Dtf 973 61 Form

What is the DTF 973 61?

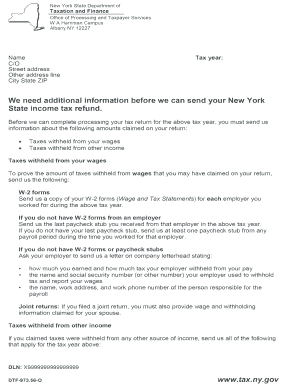

The DTF 973 61 form, also known as the New York State Department of Taxation and Finance PIT Tax form, is utilized for various tax-related purposes in New York. This form is essential for individuals and businesses to report specific income and tax liabilities accurately. Understanding its purpose is crucial for compliance with state tax regulations.

How to Use the DTF 973 61

Using the DTF 973 61 form involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and previous tax returns. Next, fill out the form with precise information regarding your income sources, deductions, and credits. It is important to double-check all entries for accuracy before submission to avoid potential penalties.

Steps to Complete the DTF 973 61

Completing the DTF 973 61 form requires careful attention to detail. Follow these steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Provide details about your income sources, such as wages, self-employment income, and any other taxable income.

- List any deductions you are eligible for, which may reduce your taxable income.

- Calculate your total tax liability based on the information provided.

- Review the form for accuracy and completeness before submission.

Legal Use of the DTF 973 61

The DTF 973 61 form must be used in accordance with New York State tax laws. It is legally binding and serves as an official document for reporting income and tax obligations. Failure to use this form correctly can result in penalties or legal repercussions. Ensure compliance with all state regulations when completing and submitting this form.

Filing Deadlines / Important Dates

Filing deadlines for the DTF 973 61 form are critical to avoid late fees and penalties. Typically, the form must be submitted by April fifteenth for individual taxpayers. However, specific deadlines may vary based on individual circumstances or changes in tax law. It is advisable to check the New York State Department of Taxation and Finance website for the most current deadlines.

Required Documents

When completing the DTF 973 61 form, certain documents are necessary for accurate reporting. These may include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Documentation for deductions, such as mortgage interest statements

- Previous tax returns for reference

Form Submission Methods

The DTF 973 61 form can be submitted through various methods, including online filing, mailing a paper form, or in-person submission at designated tax offices. Online filing is often the most efficient method, allowing for immediate processing and confirmation of receipt. Ensure to follow the specific guidelines for each submission method to guarantee proper handling of your form.

Quick guide on how to complete dtf 973 61

Prepare Dtf 973 61 effortlessly on any gadget

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Dtf 973 61 on any device with airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and eSign Dtf 973 61 without hassle

- Locate Dtf 973 61 and then click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and bears exactly the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies of documents. airSlate SignNow addresses all your document management needs in just a few clicks from your device of choice. Modify and eSign Dtf 973 61 and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dtf 973 61

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the DTF 973 61 and how does it benefit my business?

The DTF 973 61 is a key feature within airSlate SignNow that allows for efficient document signing processes. It streamlines workflows and reduces turnaround times, making it easier for businesses to handle important documents quickly and effectively.

-

How does airSlate SignNow's DTF 973 61 handle document security?

The DTF 973 61 is designed with security in mind, ensuring that all documents are encrypted and protected during the signing process. This added layer of security helps build trust with your clients while safeguarding sensitive information.

-

Can I integrate DTF 973 61 with my existing software?

Yes, airSlate SignNow's DTF 973 61 can be easily integrated with various third-party applications. This seamless integration enables you to enhance your existing workflows without disrupting your current processes.

-

What pricing options are available for DTF 973 61?

airSlate SignNow offers flexible pricing plans for the DTF 973 61, catering to businesses of all sizes. You can choose a plan that best fits your budget and document signing needs, ensuring you only pay for what you use.

-

Is training required to use DTF 973 61 effectively?

No extensive training is required to use the DTF 973 61 feature. airSlate SignNow is designed to be user-friendly, allowing your team to get started quickly with minimal learning curve.

-

What types of documents can I sign using DTF 973 61?

You can use DTF 973 61 to sign a variety of documents, including contracts, agreements, and forms. This versatility makes it an ideal solution for businesses across different industries looking to expedite their document management.

-

How does DTF 973 61 improve the overall customer experience?

By utilizing DTF 973 61, businesses can provide a faster and more convenient signing process for their customers. This not only enhances customer satisfaction but also establishes a professional image for your business.

Get more for Dtf 973 61

- Hawaii persons form

- Iowa quitclaim deed from individual to husband and wife form

- Iowa legal last will and testament form for divorced person not remarried with adult and minor children

- Ia widow form

- Iowa legal last will and testament form for divorced and remarried person with mine yours and ours children

- Idaho idaho prenuptial premarital agreement without financial statements form

- Idaho legal last will and testament form for single person with no children

- Idaho legal last will and testament form for married person with adult children from prior marriage

Find out other Dtf 973 61

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template

- eSign New York Startup Business Plan Template Online

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement