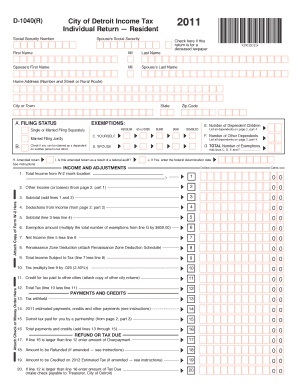

Detroit City Tax Form

What is the Detroit City Tax?

The Detroit City Tax is a municipal tax imposed on individuals and businesses earning income within the city limits of Detroit. This tax applies to both residents and non-residents who generate income from work performed in the city. The tax rate varies depending on residency status, with residents typically facing a higher rate than non-residents. Understanding the specifics of this tax is essential for compliance and accurate tax reporting.

Steps to Complete the Detroit City Tax

Completing the Detroit City Tax form involves several key steps to ensure accuracy and compliance. Here is a streamlined process to guide you:

- Gather necessary documentation, including W-2 forms, 1099s, and any other income statements.

- Obtain the correct Detroit City Tax form for the year you are filing, such as the 2017 version.

- Fill out the form accurately, ensuring all income and deductions are reported correctly.

- Review the form for any errors or omissions before submission.

- Submit the completed form through your preferred method: online, by mail, or in person.

Required Documents

To complete the Detroit City Tax form, specific documents are required. These include:

- W-2 forms from employers to report wages earned.

- 1099 forms for any freelance or contract work.

- Records of any other income sources, such as rental income or dividends.

- Documentation of deductions, if applicable, such as business expenses or education costs.

Form Submission Methods

There are multiple ways to submit the Detroit City Tax form, allowing taxpayers flexibility in how they file. The options include:

- Online: Many taxpayers prefer electronic filing for its convenience and speed.

- By Mail: Completed forms can be printed and sent to the appropriate city tax office.

- In-Person: Taxpayers may choose to deliver their forms directly to the city tax office for immediate processing.

Penalties for Non-Compliance

Failing to comply with the Detroit City Tax requirements can lead to significant penalties. These may include:

- Late filing fees, which can accumulate over time.

- Interest on unpaid taxes, increasing the overall amount owed.

- Potential legal action for severe non-compliance, which could affect future tax filings.

Eligibility Criteria

Eligibility for the Detroit City Tax is determined by several factors, including:

- Residency status: Individuals living in Detroit are subject to different tax rates compared to non-residents.

- Income level: All individuals earning income within the city must file, regardless of their total income.

- Business operations: Businesses operating in Detroit must also comply with city tax regulations.

Quick guide on how to complete detroit city tax

Complete Detroit City Tax effortlessly on any device

Managing documents online has become popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed papers, as you can easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Detroit City Tax on any device with the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The easiest way to modify and eSign Detroit City Tax smoothly

- Find Detroit City Tax and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize important parts of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to preserve your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Detroit City Tax and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the detroit city tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the detroit city tax form 2017?

The Detroit city tax form 2017 is the official document used by residents to file their city income taxes for that year. It includes sections for reporting income, calculating tax liability, and claiming any necessary deductions or credits. Understanding this form is crucial for compliant tax filings.

-

How do I access the detroit city tax form 2017?

You can access the detroit city tax form 2017 through the official Detroit city website or various tax preparation software. Many online resources also offer downloadable PDFs that you can print. airSlate SignNow can help you manage the signing and submission process seamlessly once you have the form.

-

What are the benefits of using SignNow for the detroit city tax form 2017?

Using SignNow for the detroit city tax form 2017 allows for efficient document management and secure electronic signatures. It simplifies the process of collecting signatures from multiple parties and ensures that your forms are delivered quickly. This enhances compliance and reduces the likelihood of errors.

-

Is there a cost associated with using SignNow to handle the detroit city tax form 2017?

SignNow offers affordable pricing plans tailored to different business needs, making it cost-effective for handling the detroit city tax form 2017 and other documents. You can choose a plan based on the number of users and features required. Free trials are also available to explore the platform before committing.

-

Can SignNow integrate with other software for completing the detroit city tax form 2017?

Yes, SignNow seamlessly integrates with a variety of software, including CRM systems and project management tools, to streamline the process of drafting, signing, and filing the detroit city tax form 2017. This allows for increased efficiency in document handling and minimizes manual entry.

-

What features does SignNow offer for managing the detroit city tax form 2017?

SignNow offers features such as customizable templates, audit trails for document tracking, and mobile accessibility, all aimed at improving the management of the detroit city tax form 2017. These tools enhance usability and help ensure your forms are completed accurately and securely.

-

What should I do if I have errors in my detroit city tax form 2017?

If you find errors in your detroit city tax form 2017, you should correct them as soon as possible. You can amend your tax return by filing a new form with the correct information. Leveraging SignNow's functionality can make this process easier by allowing you to quickly update and resend the form for signatures.

Get more for Detroit City Tax

- Tenant consent to background and reference check massachusetts form

- Residential lease or rental agreement for month to month massachusetts form

- Residential rental lease agreement massachusetts form

- Tenant welcome letter massachusetts form

- Warning of default on commercial lease massachusetts form

- Warning of default on residential lease massachusetts form

- Landlord tenant closing statement to reconcile security deposit massachusetts form

- Massachusetts name change form

Find out other Detroit City Tax

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors