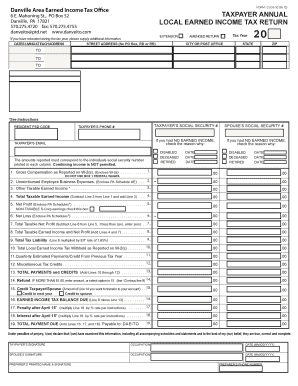

Danville Area Earned Income Tax Office Form

What is the Danville Area Earned Income Tax Office

The Danville Area Earned Income Tax Office is a local government agency responsible for the administration and collection of earned income taxes within the Danville area. This office plays a crucial role in ensuring compliance with tax laws and regulations, providing services to residents and businesses alike. The office is tasked with processing tax returns, issuing refunds, and enforcing tax collection policies. Understanding its functions is essential for residents who need to navigate their tax obligations effectively.

How to use the Danville Area Earned Income Tax Office

Utilizing the Danville Area Earned Income Tax Office involves several key steps. First, individuals and businesses must determine their tax obligations based on their earned income. The office provides various resources, including forms and guidelines, to assist in this process. Users can access these resources online or visit the office in person. Additionally, the office offers support for those who have questions regarding their tax filings or need assistance with completing forms.

Steps to complete the Danville Area Earned Income Tax Office form

Completing the Danville Area Earned Income Tax Office form requires careful attention to detail. Here are the essential steps to follow:

- Gather necessary documentation, such as proof of income and identification.

- Obtain the correct form from the Danville Area Earned Income Tax Office website or office.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form using the preferred method: online, by mail, or in person.

Legal use of the Danville Area Earned Income Tax Office

The legal use of the Danville Area Earned Income Tax Office is governed by various tax laws and regulations. To ensure compliance, individuals must adhere to specific guidelines when filing their earned income tax forms. This includes understanding the legal implications of submitting false information or failing to file on time. The office provides resources to help taxpayers understand their rights and responsibilities, ensuring that all activities related to tax filing are conducted legally.

Required Documents

When filing with the Danville Area Earned Income Tax Office, certain documents are required to support your tax return. These typically include:

- W-2 forms from employers, detailing earned income.

- 1099 forms for other income sources, such as freelance work.

- Proof of residency, if applicable.

- Identification documents, such as a driver's license or Social Security card.

Filing Deadlines / Important Dates

Filing deadlines for the Danville Area Earned Income Tax Office are crucial for compliance. Typically, the deadline for submitting earned income tax forms aligns with federal tax deadlines, which is usually April fifteenth. However, it is essential to check for any local variations or extensions that may apply. Staying informed about these dates helps taxpayers avoid penalties and ensures timely processing of their returns.

Quick guide on how to complete danville area earned income tax office

Complete Danville Area Earned Income Tax Office effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to find the necessary template and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Danville Area Earned Income Tax Office on any platform using airSlate SignNow Android or iOS applications and streamline any document-focused task today.

The easiest way to modify and eSign Danville Area Earned Income Tax Office without breaking a sweat

- Find Danville Area Earned Income Tax Office and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent parts of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or forgotten documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in a few clicks from your preferred device. Edit and eSign Danville Area Earned Income Tax Office and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the danville area earned income tax office

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Danville area earned income tax office, and how can airSlate SignNow help?

The Danville area earned income tax office is responsible for managing and collecting earned income taxes in the region. airSlate SignNow offers a seamless way to send and eSign documents related to tax filings, making the process more efficient and compliant with local regulations.

-

What features does airSlate SignNow provide that are beneficial for the Danville area earned income tax office?

AirSlate SignNow provides features such as secure eSigning, document tracking, and customizable templates. These tools can streamline communication and ensure that all necessary documents are promptly signed and submitted to the Danville area earned income tax office.

-

How does pricing work for airSlate SignNow in relation to the Danville area earned income tax office?

AirSlate SignNow offers flexible pricing plans tailored to various business needs while ensuring cost-effectiveness for those interacting with the Danville area earned income tax office. You can choose between monthly or annual subscriptions, and explore options that fit your volume of document transactions.

-

Can airSlate SignNow integrate with software used by the Danville area earned income tax office?

Yes, airSlate SignNow provides integrations with various software solutions that can be beneficial for users associated with the Danville area earned income tax office. This capability allows for a more streamlined workflow, enhancing productivity and compliance in handling tax documentation.

-

What are the benefits of using airSlate SignNow for transactions with the Danville area earned income tax office?

Using airSlate SignNow for tax-related transactions offers several benefits, including reduced turnaround time for document processing and increased accuracy in submissions. These advantages help individuals and businesses stay compliant with the Danville area earned income tax office while minimizing errors.

-

Is airSlate SignNow user-friendly for those filing taxes with the Danville area earned income tax office?

Absolutely! AirSlate SignNow is designed with user-friendliness in mind, making it accessible for individuals and businesses navigating their tax responsibilities with the Danville area earned income tax office. Our intuitive interface allows users to easily create, send, and manage documents without prior training.

-

What document types can I eSign with airSlate SignNow for the Danville area earned income tax office?

With airSlate SignNow, you can eSign a variety of document types required by the Danville area earned income tax office, including tax returns, exemption forms, and consent forms. This versatility ensures you have everything you need to complete your tax filings efficiently and securely.

Get more for Danville Area Earned Income Tax Office

- Warranty deed from corporation to corporation north dakota form

- Quitclaim deed from corporation to two individuals north dakota form

- Warranty deed from corporation to two individuals north dakota form

- Warranty deed from individual to a trust north dakota form

- Warranty deed from husband and wife to a trust north dakota form

- Warranty deed from husband to himself and wife north dakota form

- Quitclaim deed from husband to himself and wife north dakota form

- Quitclaim deed from husband and wife to husband and wife north dakota form

Find out other Danville Area Earned Income Tax Office

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple