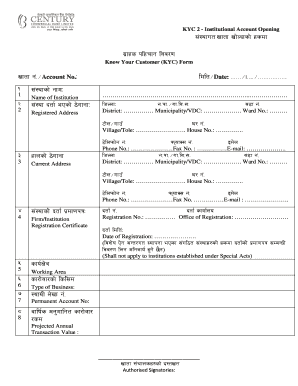

Commercial Bank Kyc Form

What is the Commercial Bank KYC Form

The Commercial Bank KYC form is a crucial document used by financial institutions to verify the identity of their customers. KYC stands for "Know Your Customer," and this process is essential for preventing fraud, money laundering, and other illegal activities. The form typically requires personal details such as name, address, date of birth, and identification numbers. By collecting this information, banks can ensure compliance with legal regulations and protect both the institution and its customers.

Steps to Complete the Commercial Bank KYC Form

Completing the Commercial Bank KYC form involves several important steps to ensure accuracy and compliance. Here is a straightforward process to follow:

- Gather Required Documents: Collect necessary identification documents, such as a government-issued ID, proof of address, and Social Security number.

- Fill Out Personal Information: Enter your full name, contact details, and any other requested personal information accurately.

- Provide Financial Information: Include details about your occupation, income sources, and any relevant financial history.

- Review the Form: Double-check all entries for accuracy and completeness before submission.

- Submit the Form: Follow the bank’s submission guidelines, whether online, via mail, or in person.

Legal Use of the Commercial Bank KYC Form

The Commercial Bank KYC form is legally binding and must be completed in accordance with federal and state regulations. Financial institutions are required to maintain accurate records of their customers' identities to comply with anti-money laundering (AML) laws and the Bank Secrecy Act (BSA). Failure to adhere to these regulations can result in severe penalties for the institution, including fines and legal repercussions. It is essential for customers to provide truthful information to avoid complications.

Required Documents for the Commercial Bank KYC Form

To successfully complete the Commercial Bank KYC form, several documents are typically required. These documents help verify your identity and address:

- Government-Issued Identification: A valid driver’s license, passport, or state ID.

- Proof of Address: Utility bills, lease agreements, or bank statements dated within the last three months.

- Social Security Number: This may be required for tax identification purposes.

- Income Verification: Pay stubs or tax returns may be requested to confirm your financial status.

How to Obtain the Commercial Bank KYC Form

The Commercial Bank KYC form can be obtained through various channels. Customers can typically find the form on the bank's official website, where it may be available for download. Additionally, physical copies can be requested at local bank branches. Some banks also provide the option to complete the KYC process online through their secure portals, making it convenient for users to submit their information electronically.

Form Submission Methods for the Commercial Bank KYC Form

Submitting the Commercial Bank KYC form can be done through several methods, depending on the bank's policies:

- Online Submission: Many banks allow customers to fill out and submit the form electronically through their websites.

- Mail Submission: Customers can print the completed form and send it via postal mail to the designated bank address.

- In-Person Submission: Visiting a local bank branch is another option for submitting the form directly to a bank representative.

Quick guide on how to complete commercial bank kyc form

Accomplish Commercial Bank Kyc Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without hassle. Manage Commercial Bank Kyc Form on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest method to modify and electronically sign Commercial Bank Kyc Form seamlessly

- Locate Commercial Bank Kyc Form and click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all information and then click the Done button to finalize your changes.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, or mistakes that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Commercial Bank Kyc Form and guarantee exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the commercial bank kyc form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a bank KYC form and why is it important?

A bank KYC form is a document that helps financial institutions verify the identity and background of their customers. This is crucial to prevent fraud and money laundering. By completing the bank KYC form, customers ensure compliance with regulations and contribute to a safer financial environment.

-

How can airSlate SignNow assist in completing a bank KYC form?

airSlate SignNow simplifies the process of filling out and eSigning a bank KYC form. Our platform allows users to easily upload, sign, and share documents securely online. This streamlines the process, making it faster and more efficient for both customers and banks.

-

Is there a cost associated with using airSlate SignNow for a bank KYC form?

airSlate SignNow offers various pricing plans suitable for businesses of all sizes. Our affordable solutions allow you to eSign and manage documents, including bank KYC forms, without breaking the bank. Explore our pricing page to find a plan that fits your requirements.

-

What features does airSlate SignNow offer for managing bank KYC forms?

With airSlate SignNow, you can access features like customizable templates, secure cloud storage, and workflow automation specifically for bank KYC forms. Our platform also allows multiple users to collaborate seamlessly, ensuring that document handling is efficient and compliant.

-

Can airSlate SignNow integrate with other tools for managing bank KYC forms?

Yes, airSlate SignNow supports integrations with a variety of third-party applications, facilitating a smoother process for managing bank KYC forms. Whether you use CRM systems, accounting software, or other tools, our platform can easily connect to enhance your workflow.

-

What are the benefits of using airSlate SignNow for bank KYC forms?

The primary benefits of using airSlate SignNow for bank KYC forms include enhanced security, improved efficiency, and better compliance. Our platform offers a user-friendly interface, making it easy for both businesses and customers to access and manage essential documents securely.

-

How secure is the airSlate SignNow platform for bank KYC forms?

airSlate SignNow prioritizes security with advanced encryption and compliance with data protection regulations. Your bank KYC forms are protected through secure channels, ensuring that sensitive customer information remains confidential and secure throughout the entire process.

Get more for Commercial Bank Kyc Form

- Rhode island summons nine 9 days landlord tenant eviction for non payment of rent form

- South carolina odometer statement form

- South carolina tenant law form

- Sc increase rent form

- Notice abandoned property 481375057 form

- Tenant lease agreement 481375058 form

- South dakota trust form

- Tennessee notice to creditors of estate form

Find out other Commercial Bank Kyc Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free