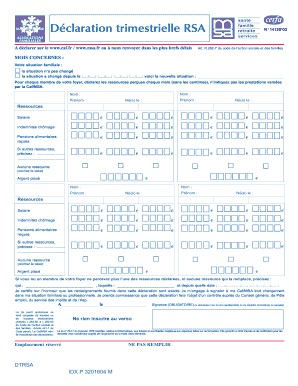

Dtrsa Form

What is the Dtrsa

The Dtrsa, or Digital Tax Return Signature Authorization, is a form used in the United States that allows taxpayers to electronically sign their tax returns. This form streamlines the filing process by enabling individuals and businesses to submit their tax documents digitally, reducing the need for paper forms and physical signatures. The Dtrsa is particularly useful for those who prefer the convenience of online filing and wish to expedite their tax submission process.

How to use the Dtrsa

Using the Dtrsa involves a few straightforward steps. First, ensure that you have all necessary information ready, including your personal identification details and tax-related information. Next, access the Dtrsa form through a reliable eSignature platform. Fill out the required fields accurately. Once completed, you can electronically sign the form using a secure method provided by the platform. Finally, submit the Dtrsa along with your tax return to the appropriate tax authority.

Steps to complete the Dtrsa

Completing the Dtrsa requires careful attention to detail. Follow these steps:

- Gather all necessary documents and information related to your tax return.

- Access the Dtrsa form through your chosen eSignature solution.

- Fill in your personal information, including your name, address, and Social Security number.

- Review the form for accuracy to avoid any potential issues.

- Utilize the electronic signature feature to sign the form securely.

- Submit the completed Dtrsa along with your tax return.

Legal use of the Dtrsa

The Dtrsa is legally recognized under U.S. law, provided it is completed in accordance with established eSignature regulations. To ensure legal validity, the form must be signed using a compliant electronic signature method. This includes adherence to the ESIGN Act and UETA, which govern electronic signatures and their acceptance in legal contexts. By following these guidelines, taxpayers can confidently use the Dtrsa for their tax filings.

Required Documents

To successfully complete the Dtrsa, certain documents are essential. These typically include:

- Your completed tax return form.

- Identification documents, such as a driver's license or Social Security card.

- Any supporting documentation relevant to your tax situation, such as W-2s or 1099s.

Having these documents ready will facilitate a smooth completion process for the Dtrsa.

Form Submission Methods

The Dtrsa can be submitted through various methods, depending on the preferences of the taxpayer. Common submission methods include:

- Online submission via an eSignature platform, which is the most efficient option.

- Mailing a printed copy of the Dtrsa to the appropriate tax authority.

- In-person submission at designated tax offices, if required.

Choosing the right method can enhance the efficiency of your tax filing process.

Quick guide on how to complete dtrsa

Complete Dtrsa effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it in the cloud. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents promptly without interruptions. Manage Dtrsa on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Dtrsa with ease

- Find Dtrsa and click Get Form to initiate.

- Use the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose your preferred method of submitting your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Dtrsa and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dtrsa

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is dtrsa in the context of airSlate SignNow?

dtrsa refers to the digital transaction record and secure signing functionality that airSlate SignNow offers. It allows businesses to streamline their document processes by securely storing and managing electronically signed documents.

-

How can I utilize dtrsa for my business needs?

By leveraging dtrsa through airSlate SignNow, you can simplify your document workflows, enhance security, and save time on processing. The platform enables quick sending and signing of documents, ensuring a more efficient operation for businesses of all sizes.

-

What are the pricing options for airSlate SignNow with dtrsa features?

airSlate SignNow offers competitive pricing plans that include the essential dtrsa features for digital transactions and eSigning. You can choose from various subscription tiers that match your business needs, ensuring you receive great value without compromising functionality.

-

What features does airSlate SignNow offer beyond dtrsa?

In addition to dtrsa, airSlate SignNow provides features such as document templates, automated workflows, and advanced security measures. This comprehensive set of tools empowers businesses to manage their paperwork efficiently and securely, enhancing productivity.

-

How does dtrsa benefit my business operations?

Implementing dtrsa into your business operations with airSlate SignNow can signNowly reduce turnaround times for documents. By digitizing the signing process, you enhance collaboration, improve customer experience, and reduce physical paperwork, all while ensuring document security.

-

Can I integrate airSlate SignNow with other software using dtrsa?

Yes, airSlate SignNow supports integrations with various applications, enhancing the dtrsa experience. Whether it’s CRM systems or task management tools, these integrations facilitate smoother workflows and ensure your documents can be managed effectively across platforms.

-

Is support available for using dtrsa with airSlate SignNow?

Absolutely, airSlate SignNow provides robust customer support to assist users with dtrsa and other features. Whether you need guidance during setup or troubleshooting, the support team is readily available to help maximize your experience with the platform.

Get more for Dtrsa

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy kentucky form

- Warranty deed for parents to child with reservation of life estate kentucky form

- Warranty deed for separate or joint property to joint tenancy kentucky form

- Warranty deed to separate property of one spouse to both spouses as joint tenants kentucky form

- Fiduciary deed for use by executors trustees trustors administrators and other fiduciaries kentucky form

- Warranty deed from limited partnership or llc is the grantor or grantee kentucky form

- Financing statement amendment 497308294 form

- Legal last will and testament form for single person with no children kentucky

Find out other Dtrsa

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word