Www Irs Govindividualsinternational TaxpayersResident AliensInternal Revenue Service IRS Tax Forms

Understanding the IRD Number Application Process

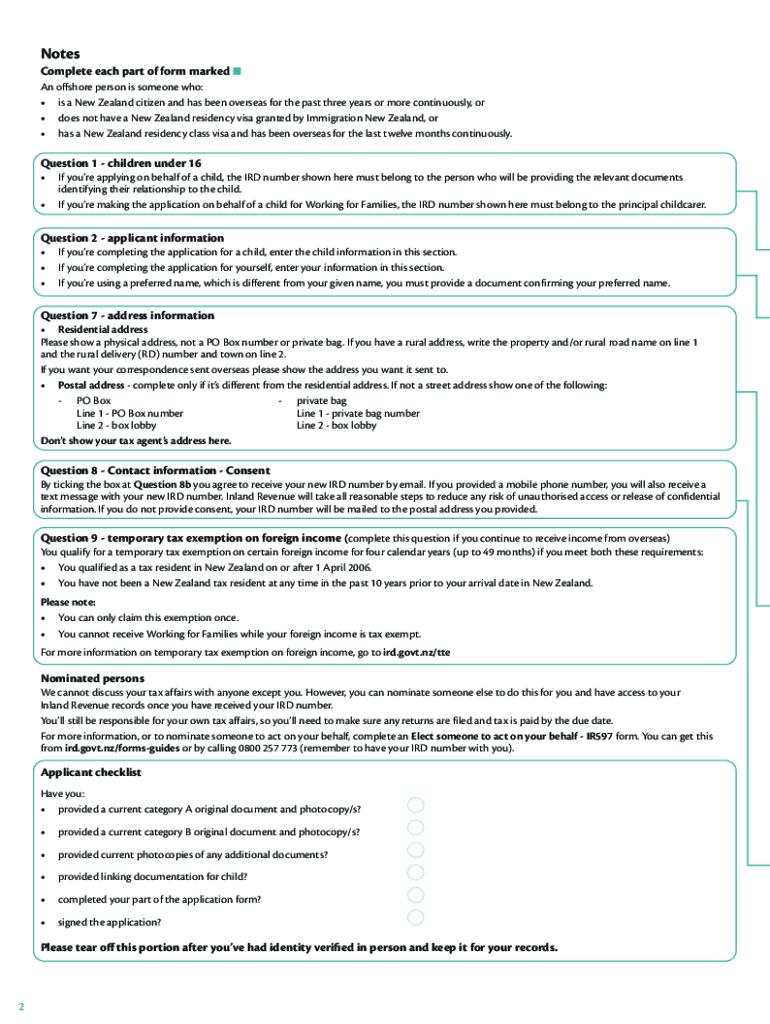

The IRD number application process is essential for individuals in New Zealand who need to comply with tax regulations. An IRD number, issued by the Inland Revenue Department, is necessary for tax identification purposes. This number helps track an individual's tax obligations and entitlements. To apply for an IRD number, individuals must complete the IR595 form, which can be done online for convenience.

Required Documents for the IRD Number Application

When applying for an IRD number, specific documents are required to verify your identity and eligibility. These typically include:

- A valid passport or New Zealand driver's license

- Proof of address, such as a utility bill or bank statement

- Any other identification documents as specified by the Inland Revenue Department

Having these documents ready will streamline the application process and ensure compliance with the requirements.

Steps to Complete the IR595 Form Online

Completing the IR595 form online involves several straightforward steps:

- Visit the official Inland Revenue Department website.

- Locate the IR595 form section and select the option to apply online.

- Fill in your personal details accurately, ensuring all required fields are completed.

- Upload the necessary identification documents as prompted.

- Review your application for accuracy before submitting it.

Following these steps will help ensure that your application is processed efficiently.

Legal Use of the IRD Number

The IRD number is legally binding and must be used in accordance with New Zealand tax laws. It is crucial for individuals to use their IRD number when filing tax returns, receiving income, or engaging in any financial transactions that require tax identification. Misuse of the IRD number can lead to penalties and legal repercussions.

Application Process and Approval Time

The application process for an IRD number typically takes a few days to a few weeks, depending on the volume of applications received by the Inland Revenue Department. After submitting the IR595 form online, applicants will receive a notification regarding the status of their application. It is advisable to apply for the IRD number well in advance of any tax obligations to avoid delays.

Digital vs. Paper Version of the IR595 Form

Applying for an IRD number online using the digital version of the IR595 form offers several advantages over the paper version. The online process is generally faster, allows for immediate submission, and reduces the risk of lost paperwork. Additionally, digital applications can be tracked more easily, providing applicants with peace of mind regarding their submission status.

Quick guide on how to complete www irs govindividualsinternational taxpayersresident aliensinternal revenue service irs tax forms

Prepare Www irs govindividualsinternational taxpayersResident AliensInternal Revenue Service IRS Tax Forms effortlessly on any device

Managing documents online has gained popularity among companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without any delays. Manage Www irs govindividualsinternational taxpayersResident AliensInternal Revenue Service IRS Tax Forms on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to adjust and eSign Www irs govindividualsinternational taxpayersResident AliensInternal Revenue Service IRS Tax Forms with ease

- Locate Www irs govindividualsinternational taxpayersResident AliensInternal Revenue Service IRS Tax Forms and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of your documents or obscure confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you prefer to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or disorganized documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Www irs govindividualsinternational taxpayersResident AliensInternal Revenue Service IRS Tax Forms to guarantee effective communication at every phase of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the www irs govindividualsinternational taxpayersresident aliensinternal revenue service irs tax forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to apply for IRD number NZ online?

To apply for an IRD number NZ online, you need to fill out the online application form provided on the official website. Ensure you have your identification documents ready, as they will be required for verification. Once submitted, you will receive a confirmation, and your IRD number will be processed efficiently.

-

How long does it take to get an IRD number when I apply for IRD number NZ online?

Typically, when you apply for IRD number NZ online, the processing time can take up to 10 working days. However, if additional information is required, it may extend the timeline. Once processed, you will receive your IRD number via email.

-

Are there any fees associated with applying for an IRD number NZ online?

There are no fees required to apply for an IRD number NZ online. The application process is free, making it economical for individuals and businesses. Ensure you are using the official government site to avoid any unexpected charges.

-

What documents do I need to apply for IRD number NZ online?

To apply for IRD number NZ online, you typically need to provide proof of identity such as a passport or driver's license. You may also be asked for additional documentation depending on your residency status or work situation. It’s essential to have these documents ready during the application.

-

Can I use airSlate SignNow to facilitate my application for IRD number NZ online?

Yes, you can use airSlate SignNow to streamline your application for IRD number NZ online by electronically signing and sending necessary documents securely. This enhances the efficiency and speed of your application. Plus, it offers a user-friendly interface that simplifies document management.

-

What are the benefits of applying for IRD number NZ online?

Applying for IRD number NZ online offers several benefits including convenience, speed, and accessibility. It allows you to submit your application anytime and from anywhere, reducing the need for in-person visits. Moreover, the online process is generally faster compared to traditional methods.

-

Is my personal information safe when I apply for IRD number NZ online?

Yes, when you apply for IRD number NZ online through official channels, your personal information is protected by stringent data security protocols. Government websites use encryption and secure servers to safeguard your data. Always ensure you are on the official site to enhance security.

Get more for Www irs govindividualsinternational taxpayersResident AliensInternal Revenue Service IRS Tax Forms

Find out other Www irs govindividualsinternational taxpayersResident AliensInternal Revenue Service IRS Tax Forms

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF