Ga Ifta Login Form

What is the Ga Ifta Login

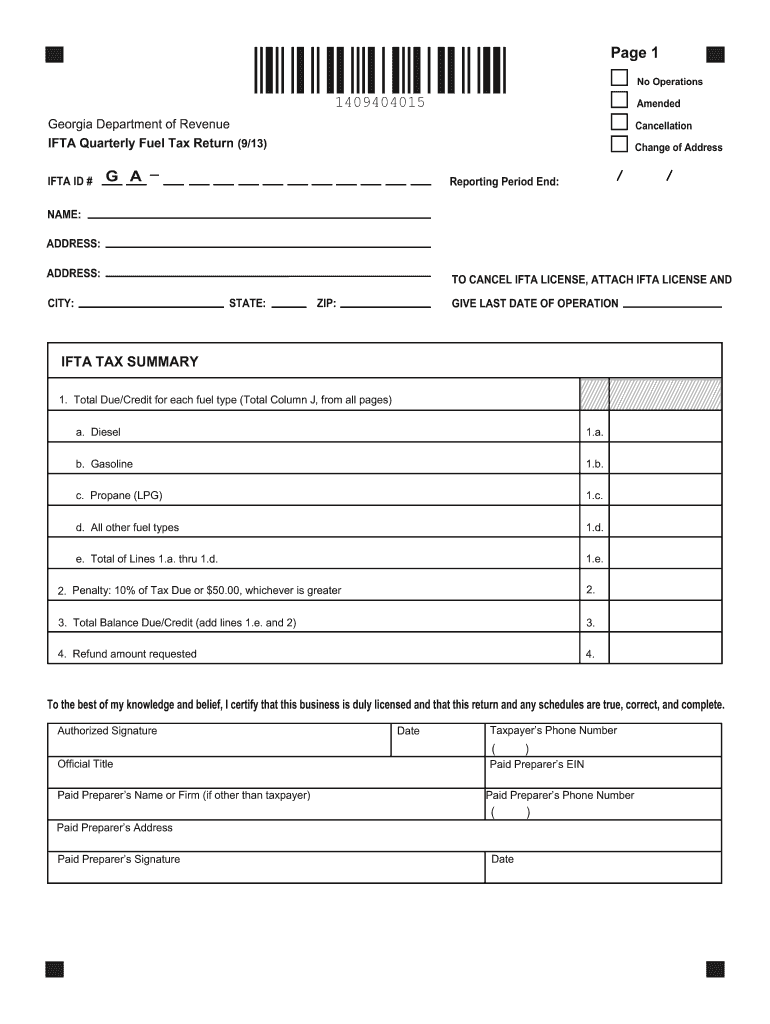

The Ga Ifta Login is a secure online portal designed for users in Georgia to manage their International Fuel Tax Agreement (IFTA) requirements. This platform allows users to access their accounts, file quarterly fuel tax returns, and track their IFTA status. It is essential for businesses that operate commercial vehicles across state lines, ensuring compliance with fuel tax regulations.

How to use the Ga Ifta Login

To use the Ga Ifta Login, navigate to the official Georgia Department of Revenue website. Enter your username and password to access your account. Once logged in, you can complete various tasks, such as filing your IFTA returns, checking your account balance, and updating your business information. Ensure that your login credentials are kept secure to protect your sensitive information.

Steps to complete the Ga Ifta Login

Completing the Ga Ifta Login involves a few straightforward steps:

- Visit the Georgia Department of Revenue website.

- Locate the IFTA login section on the homepage.

- Input your registered username and password.

- Click the login button to access your account.

- Follow the prompts to complete your desired actions, such as filing a return or updating your information.

Legal use of the Ga Ifta Login

The Ga Ifta Login must be used in accordance with state regulations governing fuel tax reporting. Users are responsible for ensuring that all information submitted through the portal is accurate and complete. Misuse of the login system or submission of false information can lead to penalties or legal repercussions. It is crucial to stay informed about the legal requirements related to IFTA compliance.

Required Documents

When using the Ga Ifta Login, certain documents may be required to complete your filings. These typically include:

- Proof of fuel purchases.

- Records of mileage traveled in each jurisdiction.

- Previous IFTA returns for reference.

- Any correspondence from the Georgia Department of Revenue.

Having these documents readily available can streamline the filing process and ensure compliance with state regulations.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Ga Ifta Login. Generally, IFTA returns are due quarterly, with specific deadlines for each quarter. For example, the first quarter's return is typically due by April 30. Missing these deadlines can result in penalties and interest charges. Always check the Georgia Department of Revenue website for the most current deadlines and important dates.

Quick guide on how to complete ga ifta login

Complete Ga Ifta Login effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed papers, allowing you to obtain the required form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your paperwork promptly without any hold-ups. Manage Ga Ifta Login on any device using airSlate SignNow's Android or iOS applications, and streamline any document-related processes today.

How to modify and eSign Ga Ifta Login with ease

- Locate Ga Ifta Login and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes just a few seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs within a few clicks from any device of your choice. Edit and eSign Ga Ifta Login to ensure excellent communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ga ifta login

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ga ifta login and how does it work?

The ga ifta login refers to the online portal where users can manage their International Fuel Tax Agreement (IFTA) accounts. Through this login, businesses can access their IFTA reports, file taxes, and ensure compliance with state regulations. This streamlined process helps save time and simplifies tax management.

-

How do I create a ga ifta login account?

To create a ga ifta login account, visit the official website and follow the registration process. You'll need to provide essential business information and verify your identity. Once registered, you can easily manage your IFTA-related activities through the login portal.

-

Is there a cost associated with using ga ifta login?

The ga ifta login is typically free for users; however, some services may incur additional fees depending on your specific transactions. airSlate SignNow also offers affordable plans that cater to various business needs, allowing for eSigning and document management alongside your IFTA filings.

-

What features are available with ga ifta login?

With ga ifta login, users can track their fuel usage, file IFTA returns, and manage their payments efficiently. Additionally, the secure portal allows access to historical data, making it easier to prepare for audits or inspections. AirSlate SignNow integrates these features to enhance your overall document management.

-

What are the benefits of using ga ifta login for my business?

Using ga ifta login streamlines your fuel tax reporting process, ensuring you meet compliance requirements effortlessly. It saves time by automating calculations and filings, reducing the risk of errors. This efficiency translates into potential cost savings and allows you to focus more on your core business operations.

-

Can I integrate ga ifta login with other software tools?

Yes, ga ifta login can be integrated with various accounting and transportation management software tools. This means you can synchronize your fuel usage and tax information across platforms seamlessly. AirSlate SignNow enhances this capability by allowing easy eSigning and document sharing for integrated workflows.

-

How secure is my information with ga ifta login?

The ga ifta login prioritizes security by employing robust encryption and authentication measures to protect your sensitive information. Regular updates and compliance with industry standards ensure your data remains safe from unauthorized access. Trust airSlate SignNow for secure document handling alongside your IFTA processes.

Get more for Ga Ifta Login

- Revocation of premarital or prenuptial agreement north dakota form

- No fault agreed uncontested divorce package for dissolution of marriage for people with minor children north dakota form

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497317403 form

- North dakota pre incorporation agreement shareholders agreement and confidentiality agreement north dakota form

- Nd corporation form

- Corporate records maintenance package for existing corporations north dakota form

- Limited liability company llc operating agreement north dakota form

- Single member limited liability company llc operating agreement north dakota form

Find out other Ga Ifta Login

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment