Form 100

What is the Form 100

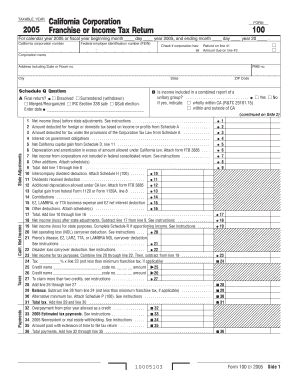

The Form 100, also known as the California Corporation Franchise Tax Form, is a critical document used by corporations operating in California to report their income and calculate their franchise tax obligations. This form is essential for both domestic and foreign corporations that are doing business in the state. It serves as a means for the California Franchise Tax Board to assess the tax liability of corporations based on their net income and other financial activities within the state.

How to use the Form 100

To effectively use the Form 100, corporations must accurately report their total income, deductions, and credits. This involves compiling financial data from the corporation's accounting records and ensuring that all figures are current and correct. The form requires specific information, including the corporation's name, address, and federal employer identification number (EIN). Once completed, the form must be submitted to the California Franchise Tax Board by the designated filing deadline.

Steps to complete the Form 100

Completing the Form 100 involves several key steps:

- Gather financial records, including income statements and balance sheets.

- Fill out the corporation's identifying information at the top of the form.

- Report total income in the appropriate section, including gross receipts and other income sources.

- Calculate allowable deductions, such as business expenses and losses.

- Determine the taxable income by subtracting deductions from total income.

- Calculate the franchise tax based on the taxable income using the current tax rates.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the Form 100 to avoid penalties. Generally, the form is due on the 15th day of the fourth month after the close of the corporation's fiscal year. For those operating on a calendar year, this means the form is typically due by April 15. It is essential to stay informed about any changes to deadlines, as these can vary based on state regulations or specific circumstances.

Legal use of the Form 100

The legal use of the Form 100 is governed by California tax laws, which stipulate that corporations must file the form annually to remain compliant. Failure to submit the form can result in penalties, including fines and interest on unpaid taxes. Additionally, the information reported on the Form 100 is subject to audit by the California Franchise Tax Board, making accurate and honest reporting crucial for legal compliance.

Required Documents

When completing the Form 100, corporations should prepare several key documents to ensure accurate reporting. These documents typically include:

- Financial statements, such as income statements and balance sheets.

- Records of all income sources and deductions claimed.

- Previous year’s tax returns for reference.

- Any supporting documentation for credits or deductions claimed.

Who Issues the Form

The Form 100 is issued by the California Franchise Tax Board (FTB), the state agency responsible for administering California's tax laws. The FTB provides guidelines and resources for corporations to help them understand their filing obligations and ensure compliance with state tax regulations. Corporations can access the form and related instructions directly from the FTB's official website or through authorized tax professionals.

Quick guide on how to complete form 100

Prepare Form 100 seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and store it securely online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents rapidly and without delays. Manage Form 100 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and electronically sign Form 100 effortlessly

- Obtain Form 100 and select Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you prefer to share your form – by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, and errors that necessitate printing new document copies. airSlate SignNow caters to all your document management requirements with just a few clicks, accessible from any device of your choice. Modify and electronically sign Form 100 to ensure effective communication throughout the entire preparation process of your form with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 100

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 100 and how can airSlate SignNow help with it?

Form 100 is a critical document used for various business purposes, including compliance and reporting. airSlate SignNow provides a seamless solution to create, send, and eSign Form 100, ensuring that your documents are signed quickly and securely.

-

Is airSlate SignNow suitable for managing form 100?

Yes, airSlate SignNow is highly effective for managing Form 100. With its user-friendly interface, you can streamline the process of signing and sending your Form 100, reducing manual work and errors.

-

What pricing plans are available for airSlate SignNow when using form 100?

airSlate SignNow offers flexible pricing plans tailored to different business needs. For those focusing on Form 100, the plans provide features that ensure efficient management and signing of documents while being cost-effective.

-

Can I integrate airSlate SignNow with other software to work with form 100?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, making it easy to manage Form 100 alongside your existing tools. This integration helps you automate workflows and improve document handling efficiency.

-

What are the main features of airSlate SignNow for form 100 management?

AirSlate SignNow offers multiple features designed to enhance Form 100 management, including customizable templates, advanced security measures, and real-time tracking of document status. These features support a streamlined and efficient signing process.

-

How does eSigning form 100 with airSlate SignNow simplify the process?

eSigning Form 100 with airSlate SignNow simplifies the signing process by allowing users to sign documents electronically from anywhere at any time. This eliminates the need for physical signatures and expedites the turnaround time for important documents.

-

What benefits does airSlate SignNow provide for businesses using form 100?

Using airSlate SignNow for Form 100 offers businesses key benefits such as saving time, reducing paper usage, and increasing accuracy in document management. These advantages contribute to improved operational efficiency and client satisfaction.

Get more for Form 100

Find out other Form 100

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe