Tr193 1 Form

What is the Tr193 1

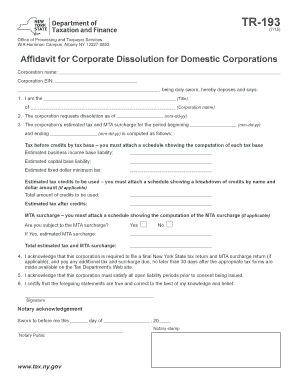

The Tr193 1 form is a specific document used for various administrative purposes within the United States. It serves as a formal request or declaration that may be required by different government agencies or organizations. Understanding the nature of this form is crucial for individuals and businesses who need to comply with specific regulations or requirements. The Tr193 1 form typically includes essential information such as the applicant's details, the purpose of the request, and any relevant supporting documentation that may be required.

How to use the Tr193 1

Using the Tr193 1 form involves several straightforward steps. First, ensure you have the correct version of the form, as updates may occur. Next, gather all necessary information and documentation required to complete the form accurately. Fill out the form with precise details, ensuring that all sections are completed as instructed. Once completed, review the form for accuracy before submission. Depending on the requirements, you may need to submit the form electronically, by mail, or in person.

Steps to complete the Tr193 1

Completing the Tr193 1 form requires careful attention to detail. Follow these steps:

- Obtain the latest version of the Tr193 1 form from the appropriate source.

- Read the instructions carefully to understand the requirements.

- Gather all necessary information, including personal or business details and any supporting documents.

- Fill out the form, ensuring all fields are completed accurately.

- Review the completed form for any errors or omissions.

- Submit the form according to the specified guidelines.

Legal use of the Tr193 1

The legal use of the Tr193 1 form is governed by various regulations that ensure its validity and acceptance. For the form to be considered legally binding, it must be filled out correctly and submitted in accordance with established guidelines. Additionally, any signatures required must comply with electronic signature laws, ensuring they are recognized by relevant authorities. Understanding these legal frameworks is essential for individuals and businesses to avoid potential issues.

Who Issues the Form

The Tr193 1 form is typically issued by a specific government agency or organization that requires the information contained within it. Identifying the issuing authority is important, as it provides context for the form's purpose and the regulations that govern its use. This authority may vary depending on the nature of the request being made and can include local, state, or federal entities.

Form Submission Methods

Submitting the Tr193 1 form can be done through various methods, depending on the requirements set by the issuing authority. Common submission methods include:

- Online Submission: Many agencies allow for electronic submission through their websites, which can expedite the process.

- Mail: The form can often be printed and mailed to the appropriate address provided by the issuing authority.

- In-Person: Some situations may require individuals to submit the form in person at designated offices.

Quick guide on how to complete tr193 1

Effortlessly prepare Tr193 1 on any device

Digital document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Tr193 1 on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The easiest way to modify and eSign Tr193 1 without hassle

- Locate Tr193 1 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invite link, or download it to your computer.

Leave behind concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Tr193 1 and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tr193 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is tr193 1 and how does it relate to airSlate SignNow?

tr193 1 refers to a specific framework that supports electronic signature solutions. airSlate SignNow complies with tr193 1 regulations, ensuring that your eSign documents are legally binding and secure. This compliance enhances trust and reliability for businesses in need of digital signing capabilities.

-

How does airSlate SignNow pricing work in relation to tr193 1?

airSlate SignNow offers flexible pricing plans that accommodate businesses of all sizes while complying with tr193 1 guidelines. You can choose from various tiers based on your features and volume needs, allowing for cost-effective solutions that meet your requirements without compromising on compliance.

-

What are the key features of airSlate SignNow related to tr193 1?

airSlate SignNow includes essential features such as customizable templates, automated workflows, and secure cloud storage, all adhering to tr193 1 standards. These features not only streamline the signing process but also ensure that your documents remain compliant with current regulations.

-

How can businesses benefit from using airSlate SignNow and tr193 1?

By leveraging airSlate SignNow, businesses can improve efficiency through faster document turnaround times while ensuring compliance with tr193 1. This leads to enhanced productivity, reduced operational costs, and a better overall customer experience when signing documents electronically.

-

Does airSlate SignNow offer integrations that support tr193 1?

Yes, airSlate SignNow offers various integrations with popular platforms that align with tr193 1 compliance. This allows businesses to seamlessly incorporate eSigning into their existing workflows and software solutions, enhancing productivity while staying within regulatory requirements.

-

Is airSlate SignNow legally binding under the tr193 1 standards?

Absolutely! airSlate SignNow ensures that all electronic signatures created through the platform comply with tr193 1 legal standards. This means that documents signed via airSlate SignNow are recognized as valid and enforceable in a court of law.

-

What industries can benefit from airSlate SignNow and tr193 1 compliance?

Various industries, including finance, healthcare, and real estate, can greatly benefit from airSlate SignNow while adhering to tr193 1 compliance. These sectors often require secure and efficient document management, making airSlate SignNow an ideal solution for their eSigning needs.

Get more for Tr193 1

- Publication 4053 rev july your civil rights are protected form

- Publication 4130 rev april eftps financial institution kit form

- Miss houston galaxy premiere promotions form

- Va form 21 0779 veterans benefits administration

- Business provider contract template form

- Business proposal contract template form

- Business purchase contract template form

- Business sale contract template form

Find out other Tr193 1

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now