Declaration of Tax Exempt Fuel User 18 Alberta Finance and Enterprise Finance Alberta Form

What is the Declaration of Tax Exempt Fuel User 18 Alberta Finance and Enterprise Finance Alberta

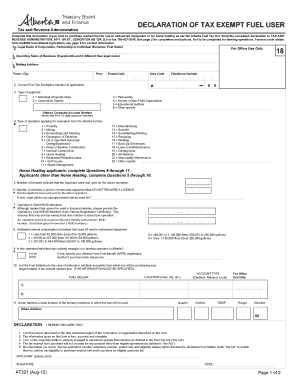

The Declaration of Tax Exempt Fuel User 18 is a specific form used in Alberta that allows eligible individuals and businesses to claim exemption from fuel taxes. This form is particularly relevant for users who utilize fuel for specific purposes, such as agriculture, construction, or other qualifying activities. By submitting this declaration, users can ensure that they are not charged tax on fuel that is used in accordance with Alberta's regulations.

Steps to Complete the Declaration of Tax Exempt Fuel User 18 Alberta Finance and Enterprise Finance Alberta

Completing the Declaration of Tax Exempt Fuel User 18 involves several key steps:

- Gather necessary information, including your business details and the specific use of the fuel.

- Fill out the form accurately, ensuring all sections are completed as required.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate Alberta Finance and Enterprise office, either online or by mail.

How to Obtain the Declaration of Tax Exempt Fuel User 18 Alberta Finance and Enterprise Finance Alberta

To obtain the Declaration of Tax Exempt Fuel User 18, you can visit the official Alberta Finance and Enterprise website. The form is typically available for download in a PDF format. Alternatively, you may request a physical copy from your local Alberta Finance office. It is important to ensure that you have the most recent version of the form to avoid any compliance issues.

Key Elements of the Declaration of Tax Exempt Fuel User 18 Alberta Finance and Enterprise Finance Alberta

The Declaration of Tax Exempt Fuel User 18 includes several key elements that must be addressed:

- Identification of the user, including name and contact information.

- Details regarding the type of fuel being used and its intended purpose.

- Certification that the fuel will be used in compliance with Alberta's tax exemption regulations.

- Signature of the user or authorized representative, affirming the accuracy of the information provided.

Legal Use of the Declaration of Tax Exempt Fuel User 18 Alberta Finance and Enterprise Finance Alberta

The legal use of the Declaration of Tax Exempt Fuel User 18 is governed by Alberta's tax regulations. To ensure compliance, users must accurately complete the form and submit it as required. Failure to adhere to the guidelines can result in penalties or the denial of tax-exempt status. It is advisable to keep copies of submitted forms and any correspondence related to the exemption for record-keeping purposes.

Eligibility Criteria for the Declaration of Tax Exempt Fuel User 18 Alberta Finance and Enterprise Finance Alberta

Eligibility for the Declaration of Tax Exempt Fuel User 18 is typically based on the intended use of the fuel. Common eligible categories include:

- Agricultural operations, including farming and ranching.

- Construction activities that require fuel for machinery and equipment.

- Other specific uses that align with Alberta's fuel tax exemption regulations.

Users must ensure that their intended use falls within these categories to qualify for the exemption.

Quick guide on how to complete declaration of tax exempt fuel user 18 alberta finance and enterprise finance alberta

Complete Declaration Of Tax Exempt Fuel User 18 Alberta Finance And Enterprise Finance Alberta effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents rapidly without delays. Manage Declaration Of Tax Exempt Fuel User 18 Alberta Finance And Enterprise Finance Alberta on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to alter and eSign Declaration Of Tax Exempt Fuel User 18 Alberta Finance And Enterprise Finance Alberta smoothly

- Find Declaration Of Tax Exempt Fuel User 18 Alberta Finance And Enterprise Finance Alberta and click Get Form to initiate.

- Make use of the tools we provide to fill out your form.

- Emphasize signNow sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the information and click the Done button to save your modifications.

- Choose how you wish to send your form: through email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Declaration Of Tax Exempt Fuel User 18 Alberta Finance And Enterprise Finance Alberta and ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the declaration of tax exempt fuel user 18 alberta finance and enterprise finance alberta

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What qualifies someone as a tax exempt fuel user in Alberta?

A tax exempt fuel user in Alberta is typically an organization or individual that uses fuel for specific purposes outlined by provincial regulations, such as agricultural operations, off-road vehicles, or certain industrial applications. To qualify, you must register and provide the necessary documentation to demonstrate your eligibility as a tax exempt fuel user in Alberta.

-

How can airSlate SignNow help tax exempt fuel users in Alberta?

airSlate SignNow offers a streamlined solution for tax exempt fuel users in Alberta to manage their documentation needs efficiently. With easy-to-use eSigning features, businesses can quickly obtain the necessary approvals and signatures for documentation required for tax exemption, enhancing their operational effectiveness.

-

Is there a cost associated with using airSlate SignNow for tax exempt fuel users in Alberta?

Yes, there is a subscription fee for using airSlate SignNow, but it provides a cost-effective solution for tax exempt fuel users in Alberta who need to streamline their document processes. Plans vary based on features and usage levels, allowing users to select the best fit for their organization's needs.

-

What features does airSlate SignNow offer for tax exempt fuel users in Alberta?

airSlate SignNow offers features such as electronic signatures, document templates, and real-time collaboration, all tailored to meet the needs of tax exempt fuel users in Alberta. These features facilitate faster document turnaround, ensuring compliance and efficiency in managing tax-related documentation.

-

Can airSlate SignNow integrate with other software used by tax exempt fuel users in Alberta?

Absolutely! airSlate SignNow provides integrations with popular software solutions such as CRM systems, cloud storage, and accounting tools, making it easier for tax exempt fuel users in Alberta to sync their documents and workflows. This flexibility helps users centralize their processes and improve productivity.

-

How does airSlate SignNow ensure the security of documents for tax exempt fuel users in Alberta?

airSlate SignNow prioritizes security with advanced encryption and secure access features, ensuring that documents for tax exempt fuel users in Alberta are protected at all times. Users can feel confident that their sensitive information and documentation are safe from unauthorized access.

-

What benefits do tax exempt fuel users in Alberta experience when using airSlate SignNow?

By using airSlate SignNow, tax exempt fuel users in Alberta experience improved efficiency in their document management processes, quicker turnaround times for signatures, and reduced operational costs. The platform's ease of use empowers businesses to focus more on their core activities instead of paperwork.

Get more for Declaration Of Tax Exempt Fuel User 18 Alberta Finance And Enterprise Finance Alberta

- Marital domestic separation and property settlement agreement adult children maine form

- Office lease agreement maine form

- Commercial sublease maine form

- Residential lease renewal agreement maine form

- Notice to lessor exercising option to purchase maine form

- Assignment of lease and rent from borrower to lender maine form

- Assignment of lease from lessor with notice of assignment maine form

- Letter from landlord to tenant as notice of abandoned personal property maine form

Find out other Declaration Of Tax Exempt Fuel User 18 Alberta Finance And Enterprise Finance Alberta

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe

- Sign Massachusetts Leave of Absence Agreement Simple

- Sign Connecticut Acknowledgement of Resignation Fast

- How To Sign Massachusetts Resignation Letter

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter

- Sign Oklahoma Resignation Letter Simple

- How Do I Sign Oklahoma Acknowledgement of Resignation

- Can I Sign Pennsylvania Resignation Letter

- How To Sign Rhode Island Resignation Letter

- Sign Texas Resignation Letter Easy

- Sign Maine Alternative Work Offer Letter Later

- Sign Wisconsin Resignation Letter Free

- Help Me With Sign Wyoming Resignation Letter

- How To Sign Hawaii Military Leave Policy