Tpt Ez Form

What is the Tpt Ez

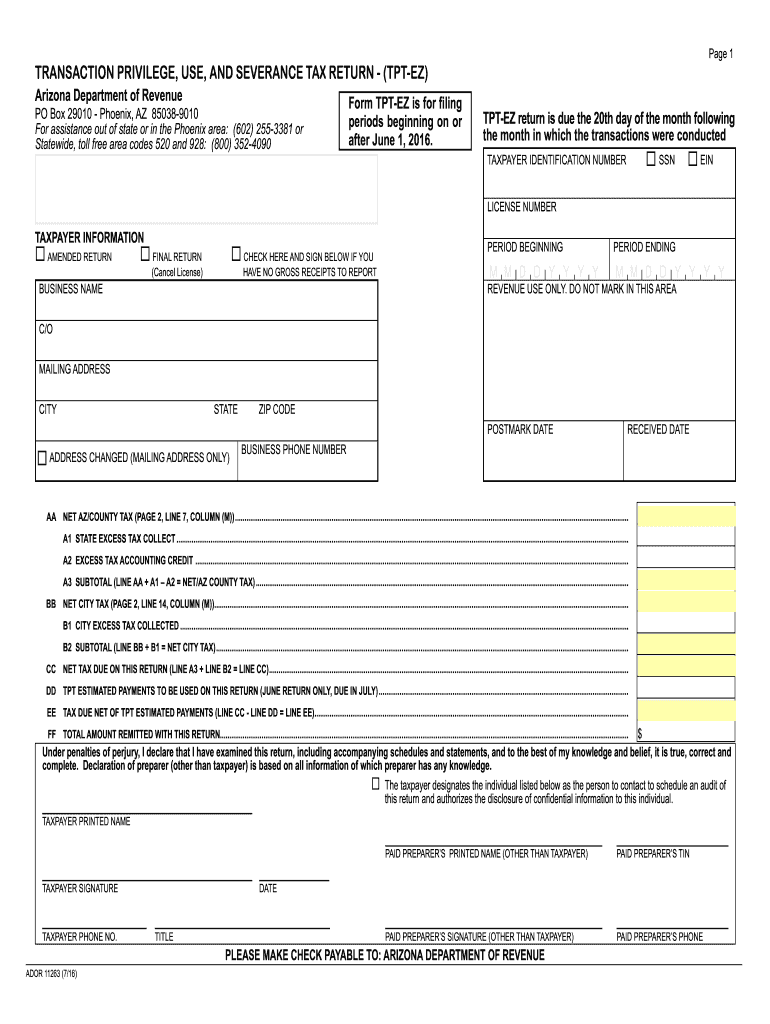

The Tpt Ez is a simplified form used for reporting transaction privilege use and severance tax returns in Arizona. This form is essential for businesses that engage in taxable activities within the state. It streamlines the process of tax reporting, making it easier for businesses to comply with state tax laws. The Tpt Ez is designed for taxpayers who have straightforward tax situations and allows for efficient filing without the complexities of more detailed forms.

How to use the Tpt Ez

Using the Tpt Ez involves several straightforward steps. First, gather all necessary information regarding your business activities, including gross income from sales and any applicable deductions. Next, download the fillable Tpt Ez blank form from the Arizona Department of Revenue website. Fill out the form accurately, ensuring all figures are correct. Once completed, you can submit the form electronically or by mail, depending on your preference. Utilizing digital tools, like airSlate SignNow, can enhance the process by providing a secure way to eSign and submit your form.

Steps to complete the Tpt Ez

Completing the Tpt Ez involves a series of clear steps:

- Gather your business financial records, including sales receipts and expense reports.

- Download the Tpt Ez blank form from the Arizona Department of Revenue website.

- Fill in the required fields, including your business name, address, and tax identification number.

- Report your gross income and any deductions accurately.

- Review the completed form for any errors or omissions.

- Submit the form electronically through a secure platform or mail it to the appropriate address.

Legal use of the Tpt Ez

The Tpt Ez is legally recognized as a valid method for reporting transaction privilege use and severance taxes in Arizona. To ensure its legal standing, it must be completed accurately and submitted within the designated deadlines. Compliance with the Arizona Department of Revenue guidelines is crucial. The use of digital signatures through platforms like airSlate SignNow can further enhance the legal validity of your submission, as it adheres to eSignature laws such as ESIGN and UETA.

Required Documents

When filling out the Tpt Ez, certain documents are necessary to ensure accurate reporting. These documents include:

- Sales records that detail gross income from taxable sales.

- Invoices and receipts for any deductions claimed.

- Your business tax identification number and contact information.

- Any prior tax returns that may inform your current filing.

Form Submission Methods

The Tpt Ez can be submitted through various methods, providing flexibility for taxpayers. You can choose to file online, which is often the quickest and most efficient option. Alternatively, you can mail the completed form to the Arizona Department of Revenue or submit it in person at designated locations. Utilizing electronic submission methods can help ensure timely processing and reduce the risk of delays.

Quick guide on how to complete tpt ez

Complete Tpt Ez seamlessly on any device

Web-based document management has become favored by companies and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without interruptions. Manage Tpt Ez on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Tpt Ez without stress

- Locate Tpt Ez and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that task.

- Generate your eSignature with the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you'd like to share your form—by email, text message (SMS), or invite link, or download it to your computer.

Put an end to lost or misplaced files, laborious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Tpt Ez and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tpt ez

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tpt ez blank form?

The tpt ez blank form is a customizable template designed for tax professionals to facilitate easy documentation. It allows users to fill out necessary information efficiently, simplifying the tax filing process.

-

How does airSlate SignNow help with tpt ez blank forms?

AirSlate SignNow offers a user-friendly platform that allows you to create, send, and eSign tpt ez blank forms effortlessly. This streamlines the signing process and ensures that documents are securely managed.

-

What are the pricing options for using the tpt ez blank form with airSlate SignNow?

airSlate SignNow provides flexible pricing plans that cater to various business needs. With plans starting at a competitive rate, you can utilize the tpt ez blank form without overspending.

-

Can I integrate the tpt ez blank form with other tools?

Yes, airSlate SignNow supports integrations with numerous business applications. This means you can seamlessly incorporate the tpt ez blank form into your existing workflow for enhanced efficiency.

-

What are the key features of the tpt ez blank form in airSlate SignNow?

Key features of the tpt ez blank form include customizable fields, electronic signature options, and secure cloud storage. These features ensure that your documentation process is both efficient and compliant with legal requirements.

-

Are there any benefits to using tpt ez blank forms in airSlate SignNow?

Using tpt ez blank forms in airSlate SignNow allows businesses to save time and reduce errors. With a streamlined eSigning process, teams can focus on more critical tasks rather than paperwork.

-

Is the tpt ez blank form secure for sensitive information?

Absolutely, airSlate SignNow prioritizes security. The tpt ez blank form is protected with advanced encryption methods to safeguard sensitive information during the signing process.

Get more for Tpt Ez

- Virginia quitclaim form

- Virginia quitclaim deed husband and wife to trust form

- Virginia quitclaim deed pursuant to a final decree of divorce two individuals to one individual form

- Transfer on death deed 481377926 form

- Virginia warranty deed for parents to child with reservation of life estate form

- Virginia spouses form

- Virginia quitclaim deed for from two individuals to one individual form

- Vermont quitclaim deed from husband and wife to husband and wife form

Find out other Tpt Ez

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement