MARY KAY COSMETICS LTD SALES TAX ADJUSTMENT REBATE FORM

Understanding the Mary Kay Cosmetics Ltd Sales Tax Adjustment Rebate Form

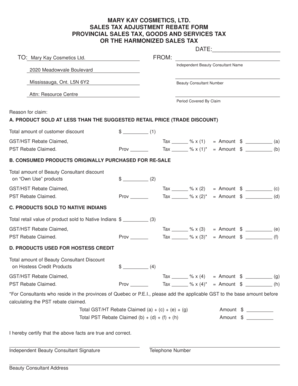

The Mary Kay Cosmetics Ltd Sales Tax Adjustment Rebate Form is a crucial document for Mary Kay consultants and customers who wish to claim a refund on sales tax paid for products. This form is designed to facilitate the adjustment of sales tax amounts, ensuring compliance with state regulations. It is essential for individuals who have purchased Mary Kay products and believe they are eligible for a sales tax rebate. Understanding the purpose and requirements of this form can help streamline the process of obtaining a refund.

Steps to Complete the Mary Kay Cosmetics Ltd Sales Tax Adjustment Rebate Form

Completing the Mary Kay Cosmetics Ltd Sales Tax Adjustment Rebate Form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including receipts and proof of purchase. Next, fill out the form with your personal details, including your name, address, and contact information. Be sure to provide accurate sales tax amounts and any relevant transaction details. After completing the form, review it for any errors before submitting it to the appropriate department. This careful approach will help prevent delays in processing your rebate.

State-Specific Rules for the Mary Kay Cosmetics Ltd Sales Tax Adjustment Rebate Form

Sales tax regulations can vary significantly from state to state, impacting the completion and submission of the Mary Kay Cosmetics Ltd Sales Tax Adjustment Rebate Form. It is important to familiarize yourself with the specific rules and guidelines applicable in your state. Some states may have unique requirements for documentation or deadlines for submitting the rebate form. Understanding these nuances can help ensure that your submission is compliant and increases the likelihood of a successful rebate claim.

Required Documents for the Mary Kay Cosmetics Ltd Sales Tax Adjustment Rebate Form

To successfully complete the Mary Kay Cosmetics Ltd Sales Tax Adjustment Rebate Form, certain documents are required. These typically include copies of receipts for the purchases made, proof of payment, and any prior correspondence related to the sales tax paid. Having these documents ready will facilitate the completion of the form and help substantiate your claim for a rebate. Ensure that all documents are clear and legible to avoid any processing delays.

Legal Use of the Mary Kay Cosmetics Ltd Sales Tax Adjustment Rebate Form

The legal use of the Mary Kay Cosmetics Ltd Sales Tax Adjustment Rebate Form is governed by state tax laws and regulations. This form serves as a formal request for a sales tax adjustment, and its proper use is essential for compliance with tax obligations. Individuals should ensure that they meet all eligibility criteria and adhere to the guidelines set forth by their state tax authority. Misuse of the form can lead to penalties or denial of the rebate claim, making it vital to understand the legal implications associated with its submission.

Filing Deadlines for the Mary Kay Cosmetics Ltd Sales Tax Adjustment Rebate Form

Filing deadlines for the Mary Kay Cosmetics Ltd Sales Tax Adjustment Rebate Form can vary based on state regulations. It is important to be aware of these deadlines to ensure timely submission of your rebate request. Missing a deadline could result in the inability to claim a refund, so keeping track of important dates is essential. Consult your state’s tax authority for specific deadlines related to sales tax adjustments to avoid any complications.

Quick guide on how to complete mary kay cosmetics ltd sales tax adjustment rebate form

Complete MARY KAY COSMETICS LTD SALES TAX ADJUSTMENT REBATE FORM effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage MARY KAY COSMETICS LTD SALES TAX ADJUSTMENT REBATE FORM on any device using the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign MARY KAY COSMETICS LTD SALES TAX ADJUSTMENT REBATE FORM with ease

- Find MARY KAY COSMETICS LTD SALES TAX ADJUSTMENT REBATE FORM and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that reason.

- Generate your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choice. Edit and eSign MARY KAY COSMETICS LTD SALES TAX ADJUSTMENT REBATE FORM to guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mary kay cosmetics ltd sales tax adjustment rebate form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the mary kay sales tax calculator and how does it work?

The mary kay sales tax calculator is a tool designed to effortlessly calculate the sales tax applicable to Mary Kay products in your region. By inputting the sale amount and selecting your state, the calculator instantly provides an accurate sales tax figure. This ensures compliance with tax regulations while simplifying your sales process.

-

Is the mary kay sales tax calculator free to use?

Yes, the mary kay sales tax calculator is free for all users to access. This makes it an invaluable resource for Mary Kay consultants and customers who want to accurately determine applicable sales taxes without any financial commitment. Take advantage of this tool to streamline your sales transactions.

-

Can I integrate the mary kay sales tax calculator with other tools?

Absolutely! The mary kay sales tax calculator can be easily integrated with various e-commerce platforms and bookkeeping software. This feature allows users to maintain accurate sales records and calculate taxes automatically, saving time and reducing errors during transactions.

-

What are the benefits of using the mary kay sales tax calculator?

The mary kay sales tax calculator helps ensure you charge the correct amount of sales tax, which is crucial for legal compliance. Additionally, it enhances efficiency by quickly calculating taxes, reducing the workload associated with manual calculations. It streamlines your sales process and helps maintain positive customer relationships.

-

How often is the information in the mary kay sales tax calculator updated?

The mary kay sales tax calculator is regularly updated to reflect the latest tax rates and regulations across different regions. This ensures that users always have access to the most accurate and current data, reducing the risk of miscalculations and compliance issues.

-

Who can benefit from using the mary kay sales tax calculator?

The mary kay sales tax calculator is designed for Mary Kay consultants, sellers, and customers alike. Whether you are managing your sales tax obligations or just want a clearer understanding of costs, this tool is beneficial for anyone involved in Mary Kay product transactions.

-

Does the mary kay sales tax calculator support multiple states?

Yes, the mary kay sales tax calculator supports multiple states, allowing users to select their specific location. This feature is particularly useful for consultants operating in different regions, ensuring accurate tax calculations regardless of where a sale occurs.

Get more for MARY KAY COSMETICS LTD SALES TAX ADJUSTMENT REBATE FORM

- Final notice of default for past due payments in connection with contract for deed massachusetts form

- Assignment of contract for deed by seller massachusetts form

- Notice of assignment of contract for deed massachusetts form

- Contract for sale and purchase of real estate with no broker for residential home sale agreement massachusetts form

- Buyers home inspection checklist massachusetts form

- Sellers information for appraiser provided to buyer massachusetts

- Subcontractors agreement massachusetts form

- Fill out and submit a personal history statement pdf capcog form

Find out other MARY KAY COSMETICS LTD SALES TAX ADJUSTMENT REBATE FORM

- How Can I Electronic signature Tennessee Sublease Agreement Template

- Electronic signature Maryland Roommate Rental Agreement Template Later

- Electronic signature Utah Storage Rental Agreement Easy

- Electronic signature Washington Home office rental agreement Simple

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast