Fha Refinance Authorization Form

What is the FHA Refinance Authorization Form

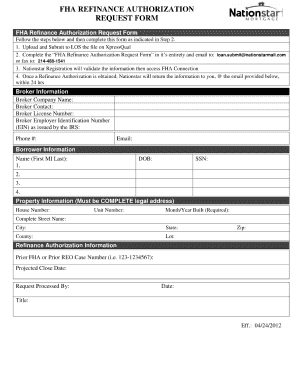

The FHA refinance authorization form is a critical document used in the refinancing process for loans backed by the Federal Housing Administration (FHA). This form allows borrowers to authorize lenders to access their financial information and complete the refinancing process. It is essential for ensuring that all parties involved have the necessary permissions to proceed with the transaction. The form typically includes details about the borrower, the property, and the specific loan being refinanced.

How to Use the FHA Refinance Authorization Form

Using the FHA refinance authorization form involves several straightforward steps. First, the borrower must fill out the form with accurate personal and financial information. This includes full names, addresses, and loan details. Once completed, the borrower must sign the form, which can be done electronically for convenience. After signing, the form should be submitted to the lender, who will then use it to process the refinance request. It is important to keep a copy of the signed form for personal records.

Steps to Complete the FHA Refinance Authorization Form

Completing the FHA refinance authorization form involves a series of clear steps:

- Gather necessary personal and financial information, including Social Security numbers and income details.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the information for any errors or omissions.

- Sign the form electronically or by hand, depending on the submission method.

- Submit the completed form to your lender via the preferred method (online, mail, or in-person).

Key Elements of the FHA Refinance Authorization Form

The FHA refinance authorization form contains several key elements that are crucial for its validity and effectiveness. These include:

- Borrower Information: Personal details of the borrower, including name, address, and contact information.

- Loan Information: Specifics about the loan being refinanced, such as the loan number and amount.

- Authorization Statement: A declaration that the borrower authorizes the lender to access necessary financial information.

- Signature: The borrower’s signature, which confirms the authorization and agreement to the terms outlined in the form.

Legal Use of the FHA Refinance Authorization Form

The legal use of the FHA refinance authorization form is governed by various regulations that ensure its validity. For the form to be legally binding, it must comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). These laws establish that electronic signatures and documents are as legally valid as their paper counterparts, provided certain conditions are met. This includes ensuring that the signer has consented to use electronic documents and signatures.

Who Issues the FHA Refinance Authorization Form

The FHA refinance authorization form is typically issued by lenders who participate in FHA loan programs. These lenders may include banks, credit unions, and mortgage companies. It is important for borrowers to obtain the form directly from their lender to ensure that they are using the correct version and that it meets all necessary legal requirements. Lenders may provide the form in both digital and paper formats, depending on the preferences of the borrower.

Quick guide on how to complete fha refinance authorization form

Complete Fha Refinance Authorization Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the accurate form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Fha Refinance Authorization Form on any device with airSlate SignNow Android or iOS applications and enhance any document-focused procedure today.

How to modify and electronically sign Fha Refinance Authorization Form without hassle

- Find Fha Refinance Authorization Form and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you would like to deliver your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and electronically sign Fha Refinance Authorization Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fha refinance authorization form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is FHA refinance authorization?

FHA refinance authorization is a formal permission that allows borrowers to refinance their existing FHA loans. This process involves obtaining consent from relevant parties to streamline the refinancing procedure, ensuring that all legal and financial requirements are satisfied. Understanding FHA refinance authorization is crucial for homeowners looking to benefit from lower interest rates or better loan terms.

-

How does airSlate SignNow facilitate FHA refinance authorization?

airSlate SignNow simplifies the FHA refinance authorization process by allowing users to easily send and eSign necessary documents online. With its user-friendly platform, borrowers can quickly manage their FHA refinance paperwork, reduce turnaround times, and mitigate delays associated with traditional methods. This efficiency helps ensure a smoother refinancing experience.

-

What are the costs associated with using airSlate SignNow for FHA refinance authorization?

The costs of using airSlate SignNow for FHA refinance authorization are competitive and designed to be budget-friendly. Users can choose from various subscription plans that offer different levels of features, making it cost-effective for both individuals and businesses. This flexibility supports efficient document management without overspending.

-

Can I integrate airSlate SignNow with my existing mortgage software for FHA refinance authorization?

Yes, airSlate SignNow offers integration capabilities with various mortgage and financial software solutions. This seamless integration allows users to manage FHA refinance authorization along with other mortgage tasks in one streamlined platform, improving workflow efficiency. Connecting your tools enhances productivity while handling refinance processes.

-

What features does airSlate SignNow offer for managing FHA refinance authorization?

airSlate SignNow provides a range of features to manage FHA refinance authorization effectively. These include customizable templates, secure eSigning, and real-time updates on document status. Such features ensure that you stay organized and informed throughout the refinancing process, making it easier to complete FHA transactions.

-

What are the benefits of using airSlate SignNow for FHA refinance authorization?

Using airSlate SignNow for FHA refinance authorization offers many benefits, such as reduced processing times and increased accuracy in document signing. Its digital nature eliminates the hassle of physical paperwork, accelerating the entire refinancing period. Additionally, users can track document progress effortlessly, enhancing their overall efficiency.

-

Is airSlate SignNow secure for handling FHA refinance authorization documents?

Absolutely, airSlate SignNow prioritizes security in managing FHA refinance authorization documents. The platform utilizes industry-standard encryption and complies with regulatory requirements to protect sensitive information. This ensures that both borrowers and lenders can trust their documents are handled securely throughout the refinancing process.

Get more for Fha Refinance Authorization Form

- Letter from landlord to tenant for failure to keep all plumbing fixtures in the dwelling unit as clean as their condition 497310248 form

- Letter landlord tenant 497310249 form

- Letter from landlord to tenant as notice to tenant of tenants disturbance of neighbors peaceful enjoyment to remedy or lease 497310250 form

- Md letter landlord form

- Maryland law enforcement form

- Maryland violation form

- Md rent increase form

- Md tenant landlord 497310255 form

Find out other Fha Refinance Authorization Form

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form